Wells Fargo 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

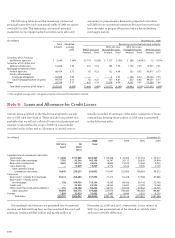

The unrealized losses associated with debt securities that

had been in a continuous loss position for 12 months or more

at December 31, 2008, were primarily due to extraordinarily

wide asset spreads for residential mortgage, commercial

mortgage and commercial loan asset-backed securities

resulting from an illiquid market, which caused these assets

to be valued at significant discounts to their acquisition cost.

At December 31, 2008, we believed that it is probable that

we will be able to collect all contractually due principal and

interest on these securities. We evaluate these securities for

impairment in accordance with our policies on a quarterly

basis or more frequently if a loss-triggering event occurs.

This evaluation includes evaluating whether there have been

any changes in security ratings issued by ratings agencies,

performance of the underlying collateral for asset-backed

securities including delinquency rates, cumulative losses

to date, and the remaining credit enhancement as

compared to expected credit losses of the security.

The unrealized losses associated with private collateralized

mortgage obligations related to securities backed by commercial

mortgages and residential mortgages. Approximately 75%

of the securities were AAA-rated by at least one major rating

agency. We estimate loss projections for each security by

assessing individual loans collateralizing the security and

determining expected default rates and loss severities. In

addition, based upon our assessment of expected credit losses

of the security given the performance of the underlying

collateral compared to our credit enhancement, we concluded

that these securities were not other-than-temporarily

impaired at December 31, 2008.

The unrealized losses associated with other securities

related to securities backed by commercial loans and individual

issuer companies. For securities with commercial loans as the

underlying collateral, we have evaluated the expected credit

losses in the security and concluded that we have sufficient

credit enhancement when compared with our estimate of

credit losses for the individual security. For individual issuers,

we evaluate the financial performance of the issuer on a

quarterly basis to determine if it is probable that the issuer

can make all contractual principal and interest payments.

The unrealized losses associated with securities of U.S.

states and political subdivisions are primarily driven by

changes in interest rates and not due to the credit quality

of the securities. These investments are almost exclusively

investment grade and were generally underwritten in

accordance with our own investment standards prior to

the determination to purchase, without relying on a bond

insurer’s guarantee in making the investment decision.

These securities will continue to be monitored as part of our

on-going impairment analysis, but are expected to perform,

even if the rating agencies reduce the credit rating of the bond

insurers. As a result, we concluded that these securities were

not other-than-temporarily impaired at December 31, 2008.

Because we have the ability and intent to hold these debt

securities until a recovery of fair value, which may be maturity,

we do not consider these investments to be other-than-

temporarily impaired at December 31, 2008.

Our marketable equity securities included approximately

$4.7 billion of investments in perpetual preferred securities

at December 31, 2008. These securities provide very attractive

tax-equivalent yields and were current as to periodic

distributions in accordance with their respective terms as

of December 31, 2008. We have opportunistically increased

our holdings in these securities over the past 18 months in

response to increased yields available in the marketplace,

driven by a significant widening in credit spreads caused

by the mortgage and credit crises. The market value of our

holdings in these securities declined during this period as

a result of the continued widening of credit spreads. We

evaluated these hybrid financial instruments for impairment

using an evaluation methodology similar to that used for debt

securities. Perpetual preferred securities were not other-than-

temporarily impaired at December 31, 2008, if there was no

evidence of credit deterioration or investment rating down-

grades of any issuers to below investment grade, and it was

probable we would continue to receive full contractual pay-

ments. We will continue to evaluate the prospects for these

securities for recovery in their market value in accordance

with our policy for determining other-than-temporary

impairment. We have recorded impairment write-downs

on perpetual preferred securities where there was evidence

of credit deterioration.

The fair values of our investment securities could decline

in the future if the underlying performance of the collateral

for the private collateralized mortgage obligations or other

securities deteriorate and our credit enhancement levels do

not provide sufficient protection to our contractual principal

and interest. As a result, there is a risk that significant other-

than-temporary impairments may occur in the future given

the current economic environment.

Securities pledged where the secured party has the right to

sell or repledge totaled $10.1 billion at December 31, 2008, and

$5.8 billion at December 31, 2007. Securities pledged where

the secured party does not have the right to sell or repledge

totaled $71.6 billion at December 31, 2008, and $44.9 billion at

December 31, 2007, primarily to secure trust and public deposits

and for other purposes as required or permitted by law.

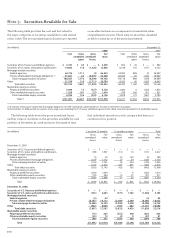

The following table shows the net realized gains on

the sales of securities from the securities available-for-sale

portfolio, including marketable equity securities. Gross

realized losses included other-than-temporary impairment

of $1,790 million, $50 million and $22 million for 2008, 2007

and 2006, respectively. Other-than-temporary impairment

for 2008 included $1,057 million related to perpetual preferred

securities that were either downgraded to less than investment

grade or evidenced other significant credit deterioration events.

(in millions) Year ended December 31,

2008 2007 2006

Gross realized gains $ 1,918 $ 472 $ 621

Gross realized losses (1,883) (127) (295)

Net realized gains $35 $ 345 $ 326