Wells Fargo 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

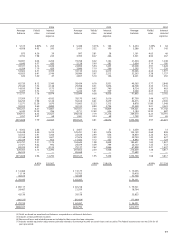

Table 3: Average Balances, Yields and Rates Paid (Taxable-Equivalent Basis) (1)(2)(3)

(in millions) 2008 2007

Average Yields/ Interest Average Yields/ Interest

balance rates income/ balance rates income/

expense expense

EARNING ASSETS

Federal funds sold, securities purchased under

resale agreements and other short-term investments $ 5,293 1.71% $ 90 $ 4,468 4.99% $ 223

Trading assets 4,971 3.80 189 4,291 4.37 188

Debt securities available for sale

(4)

:

Securities of U.S. Treasury and federal agencies 1,083 3.84 41 848 4.26 36

Securities of U.S. states and political subdivisions 6,918 6.83 501 4,740 7.37 342

Mortgage-backed securities:

Federal agencies 44,777 5.97 2,623 38,592 6.10 2,328

Private collateralized mortgage obligations 20,749 6.04 1,412 6,548 6.12 399

Total mortgage-backed securities 65,526 5.99 4,035 45,140 6.10 2,727

Other debt securities (5) 12,818 7.17 1,000 6,295 7.52 477

Total debt securities available for sale

(5)

86,345 6.22 5,577 57,023 6.34 3,582

Mortgages held for sale (6) 25,656 6.13 1,573 33,066 6.50 2,150

Loans held for sale (6) 837 5.69 48 896 7.76 70

Loans:

Commercial and commercial real estate:

Commercial 98,620 6.12 6,034 77,965 8.17 6,367

Other real estate mortgage 41,659 5.80 2,416 32,722 7.38 2,414

Real estate construction 19,453 5.08 988 16,934 7.80 1,321

Lease financing 7,141 5.62 401 5,921 5.84 346

Total commercial and commercial real estate 166,873 5.90 9,839 133,542 7.82 10,448

Consumer:

Real estate 1-4 family first mortgage 75,116 6.67 5,008 61,527 7.25 4,463

Real estate 1-4 family junior lien mortgage 75,375 6.55 4,934 72,075 8.12 5,851

Credit card 19,601 12.13 2,378 15,874 13.58 2,155

Other revolving credit and installment 54,368 8.72 4,744 54,436 9.71 5,285

Total consumer 224,460 7.60 17,064 203,912 8.71 17,754

Foreign 7,127 10.50 748 7,321 11.68 855

Total loans (6) 398,460 6.94 27,651 344,775 8.43 29,057

Other 1,920 4.73 91 1,402 5.07 71

Total earning assets $523,482 6.69 35,219 $445,921 7.93 35,341

FUNDING SOURCES

Deposits:

Interest-bearing checking $ 5,650 1.12 64 $ 5,057 3.16 160

Market rate and other savings 166,691 1.32 2,195 147,939 2.78 4,105

Savings certificates 39,481 3.08 1,215 40,484 4.38 1,773

Other time deposits 6,656 2.83 187 8,937 4.87 435

Deposits in foreign offices 47,578 1.81 860 36,761 4.57 1,679

Total interest-bearing deposits 266,056 1.70 4,521 239,178 3.41 8,152

Short-term borrowings 65,826 2.25 1,478 25,854 4.81 1,245

Long-term debt 102,283 3.70 3,789 93,193 5.18 4,824

Total interest-bearing liabilities 434,165 2.25 9,788 358,225 3.97 14,221

Portion of noninterest-bearing funding sources 89,317 — — 87,696 — —

Total funding sources $523,482 1.86 9,788 $445,921 3.19 14,221

Net interest margin and net interest income on

a taxable-equivalent basis (7) 4.83% $25,431 4.74% $21,120

NONINTEREST-EARNING ASSETS

Cash and due from banks $ 11,175 $ 11,806

Goodwill 13,353 11,957

Other 56,386 51,068

Total noninterest-earning assets $ 80,914 $ 74,831

NONINTEREST-BEARING FUNDING SOURCES

Deposits $ 87,820 $ 88,907

Other liabilities 28,939 26,557

Preferred stockholders’ equity 4,051 —

Common stockholders’ equity 49,421 47,063

Noninterest-bearing funding sources used to

fund earning assets (89,317) (87,696)

Net noninterest-bearing funding sources $ 80,914 $ 74,831

TOTAL ASSETS $604,396 $520,752

(1) Because the Wachovia acquisition was completed at the end of 2008, Wachovia's assets and liabilities are not included in average balances, and Wachovia's

results are not reflected in interest income/expense.

(2) Our average prime rate was 5.09%, 8.05%, 7.96%, 6.19% and 4.34% for 2008, 2007, 2006, 2005 and 2004, respectively. The average three-month London Interbank

Offered Rate (LIBOR) was 2.93%, 5.30%, 5.20%, 3.56% and 1.62% for the same years, respectively.

(3) Interest rates and amounts include the effects of hedge and risk management activities associated with the respective asset and liability categories.