Sallie Mae 2013 Annual Report Download - page 115

Download and view the complete annual report

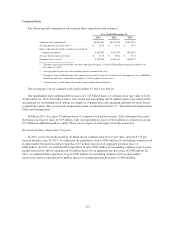

Please find page 115 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.loss confirmation period). The new accounting guidance was effective as of July 1, 2011 but was required to be

applied retrospectively to January 1, 2011. This resulted in $124 million of additional provision for loan losses in

the third quarter of 2011 from approximately $3.8 billion of student loans being classified as troubled debt

restructurings. This new accounting guidance is only applied to certain customers who use their fourth or greater

month of forbearance during the time period this new guidance is effective. This new accounting guidance has

the effect of accelerating the recognition of expected losses related to our Private Education Loan portfolio. The

increase in the provision for losses as a result of this new accounting guidance does not reflect a decrease in

credit expectations of the portfolio or an increase in the expected life-of-loan losses related to this portfolio. We

believe forbearance is an accepted and effective collections and risk management tool for Private Education

Loans. We plan to continue to use forbearance and as a result, we expect to have additional loans classified as

troubled debt restructurings in the future (see “Note 4 — Allowance for Loan Losses” for a further discussion on

the use of forbearance as a collection tool).

FFELP Loans are insured as to their principal and accrued interest in the event of default subject to a Risk

Sharing level based on the date of loan disbursement. These insurance obligations are supported by contractual

rights against the United States. For loans disbursed after October 1, 1993, and before July 1, 2006, we receive

98 percent reimbursement on all qualifying default claims. For loans disbursed on or after July 1, 2006, we receive

97 percent reimbursement. For loans disbursed prior to October 1, 1993, we receive 100 percent reimbursement.

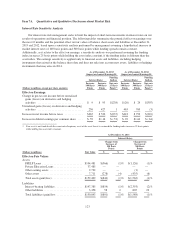

The allowance for FFELP Loan losses uses historical experience of customer default behavior and a two

year loss confirmation period to estimate the credit losses incurred in the loan portfolio at the reporting date. We

apply the default rate projections, net of applicable Risk Sharing, to each category for the current period to

perform our quantitative calculation. Once the quantitative calculation is performed, we review the adequacy of

the allowance for loan losses and determine if qualitative adjustments need to be considered.

Premium and Discount Amortization

The most judgmental estimate for premium and discount amortization on student loans is the CPR, which

measures the rate at which loans in the portfolio pay down principal compared to their stated terms. Loan

consolidation, default, term extension and other prepayment factors affecting our CPR estimates are affected by

changes in our business strategy, changes in our competitor’s business strategies, legislative changes, interest

rates and changes to the current economic and credit environment. When we determine the CPR we begin with

historical prepayment rates due to consolidation activity, defaults, payoffs and term extensions from the

utilization of forbearance. We make judgments about which historical period to start with and then make further

judgments about whether that historical experience is representative of future expectations and whether

additional adjustment may be needed to those historical prepayment rates.

In the past the consolidation of FFELP Loans and Private Education Loans significantly affected our CPRs

and updating those assumptions often resulted in material adjustments to our amortization expense. As a result of

the passage of HCERA in 2010, there is no longer the ability to consolidate under the FFELP. As a result, in

general, we do not expect to consolidate FFELP Loans in the future and do not currently expect others to actively

consolidate our FFELP loans. As a result, we expect CPRs related to our FFELP Loans to remain relatively

stable over time. See the section titled “Business Segment Earnings Summary — ‘Core Earnings’ Basis —

FFELP Loans Segment” of this Item 7, for discussion of the impact of a recent Special Direct Consolidation

Loan Initiative in 2012. We expect that in the future both we and our competitors will begin to consolidate

Private Education Loans. This is built into the CPR assumption we use for Private Education Loans. However, it

is difficult to accurately project the timing and level at which this consolidation activity will begin and our

assumption may need to be updated by a material amount in the future based on changes in the economy and

marketplace. The level of defaults is a significant component of our FFELP Loan and Private Education Loan

CPR. This component of the FFELP Loan and Private Education Loan CPR is estimated in the same manner as

discussed in the section titled “Critical Accounting Policies and Estimates — Allowance for Loan Losses” — the

only difference is for premium and discount amortization purposes the estimate of defaults is a life-of-loan

estimate whereas for allowance for loan losses it is a two-year estimate.

113