Sallie Mae 2013 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

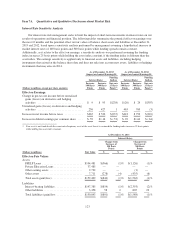

The “Funding Gaps” in the above table are primarily interest rate mismatches in short-term indices between

our assets and liabilities. We address this issue typically through the use of basis swaps that typically convert

quarterly reset three-month LIBOR to other indices that are more correlated to our asset indices. These basis

swaps do not qualify as effective hedges and as a result the effect on the funding index is not included in our

interest margin and is therefore excluded from the GAAP presentation.

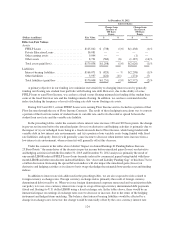

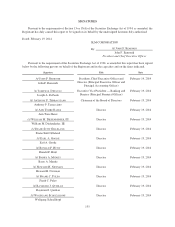

“Core Earnings” Basis

Index

(Dollars in billions)

Frequency of

Variable

Resets Assets(1) Funding(2)

Funding

Gap

3-month Treasury bill ................ weekly $ 5.4 $ — $ 5.4

Prime ............................. annual .6 — .6

Prime ............................. quarterly 4.0 — 4.0

Prime ............................. monthly 18.9 1.5 17.4

Prime ............................. daily — .1 (0.1)

PLUS Index ........................ annual .4 — 0.4

3-month LIBOR ..................... quarterly — 69.8 (69.8)

1-month LIBOR ..................... monthly 14.4 48.8 (34.4)

1-month LIBOR ..................... daily 98.2 5.0 93.2

Non-Discrete reset(3) ................. monthly — 12.8 (12.8)

Non-Discrete reset(4) ................. daily/weekly 9.7 5.1 4.6

Fixed Rate(5) ........................ 5.8 14.3 (8.5)

Total .............................. $157.4 $157.4 $—

(1) FFELP Loans of $13.3 billion ($13.1 billion LIBOR index and $.2 billion Treasury bill index) are

currently earning a fixed rate of interest as a result of the low interest rate environment.

(2) Funding (by index) includes all derivatives that management considers economic hedges of interest rate

risk and reflects how we internally manage our interest rate exposure.

(3) Funding consists of auction rate asset-backed securities and FFELP-other facilities.

(4) Assets include restricted and unrestricted cash equivalents and other overnight type instruments. Funding

includes retail and other deposits and the obligation to return cash collateral held related to derivatives

exposures.

(5) Assets include receivables and other assets (including goodwill and acquired intangibles). Funding

includes other liabilities and stockholders’ equity (excluding series B Preferred Stock).

We use interest rate swaps and other derivatives to achieve our risk management objectives. Our asset

liability management strategy is to match assets with debt (in combination with derivatives) that have the same

underlying index and reset frequency or, when economical, have interest rate characteristics that we believe are

highly correlated. The use of funding with index types and reset frequencies that are different from our assets

exposes us to interest rate risk in the form of basis and repricing risk. This could result in our cost of funds not

moving in the same direction or with the same magnitude as the yield on our assets. While we believe this risk is

low, as all of these indices are short-term with rate movements that are highly correlated over a long period of

time, market disruptions (which have occurred in recent years) can lead to a temporary divergence between

indices resulting in a negative impact to our earnings.

126