Wells Fargo 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

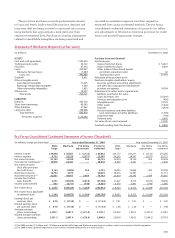

Forecasted losses are compared with actual losses and

this information is used by management in order to develop

an allowance that management believes adequate to cover

losses inherent in the loan portfolio as of the reporting date.

The portion of the allowance for commercial loans,

commercial real estate loans and lease financing was

$4.5 billion at December 31, 2008. We initially estimate this

portion of the allowance by applying historical loss factors

statistically derived from tracking losses associated with

actual portfolio movements over a specified period of time,

for each specific loan grade. Based on this process, we assign

loss factors to each pool of graded loans and a loan equivalent

amount for unfunded loan commitments and letters of credit.

These estimates are then adjusted or supplemented where

necessary from additional analysis of long-term average loss

experience, external loss data or other risks identified from

current conditions and trends in selected portfolios, including

management’s judgment for imprecision and uncertainty.

We also assess and account for certain nonaccrual

commercial and commercial real estate loans that are over

$5 million and certain consumer, commercial and commercial

real estate loans whose terms have been modified in a troubled

debt restructuring as impaired. We include the impairment

on these nonperforming loans in the allowance unless it has

already been recognized as a loss. At December 31, 2008,

we included $816 million in the allowance related to these

impaired loans.

Reflected in the portions of the allowance previously

described is an amount for imprecision or uncertainty that

incorporates the range of probable outcomes inherent in

estimates used for the allowance, which may change from

period to period. This amount is the result of our judgment

of risks inherent in the portfolios, economic uncertainties,

historical loss experience and other subjective factors,

including industry trends, calculated to better reflect our

view of risk in each loan portfolio.

In addition, the allowance for credit losses included a

reserve for unfunded credit commitments of $698 million

at December 31, 2008.

The total allowance reflects management’s estimate

of credit losses inherent in the loan portfolio at the balance

sheet date. We consider the allowance for credit losses

of $21.7 billion adequate to cover credit losses inherent in

the loan portfolio, including unfunded credit commitments,

at December 31, 2008.

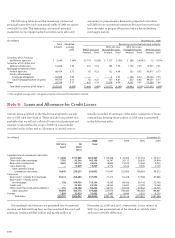

Nonaccrual loans were $6,800 million and $2,679 million

at December 31, 2008 and 2007, respectively. There were no

loans accounted for under SOP 03-3 recorded as nonaccrual.

Loans past due 90 days or more as to interest or principal

and still accruing interest were $12,645 million at December 31,

2008, and $6,393 million at December 31, 2007. The 2008 and

2007 balances included $8,185 million and $4,834 million,

respectively, in advances pursuant to our servicing agreements

to the Government National Mortgage Association (GNMA)

mortgage pools and similar loans whose repayments are

insured by the Federal Housing Administration or guaranteed

by the Department of Veterans Affairs.

The recorded investment in impaired loans included

in nonaccrual loans and the methodology used to measure

impairment follows.

The average recorded investment in these impaired loans

during 2008, 2007 and 2006 was $1,952 million, $313 million

and $173 million, respectively.

When the ultimate collectibility of the total principal

of an impaired loan is in doubt, all payments are applied to

principal, under the cost recovery method. When the ultimate

collectibility of the total principal of an impaired loan is not

in doubt, contractual interest is credited to interest income

when received, under the cash basis method. Total interest

income recognized for impaired loans in 2008, 2007 and

2006 under the cash basis method was not significant.

SOP -

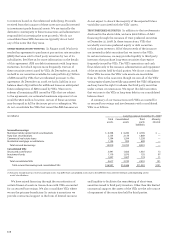

At December 31, 2008, acquired loans within the scope of

SOP 03-3 had an unpaid principal balance (less prior charge-

offs) of $93.9 billion and a carrying value of $58.8 billion.

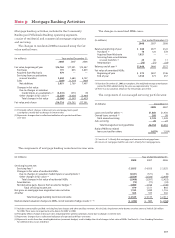

The following table provides details on the SOP 03-3 loans

acquired from Wachovia.

(in millions) December 31,

2008 2007

Impairment measurement based on:

Collateral value method $88 $285

Discounted cash flow method 3,552 184

Total (1)(2) $3,640 $469

(1) Includes $3,468 million and $369 million of impaired loans with a related

allowance of $816 million and $50 million at December 31, 2008 and 2007,

respectively.

(2) Wachovia loans accounted for under SOP 03-3 are not included in this table.

(in millions) December 31, 2008

Contractually required payments including interest $106,192

Nonaccretable difference (1) (41,955)

Cash flows expected to be collected (2) 64,237

Accretable yield (5,440)

Fair value of loans acquired $ 58,797

(1) Includes $37.2 billion in principal cash flows (purchase accounting adjustments)

not expected to be collected, $2.3 billion of pre-acquisition charge-offs and

$2.5 billion of future interest not expected to be collected.

(2) Represents undiscounted expected principal and interest cash flows.