Wells Fargo 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

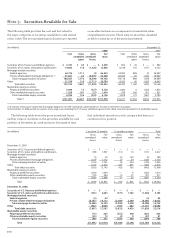

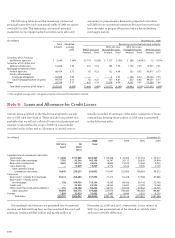

reasonable expectation about the timing and amount of cash

flows to be collected. The difference between contractually

required payments at acquisition and the cash flows expected

to be collected at acquisition, considering the impact of pre-

payments, is referred to as the nonaccretable difference.

Subsequent decreases to the expected cash flows will generally

result in a charge to the provision for credit losses resulting

in an increase to the allowance for loan losses. Subsequent

increases in cash flows result in reversal of nonaccretable

discount (or allowance for loan losses to the extent any had

been recorded) with a positive impact on interest income.

Disposals of loans, which may include sales of loans, receipt

of payments in full by the borrower, foreclosure, or troubled

debt restructurings result in removal of the loan from the

SOP 03-3 portfolio at its carrying amount.

Loans subject to SOP 03-3 are written down to an amount

estimated to be collectible. Accordingly, such loans are no

longer classified as nonaccrual even though they may be con-

tractually past due. We expect to fully collect the new carry-

ing values of such loans (that is, the new cost basis arising

out of purchase accounting). If a loan, or a pool of loans, dete-

riorates post acquisition a provision for loan losses is record-

ed to increase the allowance for loan losses. Loans subject to

SOP 03-3 are also excluded from the disclosure of loans 90

days or more past due and still accruing interest. Even

though substantially all of them are 90 days or more contrac-

tually past due, they are considered to be accruing because

the interest income on these loans relates to the establish-

ment of an accretable yield in accordance with SOP 03-3.

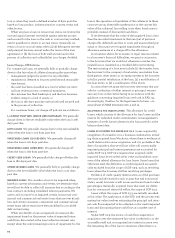

Securitizations and Beneficial Interests

In certain asset securitization transactions that meet the

applicable criteria to be accounted for as a sale, assets are sold

to an entity referred to as a qualifying special purpose entity

(QSPE), which then issues beneficial interests in the form of

senior and subordinated interests collateralized by the assets.

In some cases, we may retain up to 90% of the beneficial inter-

ests. Additionally, from time to time, we may also resecuritize

certain assets in a new securitization transaction.

The assets and liabilities sold to a QSPE are excluded from

our consolidated balance sheet, subject to a quarterly evalua-

tion to ensure the entity continues to meet the requirements to

be a QSPE. If our portion of the beneficial interests equals or

exceeds 90%, a QSPE would no longer qualify for off-balance

sheet treatment and we may be required to consolidate the

SPE, subject to determining whether the entity is a VIE and to

determining who is the primary beneficiary. In these cases, any

beneficial interests that we previously held are derecognized

from the balance sheet and we record the underlying assets

and liabilities of the SPE at fair value to the extent interests

were previously held by outside parties.

The carrying amount of the assets transferred to a QSPE,

excluding servicing rights, is allocated between the assets

sold and the retained interests based on their relative fair val-

ues at the date of transfer. We record a gain or loss in other

fee income for the difference between the carrying amount

and the fair value of the assets sold. Fair values are based on

quoted market prices, quoted market prices for similar assets,

or if market prices are not available, then the fair value is esti-

mated using discounted cash flow analyses with assumptions

for credit losses, prepayments and discount rates that are cor-

roborated by and independently verified against market

observable data, where possible. Retained interests from secu-

ritizations with off-balance sheet entities, including QSPEs and

VIEs where we are the primary beneficiary, are classified as

either available-for-sale securities, trading account assets or

loans, and are accounted for as described herein.

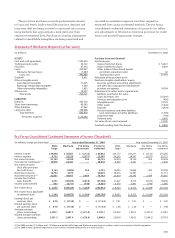

Mortgage Servicing Rights

Under FAS 156, Accounting for Servicing of Financial Assets –

an amendment of FASB Statement No. 140, servicing rights

resulting from the sale or securitization of loans we originate

(asset transfers) are initially measured at fair value at the date

of transfer. We recognize the rights to service mortgage loans

for others, or mortgage servicing rights (MSRs), as assets

whether we purchase the MSRs or the MSRs result from an

asset transfer. We determine the fair value of servicing rights

at the date of transfer using the present value of estimated

future net servicing income, using assumptions that market

participants use in their estimates of values. We use quoted

market prices when available to determine the value of other

interests held. Gain or loss on sale of loans depends on (1)

proceeds received and (2) the previous carrying amount of the

financial assets transferred and any interests we continue to

hold (such as interest-only strips) based on relative fair value

at the date of transfer.

To determine the fair value of MSRs, we use a valuation

model that calculates the present value of estimated future net

servicing income. We use assumptions in the valuation model

that market participants use in estimating future net servicing

income, including estimates of prepayment speeds (including

housing price volatility), discount rate, default rates, cost to

service (including delinquency and foreclosure costs), escrow

account earnings, contractual servicing fee income, ancillary

income and late fees. This model is validated by an indepen-

dent internal model validation group operating in accordance

with a model validation policy approved by the Corporate

Asset/Liability Management Committee (Corporate ALCO).

MORTGAGE SERVICING RIGHTS MEASURED AT FAIR VALUE We

have elected to initially measure and carry our MSRs related

to residential mortgage loans (residential MSRs) using the

fair value method. Under the fair value method, these resi-

dential MSRs are carried in the balance sheet at fair value

and the changes in fair value, primarily due to changes in

valuation inputs and assumptions and to the collection/

realization of expected cash flows, are reported in nonin-

terest income in the period in which the change occurs.

AMORTIZED MORTGAGE SERVICING RIGHTS Amortized MSRs,

which include commercial MSRs, are carried at the lower of

cost or market value. These MSRs are amortized in proportion

to, and over the period of, estimated net servicing income. The

amortization of MSRs is analyzed monthly and is adjusted to

reflect changes in prepayment speeds, as well as other factors.