Wells Fargo 2008 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLLATERALIZED DEBT OBLIGATIONS AND COLLATERALIZED

LOAN OBLIGATIONS A CDO or CLO is a securitization where

an SPE purchases a pool of assets consisting of asset-backed

securities or loans and issues multiple tranches of equity

or notes to investors. In some transactions a portion of the

assets are obtained synthetically through the use of derivatives

such as credit default swaps or total return swaps. Generally,

CDOs and CLOs are structured on behalf of a third party

asset manager that typically selects and manages the assets

for the term of the CDO or CLO. Typically, the asset manager

has some discretion to manage the sale of assets of, or

derivatives used by the CDOs and CLOs.

Prior to the securitization, we may provide all or substantially

all of the warehouse financing to the asset manager. The

asset manager uses this financing to purchase the assets into

a bankruptcy remote SPE during the warehouse period. At

the completion of the warehouse period, the assets are sold to

the CDO or CLO and the warehouse financing is repaid with

the proceeds received from the securitization’s investors.

The warehousing period is generally less than 12 months in

duration. In the event the securitization does not take place,

the assets in the warehouse are liquidated. We consolidate

the warehouse SPEs when we are the primary beneficiary.

We are the primary beneficiary when we provide substantially

all of the financing and therefore absorb the majority of the

variability. Sometimes we have loss sharing arrangements

whereby a third party asset manager agrees to absorb the

credit and market risk during the warehousing period or upon

liquidation of the collateral in the event a securitization does

not take place. In those circumstances we do not consolidate

the warehouse SPE because the third party asset manager

absorbs the majority of the variability through the loss

sharing arrangement.

In addition to our role as arranger and warehouse financing

provider, we may have other forms of involvement with these

transactions. Such involvements may include underwriter,

liquidity provider, derivative counterparty, secondary market

maker or investor. For certain transactions, we may also

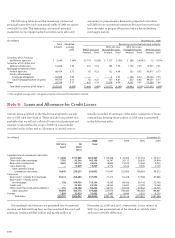

Transactions with VIEs

Our transactions with VIEs include securitization, investment

and financing activities involving collateralized debt

obligations (CDOs) backed by asset-backed and commercial

real estate securities, collateralized loan obligations (CLOs)

backed by corporate loans or bonds, and other types of

structured financing. We have various forms of involvement

with SPEs, including holding senior or subordinated interests,

entering into liquidity arrangements, credit default swaps

and other derivative contracts.

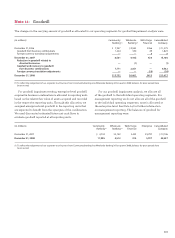

A summary of our involvements with off-balance sheet

(unconsolidated) VIEs is as follows:

(in millions) December 31, 2008

Total Debt and Derivatives Other Total

VIE equity commit-

assets(1) interests ments and

guarantees

Carrying value – asset (liability)

CDOs $ 48,802 $14,080 $ 1,053 $ — $15,133

Wachovia administered ABCP conduit 10,767 ————

Asset-based lending structures 11,614 9,232 (136) — 9,096

Tax credit structures 22,882 4,366 — (516) 3,850

CLOs 23,339 3,217 109 — 3,326

Investment funds 105,808 3,543 — — 3,543

Credit-linked note structures 12,993 50 1,472 — 1,522

Money market funds 31,843 50 10 — 60

Other (2) 1,832 3,983 (36) (141) 3,806

Total $269,880 $38,521 $ 2,472 $ (657) $40,336

Maximum exposure to loss(3)

CDOs $14,080 $ 4,849 $1,514 $20,443

Wachovia administered ABCP conduit — 15,824 — 15,824

Asset-based lending structures 9,346 136 — 9,482

Tax credit structures 4,366 — 560 4,926

CLOs 3,217 109 555 3,881

Investment funds 3,550 — 140 3,690

Credit-linked note structures 50 2,253 — 2,303

Money market funds 50 51 — 101

Other (2) 3,991 130 578 4,699

Total $38,650 $23,352 $3,347 $65,349

(1) Represents the remaining principal balance of assets held by unconsolidated VIEs using the most current information available. For VIEs that obtain exposure to assets

synthetically through derivative instruments, the remaining notional amount of the derivative is included in the asset balance.

(2) Contains investments in auction rate securities issued by VIEs that we do not sponsor and, accordingly, are unable to obtain the total assets of the entity.

(3) Represents the carrying amount of the continuing involvement plus remaining undrawn liquidity and lending commitments, notional amount of net written derivative

contracts, and notional amount of other commitments and guarantees.