Sallie Mae 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Defaults on student education loans, particularly Private Education Loans, could adversely affect our

earnings.

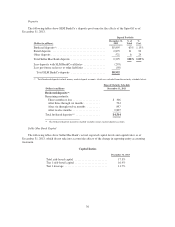

FFELP Loans are insured or guaranteed by state or not-for-profit agencies and are also protected by

contractual rights to recovery from the United States pursuant to guaranty agreements among ED and these

agencies. These guarantees generally cover at least 97 percent of a FFELP Loan’s principal and accrued interest

for loans disbursed and, in limited circumstances, 100 percent of the loan’s principal and accrued interest.

Nevertheless, we are exposed to credit risk on the non-guaranteed portion of the FFELP Loans in our portfolio

and to the possible loss of the insurance or guarantee due to a failure to comply with HEA and related

regulations.

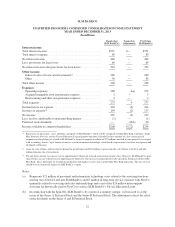

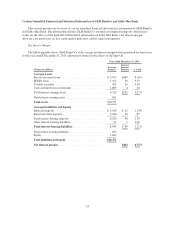

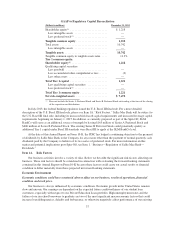

We bear the full credit exposure on Private Education Loans. For the year ended December 31, 2013, the

annual charge-off rate for our Private Education Loans (as a percentage of loans in repayment) was 2.8 percent.

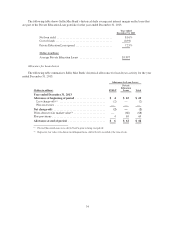

Delinquencies are an important indicator of the potential future credit performance for Private Education Loans.

Our delinquencies, as a percentage of Private Education Loans in repayment, were 8.3 percent at December 31,

2013.

The evaluation of our allowance for loan losses is inherently subjective, as it requires material estimates that

may be subject to significant changes. As of December 31, 2013, our allowance for FFELP Loan and Private

Education Loan losses was approximately $119 million and $2.1 billion, respectively. During the year ended

December 31, 2013, we recognized provisions for FFELP Loan and Private Education Loan losses of $52 million

and $787 million, respectively. The provision for loan losses reflects the activity for the applicable period and

provides an allowance at a level that management believes is appropriate to cover probable losses inherent in the

loan portfolio. However, future defaults can be higher than anticipated due to a variety of factors outside of our

control, such as downturns in the economy, regulatory or operational changes and other unforeseen future trends.

Losses on Private Education Loans are also determined by risk characteristics such as school type, loan status

(in-school, grace, forbearance, repayment and delinquency), loan seasoning (number of months in active

repayment), underwriting criteria (e.g., credit scores), a cosigner and the current economic environment. General

economic and employment conditions, including employment rates for recent college graduates, during the

recent recession led to higher rates of student loan defaults. Although default rates have decreased recently as

economic conditions have improved, they remain higher than pre-recession levels. If actual loan performance is

worse than currently estimated, it could materially affect our estimate of the allowance for loan losses and the

related provision for loan losses in our statements of income and, as a result, adversely affect our results of

operations.

Operations

A failure of our operating systems or infrastructure could disrupt our business, cause significant losses, result

in regulatory action or damage our reputation.

A failure of operating systems or infrastructure could disrupt our business. Our business is dependent on our

ability to process and monitor large numbers of daily transactions in compliance with legal and regulatory

standards and our product specifications, which change to reflect our business needs and new or revised

regulatory requirements. As processing demands change and our loan portfolios grow in both volume and

differing terms and conditions, developing and maintaining our operating systems and infrastructure becomes

increasingly challenging. There is no assurance that we can adequately or efficiently develop, maintain or acquire

access to such systems and infrastructure.

Our loan originations and conversions and the servicing, financial, accounting, data processing or other

operating systems and facilities that support them may fail to operate properly or become disabled as a result of

events that are beyond our control, adversely affecting our ability to process these transactions. Any such failure

could adversely affect our ability to service our clients, result in financial loss or liability to our clients, disrupt

our business, result in regulatory action or cause reputational damage. Despite the plans and facilities we have in

42