Wells Fargo 2008 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

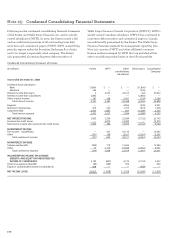

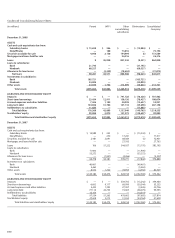

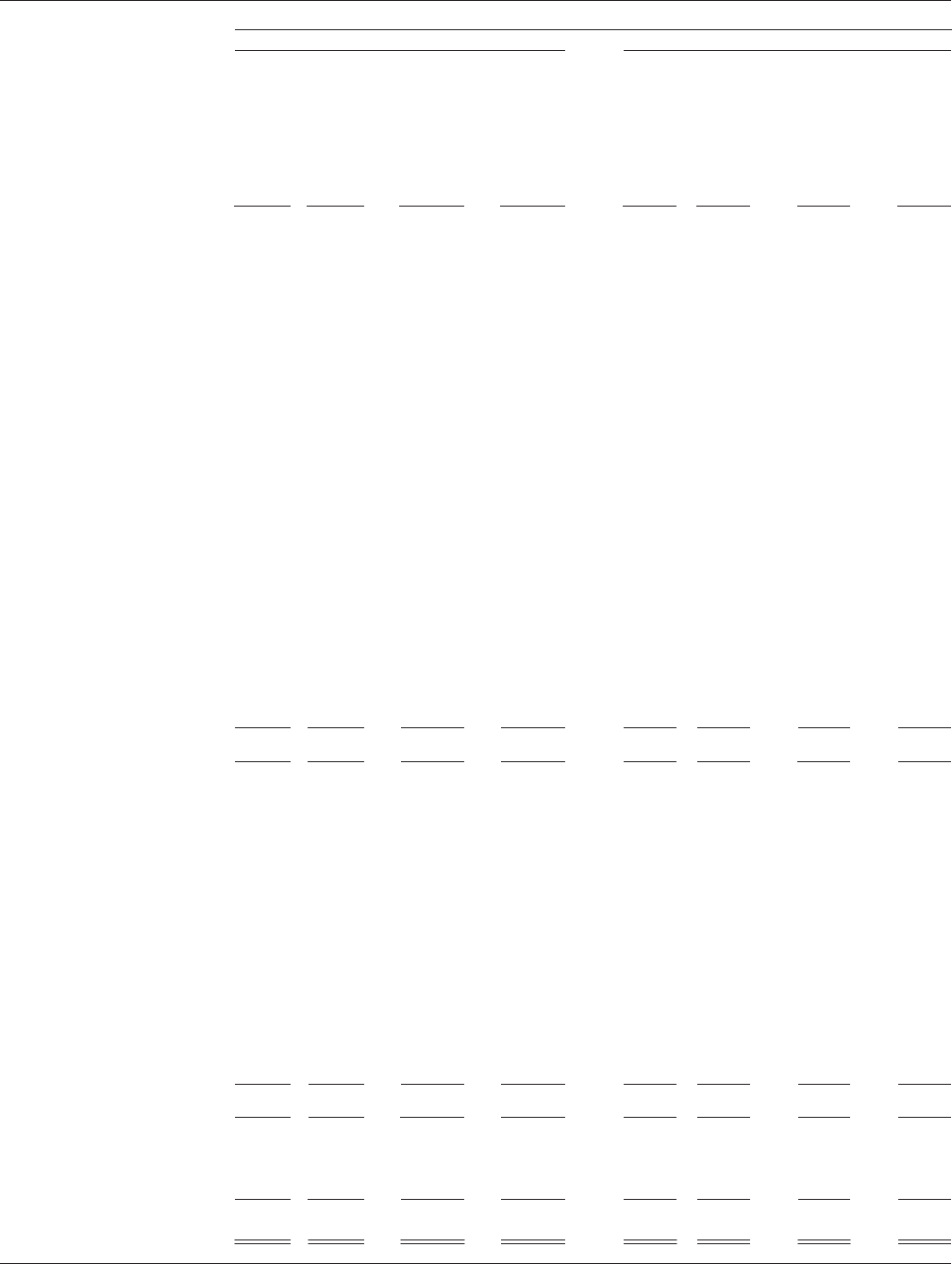

Condensed Consolidating Statements of Cash Flows

(in millions) Year ended December 31,

2008 2007

Parent WFFI Other Consolidated Parent WFFI Other Consolidated

consolidating Company consolidating Company

subsidiaries/ subsidiaries/

eliminations eliminations

Cash flows from

operating activities:

Net cash provided (used)

by operating activities $ 730 $ 2,023 $ (7,584)$ (4,831)$ 3,715 $ 1,446 $ 3,917 $ 9,078

Cash flows from

investing activities:

Securities available for sale:

Sales proceeds 2,570 875 57,361 60,806 2,554 559 44,877 47,990

Prepayments and maturities — 283 24,034 24,317 — 299 8,206 8,505

Purchases (3,514) (1,258) (100,569) (105,341) (3,487) (1,174) (70,468) (75,129)

Loans:

Increase in banking

subsidiaries’ loan originations,

net of collections — (1,684) (53,131) (54,815) — (2,686) (45,929) (48,615)

Proceeds from sales (including

participations) of loans

originated for investment

by banking subsidiaries — — 1,988 1,988 — — 3,369 3,369

Purchases (including

participations) of loans

by banking subsidiaries — — (5,513) (5,513) — — (8,244) (8,244)

Principal collected on

nonbank entities’ loans — 14,447 7,399 21,846 — 18,729 2,747 21,476

Loans originated by

nonbank entities — (12,362) (7,611) (19,973) — (20,461) (4,823) (25,284)

Net repayments from

(advances to) subsidiaries (12,415) — 12,415 — (10,338) — 10,338 —

Capital notes and term loans

made to subsidiaries (2,008) — 2,008 — (10,508) — 10,508 —

Principal collected on notes/

loans made to subsidiaries 8,679 — (8,679) — 7,588 — (7,588) —

Net decrease (increase) in

investment in subsidiaries (37,108) — 37,108 — (1,132) — 1,132 —

Net cash acquired from acquisitions 9,194 — 2,009 11,203 — — (2,811) (2,811)

Other, net (21,823) (91) 69,225 47,311 (106) (847) 2,381 1,428

Net cash provided (used)

by investing activities (56,425) 210 38,044 (18,171) (15,429) (5,581) (56,305) (77,315)

Cash flows from

financing activities:

Net change in:

Deposits — — 7,697 7,697 — — 27,058 27,058

Short-term borrowings 17,636 5,580 (38,104) (14,888) 9,138 2,670 28,019 39,827

Long-term debt:

Proceeds from issuance 21,931 1,113 12,657 35,701 24,385 11,335 (6,360) 29,360

Repayment (16,560) (8,983) (4,316) (29,859) (11,726) (9,870) 3,346 (18,250)

Common stock:

Proceeds from issuance 14,171 — — 14,171 1,876 — — 1,876

Repurchased (1,623) — — (1,623) (7,418) — — (7,418)

Cash dividends paid (4,312) — — (4,312) (3,955) — — (3,955)

Preferred stock:

Proceeds from issuance 22,674 — — 22,674 ————

Proceeds from issuance of

stock warrants 2,326 — — 2,326 ————

Excess tax benefits related to

stock option payments 121 — — 121 196 — — 196

Other, net — — — — (2) 13 (739) (728)

Net cash provided (used)

by financing activities 56,364 (2,290) (22,066) 32,008 12,494 4,148 51,324 67,966

Net change in cash

and due from banks 669 (57) 8,394 9,006 780 13 (1,064) (271)

Cash and due from banks

at beginning of year 14,989 483 (715) 14,757 14,209 470 349 15,028

Cash and due from banks

at end of year $ 15,658 $ 426 $ 7,679 $ 23,763 $ 14,989 $ 483 $ (715) $ 14,757