Sallie Mae 2013 Annual Report Download - page 28

Download and view the complete annual report

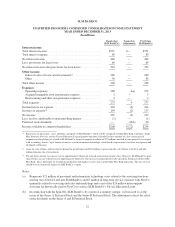

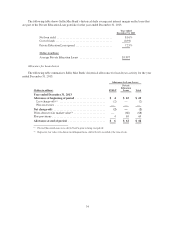

Please find page 28 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• $31.0 billion in Private Education Loans, which yield an average of 6.31 percent annually on a “Core

Earnings” basis and have a weighted average life of 7.1 years;

• $6.9 billion of other interest-earning assets, including securitization trust restricted cash;

• a leading student loan servicing platform that services loans for more than 12 million FFELP Loan, Direct

Loan and Private Education Loan customers (including cosigners), including 5.7 million customer

accounts serviced under NewCo’s contract with ED; and

• a leading student loan contingent collection platform with an outstanding inventory of contingent

collection receivables of approximately $16.2 billion, of which approximately $13.5 billion was student

loans and the remainder was other debt.

In connection with the internal corporate reorganization, we will become a subsidiary of NewCo and will

retain all of our liabilities and obligations, including as obligor on our $18.3 billion of unsecured public debt

outstanding as of December 31, 2013. We are also a party to derivative contracts on which we had a net liability

of $794 million as of December 31, 2013.

For more information regarding the businesses to be transferred to and operated by NewCo, NewCo pro

forma financial information, information regarding NewCo’s management and other information concerning

NewCo, please review the registration statement on Form 10 filed by New Corporation, which was initially filed

with the SEC on December 6, 2013 and subsequently amended on February 7, 2014, which can be accessed

through the SEC’s website at www.sec.gov/edgar.

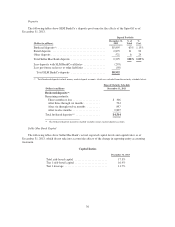

SLM BankCo After the Spin-Off

Following completion of the Spin-Off, SLM BankCo will continue to originate Private Education Loans by

promoting products on campus through the financial aid office and through direct marketing to students and their

families in the education loan market.

SLM BankCo will provide ongoing Private Education Loan servicing and collection on loans it originates

and sells to third parties as a secondary fee-based business. It will also continue to offer various products both to

help families save for college — including its free Upromise service that provides financial rewards on everyday

purchases — and to protect their college investment through tuition, rental and life insurance services.

SLM BankCo will continue to fund Private Education Loan originations through retail and brokered

deposits, and obtain additional funding through sales of Private Education Loans and their securitization.

Business of SLM BankCo

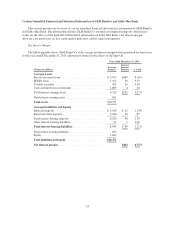

The following description of the business of SLM BankCo is based in part on Sallie Mae Bank’s current

business plan. Sallie Mae Bank’s business plan has been approved and is subject to periodic review by our Board

of Directors and the Board of Directors of Sallie Mae Bank. Sallie Mae Bank’s business plan is also reviewed

annually by the FDIC as Sallie Mae Bank’s regulator. The business plan is based on assumptions and other

factors that are subject to change.

Private Education Loans

SLM BankCo will market, price, underwrite and disburse its Private Education Loan products. To maintain

high credit standards, it will:

• focus its business on helping students attending four-year and graduate schools;

• continue the use of regularly revised and updated statistical underwriting models utilizing ten or more

years of proprietary credit performance data;

• generally require a credit qualified cosigner as a co-obligor; and

26