Wells Fargo 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

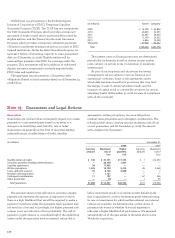

We issue standby letters of credit, which include

performance and financial guarantees, for customers in

connection with contracts between our customers and third

parties. Standby letters of credit are agreements where we

are obligated to make payment to a third party on behalf

of a customer in the event the customer fails to meet their

contractual obligations. We consider the credit risk in

standby letters of credit and commercial and similar letters

of credit in determining the allowance for credit losses.

As a securities lending agent, we loan client securities, on

a fully collateralized basis, to third party broker/dealers. We

indemnify our clients against broker default and, in certain

cases, against collateral losses. We support these guarantees

with collateral, generally in the form of cash or highly liquid

securities, that is marked to market daily. At December 31,

2008, there was $31.0 billion in collateral supporting the

$30.1 billion loaned.

We enter into other types of indemnification agreements

in the ordinary course of business under which we agree

to indemnify third parties against any damages, losses

and expenses incurred in connection with legal and other

proceedings arising from relationships or transactions with us.

These relationships or transactions include those arising from

service as a director or officer of the Company, underwriting

agreements relating to our securities, acquisition agreements

and various other business transactions or arrangements.

Because the extent of our obligations under these agreements

depends entirely upon the occurrence of future events,

our potential future liability under these agreements is

not determinable.

We provide liquidity facilities on all commercial paper

issued by the conduit we administer. We also provide liquidity

to certain off-balance sheet entities that hold securitized

fixed rate municipal bonds and consumer or commercial

assets that are partially funded with the issuance of money

market and other short-term notes. See Note 8 for additional

information on these arrangements.

Written put options are contracts that give the counterparty

the right to sell to us an underlying instrument held by the

counterparty at a specified price, and include options, floors,

caps and credit default swaps. These written put option

contracts generally permit net settlement. While these

derivative transactions expose us to risk in the event the

option is exercised, we manage this risk by entering into

offsetting trades or by taking short positions in the underlying

instrument. We offset substantially all put options written

to customers with purchased options. Additionally, for certain

of these contracts, we require the counterparty to pledge the

underlying instrument as collateral for the transaction. Our

ultimate obligation under written put options is based on

future market conditions and is only quantifiable at settlement.

See Note 8 for additional information regarding transactions

with VIEs and Note 16 for additional information regarding

written derivative contracts.

In certain loan sales or securitizations, we provide

recourse to the buyer whereby we are required to repurchase

loans at par value plus accrued interest on the occurrence of

certain credit-related events within a certain period of time.

The maximum risk of loss represents the outstanding principal

balance of the loans sold or securitized that are subject to

recourse provisions, but the likelihood of the repurchase

of the entire balance is remote and amounts paid can be

recovered in whole or in part from the sale of collateral.

In 2008 and in 2007, we did not repurchase a significant

amount of loans associated with these agreements.

We provide residual value guarantees as part of certain

leasing transactions of corporate assets, principally railcars.

The lessors in these leases are generally large financial

institutions or their leasing subsidiaries. These guarantees

protect the lessor from loss on sale of the related asset at the

end of the lease term. To the extent that a sale of the leased

assets results in proceeds less than a stated percent (generally

80% to 89%) of the asset’s cost less depreciation, we would be

required to reimburse the lessor under our guarantee.

In connection with certain brokerage, asset management,

insurance agency and other acquisitions we have made,

the terms of the acquisition agreements provide for deferred

payments or additional consideration, based on certain

performance targets.

We have entered into various contingent performance

guarantees through credit risk participation arrangements.

Under these agreements, if a customer defaults on its

obligation to perform under certain credit agreements with

third parties, we will be required to make payments to the

third parties.

Wells Fargo is a Class B common shareholder of Visa Inc.

(Visa). Based on agreements previously executed among

Wells Fargo, Visa and its predecessors and certain member

banks of the Visa USA network, we may be required to

indemnify Visa with respect to certain covered litigation.

In conjunction with its initial public offering in March 2008,

Visa deposited $3 billion of the proceeds of the offering into

a litigation escrow account to be used to satisfy settlement

obligations with respect to prior litigation and to make

payments with respect to the future resolution of the covered

litigation. The extent of our future obligations, if any, under

these arrangements depends on the ultimate resolution of

the covered litigation. In October 2008, Visa entered into

an agreement in principle to settle with Discover Financial

Services (Discover). We had previously established a reserve

to reflect the fair value of our possible indemnification

obligation to Visa for the Discover litigation.