Wells Fargo 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating losses in 2008 included a $151 million reversal

of Visa litigation expenses related to the Visa initial public

offering. Operating losses for 2007 included $203 million for

2007 of litigation expenses associated with indemnification

obligations arising from our ownership interest in Visa.

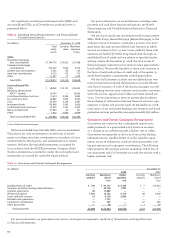

Income Tax Expense

Our effective tax rate for 2008 was 18.5%, compared with

30.7% for 2007. The decrease in the effective tax rate was

primarily due to a lower level of pre-tax income and higher

amounts of tax credits and tax-exempt income.

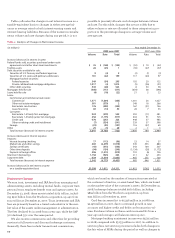

Operating Segment Results

We have three lines of business for our 2008 management

reporting results: Community Banking, Wholesale Banking

and Wells Fargo Financial. For a more complete description

of our operating segments, including additional financial

information and the underlying management accounting

process, see Note 24 (Operating Segments) to Financial

Statements. To reflect the realignment of our corporate trust

business from Community Banking into Wholesale Banking

in first quarter 2008, results for prior periods have been

revised.

Community Banking’s net income decreased 43% to $2.93 bil-

lion in 2008 from $5.11 billion in 2007. Double-digit revenue

growth was driven by strong balance sheet growth, combined

with disciplined expense management, and was offset by

higher credit costs, including a $4.7 billion (pre tax) credit

reserve build. Revenue increased 11% to $27.76 billion from

$24.93 billion in 2007. Net interest income increased 24% to

$16.19 billion in 2008 from $13.10 billion in 2007. Net interest

margin increased 36 basis points to 5.02% due to earning

assets growth of $41.4 billion, or 15%, offsetting lower invest-

ment yields. The growth in earning assets was primarily

driven by loan and investment growth. Average loans were

up 13% to $218.8 billion in 2008 from $194.0 billion in 2007.

Average core deposits were up 5% to $254.6 billion in 2008

from $242.2 billion a year ago. Noninterest income decreased

2% to $11.57 billion in 2008 from $11.83 billion in 2007,

primarily due to lower mortgage banking income and trust

and investment fees. The provision for credit losses for

2008 increased to $9.56 billion from $3.19 billion in 2007.

Noninterest expense decreased 2% to $14.35 billion in 2008

from $14.70 billion in 2007.

Wholesale Banking’s net income decreased 48% to $1.29 bil-

lion in 2008 from $2.47 billion in 2007, largely due to the

$1.12 billion (pre tax) provision for credit losses, which

included a $586 million (pre tax) credit reserve build.

Revenue decreased 5% to $8.54 billion from $8.95 billion in

2007. Net interest income increased 23% to $4.47 billion for

2008 from $3.65 billion for 2007 driven by strong loan and

deposit growth. Average loans increased 31% to $112.1 billion

in 2008 from $85.6 billion in 2007, with double-digit increases

across nearly all wholesale lending businesses. Average core

deposits grew 16% to $70.6 billion from a year ago, primarily

from large corporate, middle market and correspondent bank-

ing customers. The increase in provision for credit losses to

$1.12 billion in 2008 from $69 million in 2007 was due to higher

net charge-offs and additional provision taken to build

reserves for the wholesale portfolio. Noninterest income

decreased 23% to $4.07 billion in 2008, primarily due to

impairment charges and other losses in our capital markets

areas, as well as lower commercial real estate brokerage and

trust and investment fees. Noninterest expense increased 9%

to $5.55 billion in 2008 from $5.08 billion in 2007, due to the

acquisition of ABD Insurance as well as higher agent com-

missions in the crop insurance business stemming from higher

commodity prices and the liability recorded for a capital

support agreement for a structured investment vehicle.

Wells Fargo Financial reported a net loss of $764 million in

2008 compared with net income of $481 million in 2007,

reflecting higher credit costs, including a $1.7 billion credit

reserve build due to continued softening in the real estate,

auto and credit card markets. Revenue was up 2% to $5.59 bil-

lion in 2008 from $5.51 billion in 2007. Net interest income

increased 6% to $4.48 billion from $4.23 billion in 2007 due to

growth in average loans, which increased 4% to $67.6 billion

in 2008 from $65.2 billion in 2007. The provision for credit

losses increased $2.38 billion in 2008 from 2007, primarily

due to the $1.7 billion credit reserve build, and an increase in

net charge-offs in the credit card and auto portfolios due to

continued softening in these markets. Noninterest income

decreased $171 million in 2008 from 2007. Noninterest

expense decreased 9% to $2.76 billion in 2008 from 2007, pri-

marily due to lower expenses from the run off of the auto

lease portfolio and reduction in team members.

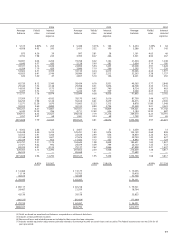

Table 6: Noninterest Expense

(in millions) Year ended December 31, % Change

2008 2007 2006 2008/ 2007/

2007 2006

Salaries $ 8,260 $ 7,762 $ 7,007 6% 11%

Commission and

incentive compensation 2,676 3,284 2,885 (19) 14

Employee benefits 2,004 2,322 2,035 (14) 14

Equipment 1,357 1,294 1,252 53

Net occupancy 1,619 1,545 1,405 510

Operating leases 389 561 630 (31) (11)

Outside professional services 847 899 942 (6) (5)

Insurance 725 416 257 74 62

Outside data processing 480 482 437 —10

Travel and entertainment 447 474 542 (6) (13)

Contract services 407 448 579 (9) (23)

Advertising and promotion 378 412 456 (8) (10)

Postage 338 345 312 (2) 11

Telecommunications 321 321 279 —15

Stationery and supplies 218 220 223 (1) (1)

Core deposit and other

customer relationship

intangibles 186 158 177 18 (11)

Security 178 176 179 1(2)

Operating losses 142 437 275 (68) 59

All other 1,689 1,268 965 33 31

Total $22,661 $22,824 $20,837 (1) 10