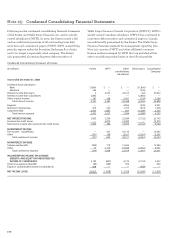

Wells Fargo 2008 Annual Report Download - page 154

Download and view the complete annual report

Please find page 154 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

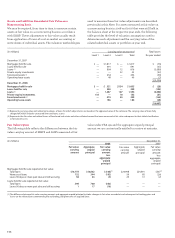

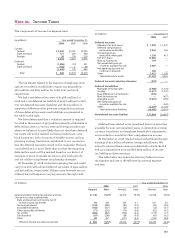

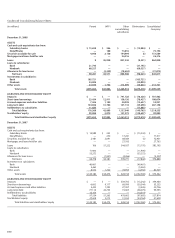

Year ended December 31,

2008 2007 2006

Pension Other Pension Other Pension Other

benefits(1) benefits benefits (1) benefits benefits(1) benefits

Discount rate 6.25% 6.25% 5.75% 5.75% 5.75% 5.75%

Expected return on plan assets 8.75 8.75 8.75 8.75 8.75 8.75

Rate of compensation increase 4.0 — 4.0 — 4.0 —

(1) Includes both qualified and nonqualified pension benefits.

The weighted-average assumptions used to determine the net periodic benefit cost were:

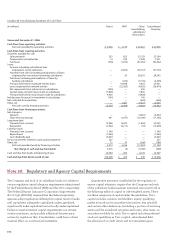

The long-term rate of return assumptions above were

derived based on a combination of factors including

(1) long-term historical return experience for major asset

class categories (for example, large cap and small cap

domestic equities, international equities and domestic fixed

income), and (2) forward-looking return expectations for

these major asset classes.

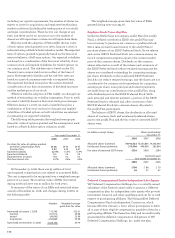

To account for postretirement health care plans we use

health care cost trend rates to recognize the effect of expected

changes in future health care costs due to medical inflation,

utilization changes, new technology, regulatory requirements

and Medicare cost shifting. We assumed average annual

increases of approximately 9% (before age 65) and 8.5% (after

age 65) for health care costs for 2009. The rates of average

annual increases are assumed to trend down 0.5% each year

until the trend rates reach an ultimate trend of 5% in 2017

(before age 65) and 2016 (after age 65). Increasing the

assumed health care trend by one percentage point in each

year would increase the benefit obligation as of December 31,

2008, by $60 million and the total of the interest cost and

service cost components of the net periodic benefit cost for

2008 by $5 million. Decreasing the assumed health care trend

by one percentage point in each year would decrease the

benefit obligation as of December 31, 2008, by $55 million

and the total of the interest cost and service cost components

of the net periodic benefit cost for 2008 by $4 million.

The investment strategy for assets held in the Retiree

Medical Plan Voluntary Employees’ Beneficiary Association

(VEBA) trust and other pension plans is maintained separate

from the strategy for the assets in the Cash Balance Plan and

Pension Plan. The general target asset mix is 45–65% equities

and 35–55% fixed income. In addition, the strategy for the

VEBA trust assets considers the effect of income taxes by

utilizing a combination of variable annuity and low turnover

investment strategies. Members of the EBRC formally review

the investment risk and performance of these assets on a

quarterly basis.

Other benefits payments are expected to be reduced by

prescription drug subsidies from the federal government

provided by the Medicare Prescription Drug, Improvement

and Modernization Act of 2003, as follows:

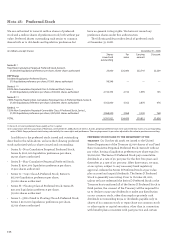

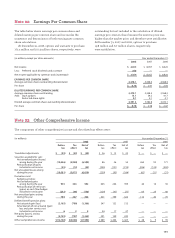

(in millions) Pension benefits

Non- Other

Qualified qualified benefits

Year ended December 31,

2009 $ 802 $ 82 $117

2010 825 80 121

2011 823 80 125

2012 849 69 127

2013 971 65 129

2014-2018 4,659 330 653

Future benefits, reflecting expected future service

that we expect to pay under the pension and other benefit

plans, follow.

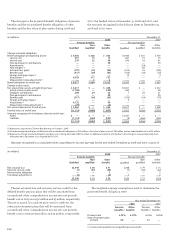

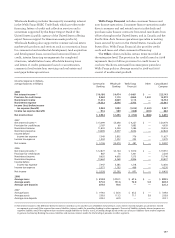

(in millions) Year ended December 31,

2008 2007 2006

Outside professional services $847 $899 $942

Insurance 725 416 257

Travel and entertainment 447 474 542

Contract services 407 448 579

Other Expenses

Expenses exceeding 1% of total interest income and noninterest

income in any of the years presented that are not otherwise

shown separately in the financial statements or Notes to

Financial Statements were:

(in millions) Other benefits

subsidy receipts

Year ended December 31,

2009 $19

2010 20

2011 22

2012 23

2013 24

2014-2018 84