Sallie Mae 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Liquidity may also be available under secured credit facilities to the extent we have eligible collateral and

capacity available. Maximum borrowing capacity under the FFELP Loan–other facilities will vary and be subject

to each agreement’s borrowing conditions, including, among others, facility size, current usage and availability

of qualifying collateral from unencumbered FFELP Loans. As of December 31, 2013 and 2012, the maximum

additional capacity under these facilities was $10.6 billion and $11.8 billion, respectively. For the years ended

December 31, 2013 and 2012, the average maximum additional capacity under these facilities was $11.1 billion

and $11.3 billion, respectively.

We also hold a number of other unencumbered assets, consisting primarily of Private Education Loans and

other assets. Total unencumbered student loans, net, comprised $13.9 billion of our unencumbered assets of

which $11.2 billion and $2.7 billion related to Private Education Loans, net and FFELP Loans, net, respectively.

At December 31, 2013, we had a total of $23.8 billion of unencumbered assets inclusive of those described above

as sources of primary liquidity and exclusive of goodwill and acquired intangible assets.

Sallie Mae Bank’s ability to pay dividends is subject to the laws of Utah and the regulations of the FDIC.

Generally, under Utah’s industrial bank laws and regulations as well as FDIC regulations, Sallie Mae Bank may

pay dividends from its net profits without regulatory approval if, following the payment of the dividend, Sallie

Mae Bank’s capital and surplus would not be impaired. While applicable Utah and FDIC regulations differ in

approach as to determinations of impairment of capital and surplus, neither method of determination has

historically required Sallie Mae Bank to obtain consent to the payment of dividends. For the years ended

December 31, 2013 and 2012, Sallie Mae Bank paid dividends of $120 million and $420 million, respectively.

In addition to the foregoing, Sallie Mae Bank’s annual business plans are periodically reviewed by the

FDIC. Recently the FDIC expressed its objection to the payment of dividends from Sallie Mae Bank to the

Company prior to the completion of the Spin-Off. The bases for the objection are unrelated to the current

capitalization of Sallie Mae Bank or the results of its operations. The FDIC has stated its preference that Sallie

Mae Bank refrain from making periodic dividends to the Company for any reason other than the payment of the

normal quarterly cash dividend paid by the Company to holders of its two series of preferred stock until all terms

of the pending formal enforcement action with the FDIC are resolved and the Spin-Off has been completed.

Sallie Mae Bank does not expect to declare such a dividend prior to the occurrence of the Spin-Off and not doing

so will not materially or adversely affect the financial condition, operations or liquidity of the Company and its

subsidiaries taken as a whole. If the FDIC continues its general objection to the payment of dividends from Sallie

Mae Bank to its parent for an extended period of time after the completion of the Spin-Off, SLM BankCo’s

financial condition, operations, liquidity and ability to access capital markets could be materially and adversely

affected.

For further discussion of our various sources of liquidity, such as Sallie Mae Bank, our continued access to

the ABS market, our asset-backed financing facilities, and our issuance of unsecured debt, see “Note 6 —

Borrowings.”

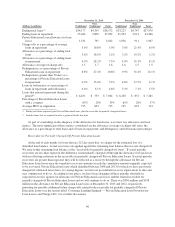

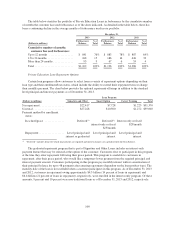

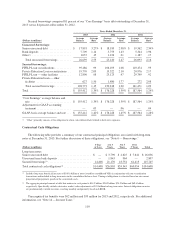

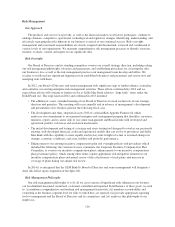

The following table reconciles encumbered and unencumbered assets and their net impact on total tangible

equity.

December 31,

(Dollars in billions) 2013 2012

Net assets of consolidated variable interest entities (encumbered assets)

— FFELP Loans ........................................... $ 4.6 $ 6.6

Net assets of consolidated variable interest entities (encumbered assets)

— Private Education Loans .................................. 6.7 6.6

Tangible unencumbered assets — Holding Company and other non-bank

subsidiaries(1) ............................................. 13.1 12.6

Tangible unencumbered assets — Sallie Mae Bank(1) ................ 10.7 8.6

Unsecured debt .............................................. (27.9) (26.7)

Mark-to-market on unsecured hedged debt(2) ....................... (.8) (1.7)

Other liabilities, net .......................................... (1.2) (1.4)

Total tangible equity ........................................ $ 5.2 $ 4.6

(1) Excludes goodwill and acquired intangible assets.

(2) At December 31, 2013 and 2012, there were $612 million and $1.4 billion, respectively, of net gains on derivatives hedging

this debt in unencumbered assets, which partially offset these losses.

106