Wells Fargo 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

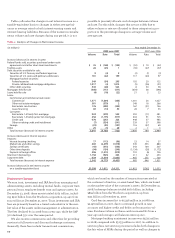

Loan Portfolio

A discussion of average loan balances is included in

“Earnings Performance – Net Interest Income” on page 47

and a comparative schedule of average loan balances is

included in Table 3; year-end balances are in Note 6 (Loans

and Allowance for Credit Losses) to Financial Statements.

Total loans at December 31, 2008, were $864.8 billion,

up $482.6 billion from $382.2 billion at December 31, 2007,

including $446.1 billion (net of $30.5 billion of purchase

accounting net write-downs) acquired from Wachovia.

Consumer loans were $474.9 billion at December 31, 2008,

up $253.0 billion from $221.9 billion a year ago, including

$246.8 billion (net of $21.0 billion of purchase accounting net

write-downs) acquired from Wachovia. Commercial and com-

mercial real estate loans of $356.1 billion at December 31,

2008, increased $203.3 billion from a year ago, including

$171.4 billion (net of $7.9 billion of purchase accounting net

write-downs) acquired from Wachovia. Mortgages held for

sale decreased to $20.1 billion at December 31, 2008, from

$26.8 billion a year ago, including $1.4 billion acquired from

Wachovia.

A summary of the major categories of loans outstanding

showing those subject to SOP 03-3 is presented in the follow-

ing table. For further detail on SOP 03-3 loans see Note 1

(Summary of Significant Accounting Policies – Loans) and

Note 6 (Loans and Allowance for Credit Losses).

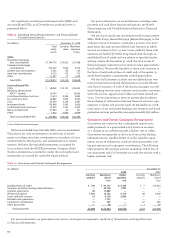

Table 9: Maturities for Selected Loan Categories

(in millions) December 31, 2008

Within After After Total

one one year five

year through years

five years

Selected loan maturities:

Commercial $ 59,246 $109,764 $33,459 $202,469

Other real estate

mortgage 23,880 45,565 33,663 103,108

Real estate construction 19,270 13,942 1,464 34,676

Foreign 23,605 7,288 2,989 33,882

Total selected loans $126,001 $176,559 $71,575 $374,135

Sensitivity of loans due after

one year to changes in

interest rates:

Loans at fixed interest rates $ 24,766 $23,628

Loans at floating/variable

interest rates 151,793 47,947

Total selected loans $176,559 $71,575

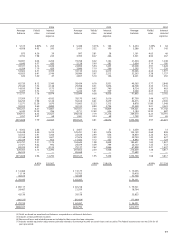

Table 8: Loan Portfolios

(in millions) December 31,

2008 2007

SOP 03-3 All Total

loans other

loans

Commercial and commercial real estate:

Commercial $ 4,580 $197,889 $202,469 $ 90,468

Other real estate mortgage 7,762 95,346 103,108 36,747

Real estate construction 4,503 30,173 34,676 18,854

Lease financing — 15,829 15,829 6,772

Total commercial and commercial real estate 16,845 339,237 356,082 152,841

Consumer:

Real estate 1-4 family first mortgage 39,214 208,680 247,894 71,415

Real estate 1-4 family junior lien mortgage 728 109,436 110,164 75,565

Credit card — 23,555 23,555 18,762

Other revolving credit and installment 151 93,102 93,253 56,171

Total consumer 40,093 434,773 474,866 221,913

Foreign 1,859 32,023 33,882 7,441

Total loans $58,797 $806,033 $864,830 $382,195

Table 9 shows contractual loan maturities and interest

rate sensitivities for selected loan categories.