Wells Fargo 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

“ We’re approaching the merger

of Wells Fargo and Wachovia

not as if we’re building an

empire but as if we’re building

a home — into which we can

welcome our customers so we

can have conversations they

fi nd of value about their hopes

and dreams and fi nancial goals.”

Keeping talent

In this merger, as always in our company, people come fi rst.

A major test of our success in this merger is how much talent

we can keep because the talent of our people is our product.

We’re a service company, and our team members are the

biggest infl uence on our customers. Enthusiastic, loyal, satisfi ed

team members create enthusiastic, loyal, satisfi ed customers

who want to stay with us for a lifetime. That is why we call them

“team members” (an asset in which to invest), not “employees”

(an expense to be managed).

Many people think they have to change companies or careers

every fi ve years to be successful. We’re contrarians — we value

loyalty. We believe that the longer talented team members

stay with us, the more they can use their skill, knowledge and

experience to benefi t our customers. In a merger this big and

complex (it makes us one of America’s top 10-largest private

employers, with 281,000 team members), some positions have

to be eliminated because they’re duplicated or because they

no longer fi t the new structure as we combine businesses and

functions. Inevitably, this causes disruption and uncertainty for

those team members whose positions are eliminated due

to the merger.

Just because a position is eliminated, however, doesn’t

necessarily mean the team member in that position has to leave

the company. To keep as much talent as possible, we’ve paused

in most of our external recruiting and external hiring so we can

help give team members displaced by the merger the chance

to search for other exciting opportunities in our company.

We’re a growth company. We have thousands of open jobs in

our company. We’re adding them every day — in our banks, our

mortgage company, in investments and insurance and many of

our other businesses.

More alike than di erent

The past several months I’ve had the privilege of meeting

and getting to know many thousands of Wachovia team

members in my visits to Charlotte, Winston-Salem, Columbia

(South Carolina), Richmond, Atlanta, Miami, Jacksonville,

Birmingham, Houston, Dallas, Summit (New Jersey),

Washington, D.C., Philadelphia, Boston, New York City,

St. Louis, Los Angeles and the San Francisco Bay Area. I’ve

found them to be just like our Wells Fargo team members

— friendly, caring, sincere, very much committed to their

customers and communities. We’ve had di erent systems,

processes and ways of doing things, but from the customer

point of view I believe we’re much more alike than we’re

di erent. This is one of our great advantages as we integrate

our two companies. Each company began at opposite ends of

the country — Wells Fargo tracing its legacy to 1852, Wachovia

to 1781 — but in the last few months we’ve discovered how much

we have in common and how much we can learn from each

other. We both believe community banking is a noble calling

— the opportunity to help people be fi nancially successful, be

a catalyst for economic growth in our communities and still

earn a fair profi t. By instinct and habit we both begin every

discussion with what’s best for our customers and communities.

We both want every customer to say, “Wow, I didn’t know I

could get service like that. She made a di erence. He solved my

problem and helped me understand how I can achieve my goals.

I learned something new about my fi nancial health.”

We’re very proud of the communities in which we live and

work, and we want our companies to be known as leaders in

making them even better places to live and work. In our Annual

Report this year, beginning on page 10, we introduce you to

13 team members from Wells Fargo and 13 team members

from Wachovia, each working in the same business or similar

geography to satisfy all our customers’ fi nancial needs and help

them succeed fi nancially. These great team members are living

proof: We’re much more alike than we’re di erent.

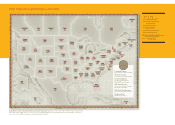

Our national scope

Our name remains Wells Fargo, our vision and values

remain unchanged, our corporate headquarters remains in

San Francisco, but the talent and resources of our company

are more broadly dispersed across North America than ever

before. Several metro areas across the country have signifi cant

concentrations of businesses, functions and employment

for our company. Des Moines is national headquarters for

Wells Fargo Home Mortgage and global headquarters for

Wells Fargo Financial. Our credit card business has signifi cant

concentrations in Des Moines, Concord (California), Beaverton

(Oregon), and Sioux Falls (South Dakota). Minneapolis-St. Paul

is headquarters for 18 national businesses including Wells Fargo

Insurance (consumer), Institutional Trust, Equipment Finance,

Municipal Finance and SBA Lending. Chicago is our national

headquarters for Wells Fargo Insurance Services (commercial).

Los Angeles is headquarters for 15 national businesses

including U.S. Corporate Banking, Commercial Real Estate

Lending, Community Real Estate Lending, International

Financial Services, Wells Capital Management and Foothill

Capital. Three important centers of employment and expertise

from Wachovia now join this national group of “hubquarters”

for Wells Fargo. Charlotte, North Carolina — Wachovia’s former

corporate headquarters — is now Wells Fargo’s headquarters

for Eastern Community Banking. It’s also home to more than

a dozen of our company’s senior business heads in Wealth