Wells Fargo 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

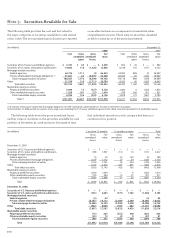

sale as whole loans. Effective January 1, 2007, in connection

with the adoption of FAS 159, The Fair Value Option for

Financial Assets and Financial Liabilities, including an amend-

ment of FASB Statement No. 115 (FAS 159), we elected to mea-

sure new prime residential MHFS at fair value (see Note 17).

Nonprime residential and commercial MHFS continue to

be held at the lower of cost or market value. For these loans,

gains and losses on loan sales (sales proceeds minus carrying

value) are recorded in noninterest income. Direct loan origi-

nation costs and fees are deferred at origination of the loans

and are recognized in mortgage banking noninterest income

upon sale of the loan.

Our lines of business are authorized to originate held-for-

investment loans that meet or exceed established loan prod-

uct profitability criteria, including minimum positive net

interest margin spreads in excess of funding costs. When a

determination is made at the time of commitment to originate

loans as held for investment, it is our intent to hold these

loans to maturity or for the “foreseeable future,” subject to

periodic review under our corporate asset/liability manage-

ment process. In determining the “foreseeable future” for

these loans, management considers (1) the current economic

environment and market conditions, (2) our business strategy

and current business plans, (3) the nature and type of the loan

receivable, including its expected life, and (4) our current

financial condition and liquidity demands. Consistent with

our core banking business of managing the spread between

the yield on our assets and the cost of our funds, loans are

periodically reevaluated to determine if our minimum net

interest margin spreads continue to meet our profitability

objectives. If subsequent changes in interest rates significant-

ly impact the ongoing profitability of certain loan products,

we may subsequently change our intent to hold these loans

and we would take actions to sell such loans in response to the

Corporate ALCO directives to reposition our balance sheet

because of the changes in interest rates. Such Corporate

ALCO directives identify both the type of loans (for example

3/1, 5/1, 10/1 and relationship adjustable-rate mortgages

(ARMs), as well as specific fixed-rate loans) to be sold and the

weighted-average coupon rate of such loans no longer meet-

ing our ongoing investment criteria. Upon the issuance of

such directives, we immediately transfer these loans to the

MHFS portfolio at the lower of cost or market value.

Loans Held for Sale

Loans held for sale are carried at the lower of cost or market

value (LOCOM) or fair value under FAS 159. For loans

carried at LOCOM, gains and losses on loan sales (sales

proceeds minus carrying value) are recorded in noninterest

income, and direct loan origination costs and fees are

deferred at origination of the loan and are recognized in

noninterest income upon sale of the loan.

Loans

Loans are reported at their outstanding principal balances net

of any unearned income, charge-offs, unamortized deferred

fees and costs on originated loans and premiums or discounts

on purchased loans, except for certain purchased loans that

fall under the scope of SOP 03-3, which are recorded at fair

value on their purchase date. See “Loans accounted for under

SOP 03-3” on page 96. Unearned income, deferred fees and

costs, and discounts and premiums are amortized to income

over the contractual life of the loan using the interest method.

We offer a portfolio product known as relationship

adjustable-rate mortgages (ARMs) that provides interest rate

reductions to reward eligible banking customers who have an

existing relationship or establish a new relationship with

Wells Fargo. Accordingly, this product offering is generally

underwritten to certain Company guidelines rather than

secondary market standards and is typically originated for

investment. At December 31, 2008 and 2007, we had $15.6 bil-

lion and $15.4 billion, respectively, of relationship ARMs in

loans held for investment. Originations, net of collections and

proceeds from the sale of these loans are reflected as invest-

ing cash flows consistent with their original classification.

Loans also include direct financing leases that are recorded

at the aggregate of minimum lease payments receivable plus

the estimated residual value of the leased property, less

unearned income. Leveraged leases, which are a form of

direct financing leases, are recorded net of related nonre-

course debt. Leasing income is recognized as a constant per-

centage of outstanding lease financing balances over the

lease terms.

Loan commitment fees are generally deferred and amor-

tized into noninterest income on a straight-line basis over the

commitment period.

We pledge loans to secure borrowings from the Federal

Home Loan Bank and the Federal Reserve Bank as part of our

liquidity management strategy. At December 31, 2008, loans

pledged where the secured party has the right to sell or

repledge totaled $201 billion, and loans pledged where the

secured party does not have the right to sell or repledge

totaled $137 billion.

NONACCRUAL LOANS We generally place loans on nonaccrual

status when:

• the full and timely collection of interest or principal

becomes uncertain;

• they are 90 days (120 days with respect to real estate 1-4

family first and junior lien mortgages and auto loans) past

due for interest or principal (unless both well-secured and

in the process of collection); or

• part of the principal balance has been charged off.

Loans subject to SOP 03-3 are written down to an amount

estimated to be collectible. Accordingly, such loans are no

longer classified as nonaccrual even though they may be con-

tractually past due, because we expect to fully collect the new

carrying values of such loans (that is, the new cost basis aris-

ing out of purchase accounting).

Generally, consumer loans not secured by real estate or

autos are placed on nonaccrual status only when part of the

principal has been charged off. These loans are charged off or

charged down to the net realizable value of the collateral

when deemed uncollectible, due to bankruptcy or other fac-