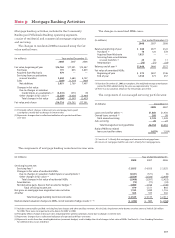

Wells Fargo 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

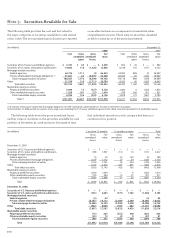

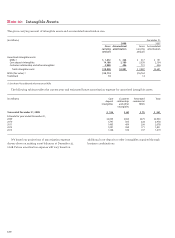

(in millions) December 31, 2008

Total Debt and Servicing Derivatives Other Total

QSPE equity assets commit-

assets(1) interests(2) ments and

guarantees

Carrying value – asset (liability)

Residential mortgage loan securitizations $1,144,775 $17,469 $12,951 $ 30 $ (511) $29,939

Commercial mortgage securitizations 355,267 1,452 1,098 524 (14) 3,060

Auto loan securitizations 4,133 72 — 43 — 115

Student loan securitizations 2,765 76 57 — — 133

Other 11,877 74 — (3) — 71

Total $1,518,817 $19,143 $14,106 $ 594 $ (525) $33,318

Maximum exposure to loss(3)

Residential mortgage loan securitizations $17,469 $12,951 $ 300 $ 718 $31,438

Commercial mortgage securitizations 1,452 1,098 524 3,302 6,376

Auto loan securitizations 72 — 43 — 115

Student loan securitizations 76 57 — — 133

Other 74 — 1,465 37 1,576

Total $19,143 $14,106 $2,332 $4,057 $39,638

(1) Represents the remaining principal balance of assets held by QSPEs using the most current information available.

(2) Excludes certain debt securities held related to loans serviced for FNMA, FHLMC and GNMA.

(3) Represents the carrying amount of our continuing involvement plus remaining undrawn liquidity and lending commitments, notional amount of net written derivative

contracts, and notional amount of other commitments and guarantees.

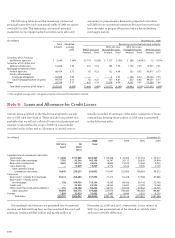

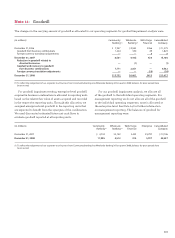

(in millions) Year ended December 31,

2008 2007

Mortgage Other Mortgage Other

loans financial loans financial

assets assets

Sales proceeds from securitizations (1) $212,770 $ — $38,971 $—

Servicing fees (1) 3,128 — 300 —

Other interests held 1,509 131 496 6

Purchases of delinquent assets 36 — ——

Net servicing advances 61 — 22 —

(1) Represents cash flow data for all loans securitized in 2008 and 2007. For 2007, cash flow data excluded loans securitized through FNMA and FHLMC and those loans we

continued to service, but for which we had no other continuing involvement.

We recognized net gains of $10 million from sales of

financial assets in securitizations in 2007 (none in 2008).

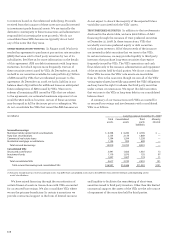

Transactions with QSPEs

We use QSPEs to securitize consumer and commercial real

estate loans and other types of financial assets, including

student loans, auto loans and municipal bonds. We typically

retain the servicing rights from these sales and may continue

to hold other beneficial interests in QSPEs. We may also

provide liquidity to investors in the beneficial interests and

credit enhancements in the form of standby letters of credit.

Through these securitizations we may be exposed to liability

under limited amounts of recourse as well as standard

representations and warranties we make to purchasers and

issuers. The amount recorded for this liability is included in

other commitments and guarantees in the following table.

A summary of our involvements with QSPEs is as follows:

Additionally, we had the following cash flows with our

securitization trusts.