Wells Fargo 2008 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For real estate 1-4 family first and junior lien mortgages,

fair value is calculated by discounting contractual cash flows,

adjusted for prepayment and credit loss estimates, using

discount rates based on current industry pricing (where

readily available) or our own estimate of an appropriate

risk-adjusted discount rate for loans of similar size, type,

remaining maturity and repricing characteristics.

For credit card loans, the portfolio’s yield is equal to our

current pricing and, therefore, the fair value is equal to book

value adjusted for estimates of credit losses inherent in the

portfolio at the balance sheet date.

For all other consumer loans, the fair value is generally

calculated by discounting the contractual cash flows, adjusted

for prepayment and credit loss estimates, based on the

current rates we offer for loans with similar characteristics.

Loan commitments, standby letters of credit and

commercial and similar letters of credit are not included in

the FAS 107 table on page 143. These instruments generate

ongoing fees at our current pricing levels, which are recognized

over the term of the commitment period. In situations where

the credit quality of the counterparty to a commitment has

declined, we record a reserve. A reasonable estimate of the

fair value of these instruments is the carrying value of

deferred fees plus the related reserve. This amounted to $719

million and $33 million at December 31, 2008 and 2007,

respectively. Certain letters of credit that are hedged with

derivative instruments are carried at fair value in trading

assets or liabilities. For those letters of credit fair value is

calculated based on readily quotable credit default spreads,

using a market risk credit default swap model.

DERIVATIVES Quoted market prices are available and used

for our exchange-traded derivatives, such as certain interest

rate futures and option contracts, which we classify as Level 1.

However, substantially all of our derivatives are traded in over-

the-counter (OTC) markets where quoted market prices are not

readily available. OTC derivatives are valued using internal

valuation techniques. Valuation techniques and inputs to internally-

developed models depend on the type of derivative and nature

of the underlying rate, price or index upon which the derivative’s

value is based. Key inputs can include yield curves, credit curves,

foreign-exchange rates, prepayment rates, volatility measurements

and correlation of such inputs. Where model inputs can be

observed in a liquid market and the model does not require

significant judgment, such derivatives are typically classified

as Level 2 of the fair value hierarchy. Examples of derivatives

classified as Level 2 include generic interest rate swaps, foreign

currency swaps, commodity swaps, and option contracts. When

instruments are traded in less liquid markets and significant

inputs are unobservable, such derivatives are classified within

Level 3. Examples of derivatives classified as Level 3 include

complex and highly structured derivatives, credit default swaps,

interest rate lock commitments written for our residential mort-

gage loans that we intend to sell and long dated equity options

where volatility is not observable. Additionally, significant

judgments are required when classifying financial instruments

within the fair value hierarchy, particularly between Level 2 and

3, as is the case for certain derivatives.

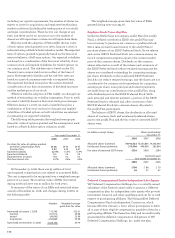

MORTGAGE SERVICING RIGHTS AND CERTAIN OTHER INTERESTS

HELD IN SECURITIZATIONS Mortgage servicing rights (MSRs)

and certain other interests held in securitizations (e.g.,

interest-only strips) do not trade in an active market with

readily observable prices. Accordingly, we determine the fair

value of MSRs using a valuation model that calculates the

present value of estimated future net servicing income. The

model incorporates assumptions that market participants

use in estimating future net servicing income, including

estimates of prepayment speeds (including housing price

volatility), discount rate, cost to service (including delinquency

and foreclosure costs), escrow account earnings, contractual

servicing fee income, ancillary income and late fees.

Commercial MSRs are carried at lower of cost or market value,

and therefore can be subject to fair value measurements on a

nonrecurring basis. For other interests held in securitizations

(such as interest-only strips) we use a valuation model that

calculates the present value of estimated future cash flows.

The model incorporates our own estimates of assumptions

market participants use in determining the fair value, including

estimates of prepayment speeds, discount rates, defaults and

contractual fee income. Interest-only strips are recorded as

trading assets. Fair value measurements of our MSRs and

interest-only strips use significant unobservable inputs and,

accordingly, we classify as Level 3. We may also retain

securities from our loan securitization activities. The valuation

technique for these securities is discussed in Securities

available for sale.

FORECLOSED ASSETS Foreclosed assets include foreclosed

properties securing residential, auto and GNMA loans.

Foreclosed assets are adjusted to fair value less costs to sell

upon transfer of the loans to foreclosed assets. Subsequently,

foreclosed assets are carried at the lower of carrying value or

fair value less costs to sell. Fair value is generally based upon

independent market prices or appraised values of the collateral

and, accordingly, we classify foreclosed assets as Level 2.

NONMARKETABLE EQUITY INVESTMENTS Nonmarketable equity

investments are recorded under the cost or equity method of

accounting. Nonmarketable equity securities that fall within

the scope of the AICPA Investment Company Audit Guide

are carried at fair value (principal investments). There are

generally restrictions on the sale and/or liquidation of these

investments, including federal bank stock. Federal bank stock

carrying value approximates fair value. We use facts and

circumstances available to estimate the fair value of our

nonmarketable equity investments. We typically consider our

access to and need for capital (including recent or projected

financing activity), qualitative assessments of the viability

of the investee, evaluation of the financial statements of the

investee and prospects for its future. Principal investments,

including certain public equity and non-public securities

and certain investments in private equity funds, are recorded

at fair value with realized and unrealized gains and losses

included in gains and losses on equity investments in the

income statement, and are included in other assets on

the balance sheet. Public equity investments are valued