Wells Fargo 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Note 8: Securitizations and Variable Interest Entities

Involvement with SPEs

We enter into various types of on and off-balance sheet

transactions with special purpose entities (SPEs) in the

normal course of business. SPEs are corporations, trusts

or partnerships that are established for a limited purpose.

We use SPEs to create sources of financing, liquidity and

regulatory capital capacity for the Company, as well as

sources of financing and liquidity, and investment products

for our clients. Our use of SPEs generally consists of various

securitization activities with SPEs whereby financial assets

are transferred to an SPE and repackaged as securities or

similar interests that are sold to investors. In connection

with our securitization activities, we have various forms

of ongoing involvement with SPEs, which may include:

• underwriting securities issued by SPEs and subsequently

making markets in those securities;

• providing liquidity facilities to support short-term

obligations of SPEs issued to third party investors;

• providing credit enhancement on securities issued by

SPEs or market value guarantees of assets held by SPEs

through the use of letters of credit, financial guarantees,

credit default swaps and total return swaps;

• entering into other derivative contracts with SPEs;

• holding senior or subordinated interests in SPEs;

• acting as servicer or investment manager for SPEs; and

• providing administrative or trustee services to SPEs.

The SPEs we use are primarily either qualifying SPEs

(QSPEs) or variable interest entities (VIEs). A QSPE represents

a specific type of SPE. A QSPE is a passive entity that has

significant limitations on the types of assets and derivative

instruments it may own and the extent of activities and decision

making in which it may engage. For example, a QSPE’s

activities are generally limited to purchasing assets, passing

along the cash flows of those assets to its investors, servicing

its assets and, in certain transactions, issuing liabilities. Among

other restrictions on a QSPE’s activities, a QSPE may not

actively manage its assets through discretionary sales or

modifications. A QSPE is exempt from consolidation.

A VIE is an entity that has either a total equity investment

that is insufficient to permit the entity to finance its activities

without additional subordinated financial support or whose

equity investors lack the characteristics of a controlling financial

interest. A VIE is consolidated by its primary beneficiary,

which is the entity that, through its variable interests, absorbs

the majority of a VIE’s variability. A variable interest is a

contractual, ownership or other interest that changes with

changes in the fair value of the VIE’s net assets.

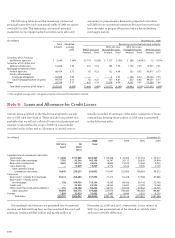

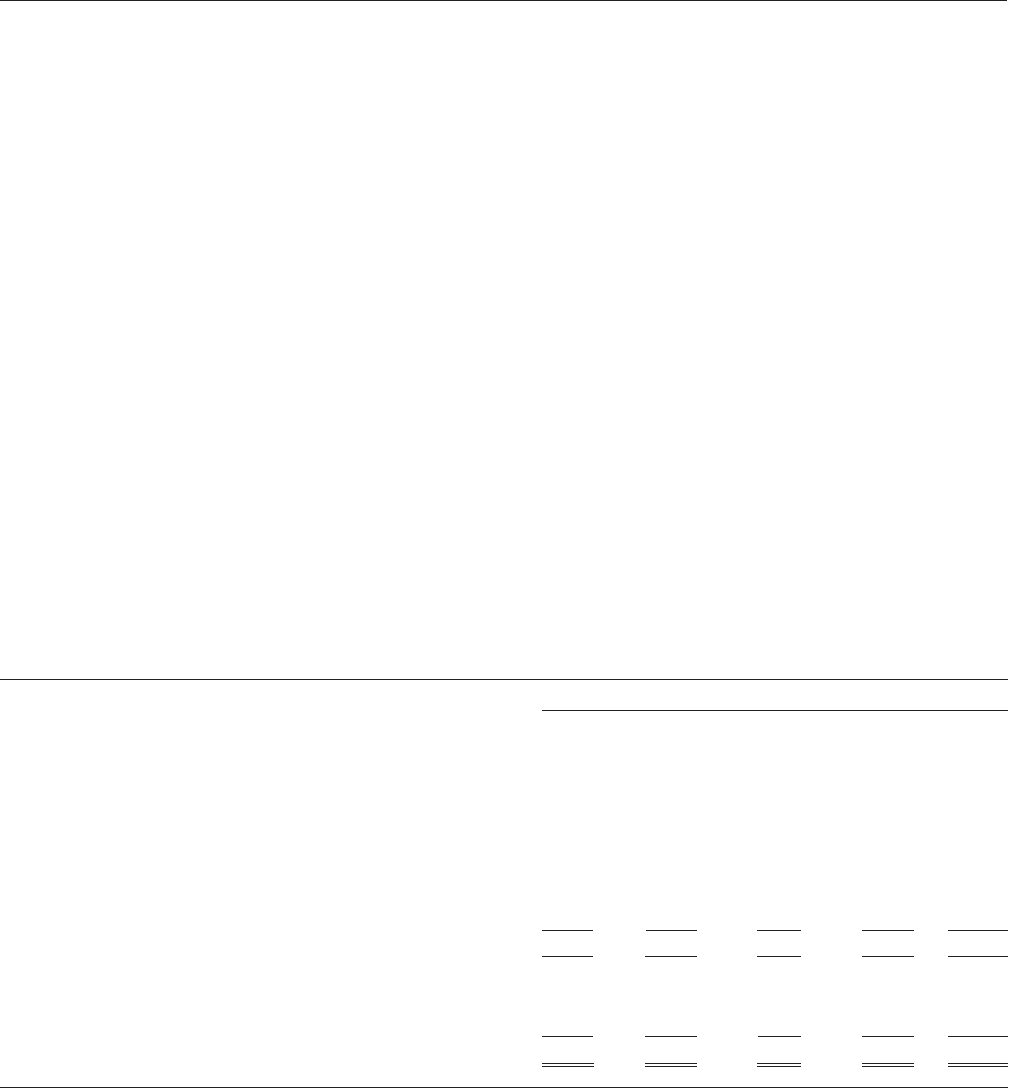

The classifications of assets and liabilities in our balance

sheet associated with our transactions with QSPEs and VIEs

are as follows:

(in millions) December 31, 2008

QSPEs VIEs that we VIEs that we Transfers that Total

do not consolidate we account

consolidate for as secured

borrowings

Cash $ — $ — $ 117 $ 287 $ 404

Trading account assets 1,261 5,241 71 141 6,714

Securities (1) 18,078 15,168 922 6,094 40,262

Mortgages held for sale 56 — — — 56

Loans (2) — 16,882 217 4,126 21,225

MSRs 14,106 — — — 14,106

Other assets 345 5,022 2,416 55 7,838

Total assets 33,846 42,313 3,743 10,703 90,605

Short-term borrowings — — 307 1,440 1,747

Accrued expenses and other liabilities 528 1,976 330 26 2,860

Long-term debt — — 1,773 7,125 8,898

Minority interests — — 121 — 121

Total liabilities and minority interests $ 528 $ 1,976 $2,531 $ 8,591 $ 13,626

(1) Excludes certain debt securities related to loans serviced for the Federal National Mortgage Association (FNMA), Federal Home Loan Mortgage Corporation (FHLMC) and

Government National Mortgage Association (GNMA).

(2) Excludes related allowance for loan losses.

The following disclosures regarding our significant

continuing involvement with QSPEs and unconsolidated VIEs

exclude entities where our only involvement is in the form

of: (1) investments in trading securities, (2) investments in

securities or loans underwritten by third parties, (3) certain

derivatives such as interest rate swaps or cross currency

swaps that have customary terms, and (4) administrative

or trustee services. We have also excluded investments

accounted for in accordance with the AICPA Investment

Company Audit Guide, investments accounted for under

the cost method, and investments accounted for under the

equity method.