Wells Fargo 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

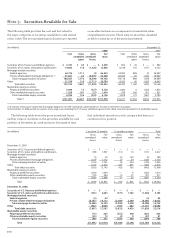

Because of the hybrid nature of these securities, we evalu-

ate PPS for other-than-temporary impairment using the

model we use for debt securities as described above. Among

the factors we consider in our evaluation of PPS are whether

there is any evidence of deterioration in the credit of the

issuer as indicated by a decline in cash flows or a rating

agency downgrade and the estimated recovery period.

Additionally, in determining if there was evidence of credit

deterioration, we evaluate: (1) the severity of decline in mar-

ket value below cost, (2) the period of time for which the

decline in fair value has existed, and (3) the financial condi-

tion and near-term prospects of the issuer, including any spe-

cific events which may influence the operations of the issuer.

We consider PPS to be impaired on an other-than-temporary

basis if it is probable that the issuer will be unable to make its

contractual payments or if we no longer believe the security

will recover within the estimated recovery period.

In 2008, we recorded $1,057 million of other-than-tempo-

rary impairment on PPS issued by Government Sponsored

Enterprises and corporations. None of our investments in

PPS that have not been impaired had been downgraded below

investment grade, and management believes that there are

no factors to suggest that we will not fully realize our invest-

ment in these instruments over a reasonable recovery period.

For marketable equity securities, we also consider the

issuer’s financial condition, capital strength, and near-term

prospects.

For debt securities and for PPS, which are treated as

debt securities for the purpose of other-than-temporary

impairment, we also consider:

• the cause of the price decline such as the general level of

interest rates and industry and issuer-specific factors;

• the issuer’s financial condition, near-term prospects and

current ability to make future payments in a timely manner;

• the issuer’s ability to service debt;

• any change in agencies’ ratings at evaluation date from

acquisition date and any likely imminent action; and

• for asset-backed securities, the credit performance of the

underlying collateral, including delinquency rates, cumu-

lative losses to date, and the remaining credit enhance-

ment compared to expected credit losses.

The securities portfolio is an integral part of our

asset/liability management process. We manage these

investments to provide liquidity, manage interest rate risk

and maximize portfolio yield within capital risk limits

approved by management and the Board of Directors and

monitored by the Corporate Asset/Liability Management

Committee (Corporate ALCO). We recognize realized gains

and losses on the sale of these securities in noninterest

income using the specific identification method.

Unamortized premiums and discounts are recognized in

interest income over the contractual life of the security using

the interest method. As principal repayments are received on

securities (i.e., primarily mortgage-backed securities) a pro-

rata portion of the unamortized premium or discount is rec-

ognized in interest income.

NONMARKETABLE EQUITY SECURITIES Nonmarketable equity

securities include venture capital equity securities that are not

publicly traded and securities acquired for various purposes,

such as to meet regulatory requirements (for example, Federal

Reserve Bank and Federal Home Loan Bank stock). These

securities are accounted for under the cost or equity method

or are carried at fair value and are included in other assets.

We review those assets accounted for under the cost or equity

method at least quarterly for possible other-than-temporary

impairment. Our review typically includes an analysis of the

facts and circumstances of each investment, the expectations

for the investment’s cash flows and capital needs, the viability

of its business model and our exit strategy. We reduce the

asset value when we consider declines in value to be other

than temporary. We recognize the estimated loss as a loss

from equity investments in noninterest income.

Nonmarketable equity securities that fall within the scope

of the AICPA Investment Company Audit Guide are carried at

fair value (principal investments). Principal investments,

including certain public equity and non-public securities and

certain investments in private equity funds, are recorded at

fair value with realized and unrealized gains and losses

included in gains and losses on equity investments in the

income statement, and are included in other assets in the bal-

ance sheet. Public equity investments are valued using quoted

market prices and discounts are only applied when there are

trading restrictions that are an attribute of the investment.

Private direct investments are valued using metrics such

as security prices of comparable public companies, acquisi-

tion prices for similar companies and original investment

purchase price multiples, while also incorporating a portfolio

company’s financial performance and specific factors. For

certain fund investments, where the best estimates of fair

value were primarily determined based upon fund sponsor

data, we use the net asset value (NAV) provided by the fund

sponsor as an appropriate measure of fair value. In some

cases, such NAVs require adjustments based on certain unob-

servable inputs. In situations where a portion of an invest-

ment in a non-public security or fund is sold, we recognize a

realized gain or loss on the portion sold and an unrealized

gain or loss on the portion retained.

Securities Purchased and Sold Agreements

Securities purchased under resale agreements and securities

sold under repurchase agreements are generally accounted

for as collateralized financing transactions and are recorded

at the acquisition or sale price plus accrued interest. It is our

policy to take possession of securities purchased under resale

agreements, which are primarily U.S. Government and

Government agency securities. We monitor the market value

of securities purchased and sold, and obtain collateral from

or return it to counterparties when appropriate.

Mortgages Held for Sale

Mortgages held for sale (MHFS) include commercial and res-

idential mortgages originated for sale and securitization in

the secondary market, which is our principal market, or for