Wells Fargo 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

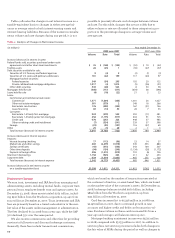

Contractual Obligations

In addition to the contractual commitments and arrange-

ments previously described, which, depending on the nature

of the obligation, may or may not require use of our

resources, we enter into other contractual obligations in the

ordinary course of business, including debt issuances for the

funding of operations and leases for premises and equipment.

Table 13 summarizes these contractual obligations at

December 31, 2008, except obligations for short-term borrow-

ing arrangements and pension and postretirement benefit

plans. More information on those obligations is in Note 13

(Short-Term Borrowings) and Note 20 (Employee Benefits

and Other Expenses) to Financial Statements.

We are subject to the income tax laws of the U.S., its states

and municipalities, and those of the foreign jurisdictions in

which we operate. We have various unrecognized tax obliga-

tions related to these operations which may require future

cash tax payments to various taxing authorities. Because of

their uncertain nature, the expected timing and amounts of

these payments generally are not reasonably estimable or

determinable. We attempt to estimate the amount payable in

the next 12 months based on the status of our tax examina-

tions and settlement discussions. See Note 21 (Income Taxes)

to Financial Statements for more information.

We enter into derivatives, which create contractual obliga-

tions, as part of our interest rate risk management process,

for our customers or for other trading activities. See “Asset/

Liability and Market Risk Management” in this Report and Note 16

(Derivatives) to Financial Statements for more information.

PRUDENTIAL JOINT VENTURE Our financial statements include

Prudential Financial Inc.’s (Prudential) minority interest in

Wachovia Securities Financial Holdings, LLC (WSFH). As a

result of Wachovia’s contribution to WSFH on January 1,

2008, of the retail securities business of A.G. Edwards, Inc.

(A.G. Edwards), which Wachovia acquired on October 1, 2007,

Prudential’s percentage interest in WSFH was diluted as of

that date based on the value of the contributed business

relative to the value of WSFH. Although the adjustment in

Prudential’s interest will be effective on a retroactive basis

as of the January 1, 2008, contribution date, the valuations

necessary to calculate the precise reduction in that percentage

interest have not been finalized. Based on currently available

information, Wells Fargo estimates that Prudential’s percentage

interest has been diluted from its pre-contribution percentage

interest of 38% to approximately 23% as a result of the A.G.

Edwards contribution. This percentage interest may be

adjusted higher or lower in a subsequent quarter retroactive

to January 1, 2008, if the final valuations differ from

Wells Fargo’s current estimate.

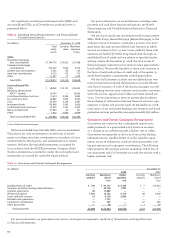

In connection with Wachovia's contribution of A.G.

Edwards to the joint venture, Prudential elected to exercise

its lookback option, which permits Prudential to delay until

January 1, 2010, its decision to make or not make an addition-

al capital contribution to the joint venture or other payments

to avoid or limit dilution of its ownership interest in the joint

venture. During this lookback period, Prudential's share in

the joint venture's earnings and one-time costs associated

with the combination will be based on Prudential's diluted

ownership level following the A.G. Edwards combination.

At the end of the lookback period, Prudential may elect to

make an additional capital contribution or other payment,

based on the appraised value (as defined in the joint venture

agreements) of the existing joint venture and the A.G.

Edwards business as of January 1, 2008, to avoid or limit

dilution. Alternatively, at the end of the lookback period,

Prudential may put its joint venture interests to Wells Fargo

based on the appraised value of the joint venture, excluding

the A.G. Edwards business, as of January 1, 2008. Prudential

has announced its intention to exercise, but has not yet for-

mally exercised, this lookback put option. Prudential has

until September 30, 2009, to exercise the lookback put option.

If Prudential exercises the lookback put option, the closing

would occur on or about January 1, 2010. Prudential also

has a discretionary right to put its joint venture interests

to Wells Fargo, including the A.G. Edwards business, at any

time after July 1, 2008. If Prudential exercises this discre-

tionary put option, the closing would occur approximately

one year from the date of exercise and the appraised value

would be determined at that time. Wells Fargo may pay the

purchase price for either the lookback or discretionary put

option in cash, shares of Wells Fargo common stock, or a

combination thereof.

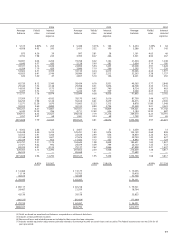

Table 13: Contractual Obligations

(in millions) Note(s) to Less than 1-3 3-5 More than Indeterminate Total

Financial 1 year years years 5 years maturity (1)

Statements

Contractual payments by period:

Deposits 12 $201,250 $ 27,084 $19,928 $ 3,213 $529,927 $ 781,402

Long-term debt (2) 7, 14 53,893 81,063 38,850 93,352 — 267,158

Operating leases 7 1,408 3,170 1,723 3,995 — 10,296

Unrecognized tax obligations 21 2,311 — — — 2,952 5,263

Purchase obligations (3) 510 878 192 41 — 1,621

Total contractual obligations $259,372 $112,195 $60,693 $100,601 $532,879 $1,065,740

(1) Includes interest-bearing and noninterest-bearing checking, and market rate and other savings accounts.

(2) Includes obligations under capital leases of $103 million.

(3) Represents agreements to purchase goods or services.