Wells Fargo 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

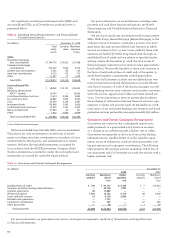

Our significant continuing involvement with QSPEs and

unconsolidated VIEs as of December 31, 2008 and 2007, is

presented below.

We have excluded from the table SPEs and unconsolidated

VIEs where our only involvement is in the form of invest-

ments in trading securities, investments in securities or loans

underwritten by third parties, and administrative or trustee

services. We have also excluded investments accounted for

in accordance with the AICPA Investment Company Audit

Guide, investments accounted for under the cost method and

investments accounted for under the equity method.

For more information on securitizations, including sales

proceeds and cash flows from securitizations, see Note 8

(Securitizations and Variable Interest Entities) to Financial

Statements.

We also have significant involvement with voting interest

SPEs. Wells Fargo Home Mortgage (Home Mortgage), in the

ordinary course of business, originates a portion of its mort-

gage loans through unconsolidated joint ventures in which

we own an interest of 50% or less. Loans made by these joint

ventures are funded by Wells Fargo Bank, N.A. through an

established line of credit and are subject to specified under-

writing criteria. At December 31, 2008, the total assets of

these mortgage origination joint ventures were approximate-

ly $46 million. We provide liquidity to these joint ventures in

the form of outstanding lines of credit and, at December 31,

2008, these liquidity commitments totaled $135 million.

We also hold interests in other unconsolidated joint ven-

tures formed with unrelated third parties to provide efficien-

cies from economies of scale. A third party manages our real

estate lending services joint ventures and provides customers

with title, escrow, appraisal and other real estate related ser-

vices. Our fraud prevention services partnership facilitates

the exchange of information between financial services orga-

nizations to detect and prevent fraud. At December 31, 2008,

total assets of our real estate lending joint ventures and fraud

prevention services partnership were approximately $132 million.

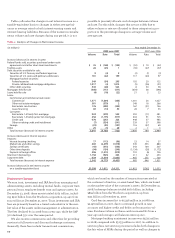

Guarantees and Certain Contingent Arrangements

Guarantees are contracts that contingently require us to

make payments to a guaranteed party based on an event

or a change in an underlying asset, liability, rate or index.

Guarantees are generally in the form of securities lending

indemnifications, standby letters of credit, liquidity agree-

ments, recourse obligations, residual value guarantees, writ-

ten put options and contingent consideration. The following

table presents the carrying amount, maximum risk of loss of

our guarantees and, for December 31, 2008, the amount with a

higher payment risk.

Table 12: Guarantees and Certain Contingent Arrangements

(in millions) December 31,

2008 2007

Carrying Maximum Higher Carrying Maximum

amount risk of payment amount risk of

loss risk loss

Standby letters of credit $ 130 $ 47,191 $17,293 $ 7 $12,530

Securities and other lending indemnifications — 30,120 1,907 ——

Liquidity agreements 30 17,602 — ——

Written put options 1,376 10,182 5,314 48 2,569

Loans sold with recourse 53 6,126 2,038 —2

Residual value guarantees — 1,121 — ——

Contingent consideration 11 187 — 67 246

Other guarantees — 38 — 1 59

Total guarantees $1,600 $112,567 $26,552 $123 $15,406

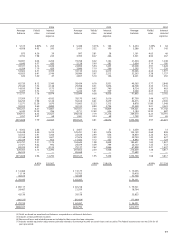

Table 11: Qualifying Special Purpose Entities and Unconsolidated

Variable Interest Entities

(in millions) December 31, 2008

Total Carrying Maximum

entity value exposure

assets to loss

QSPEs

Residential mortgage

loan securitizations $1,144,775 $29,939 $31,438

Commercial mortgage

securitizations 355,267 3,060 6,376

Student loan securitizations 2,765 133 133

Auto loan securitizations 4,133 115 115

Other 11,877 71 1,576

Total QSPEs $1,518,817 $33,318 $39,638

Unconsolidated VIEs

CDOs $ 48,802 $15,133 $20,443

Wachovia administered

ABCP (1) conduit 10,767 — 15,824

Asset-based lending structures 11,614 9,096 9,482

Tax credit structures 22,882 3,850 4,926

CLOs 23,339 3,326 3,881

Investment funds 105,808 3,543 3,690

Credit-linked note structures 12,993 1,522 2,303

Money market funds 31,843 60 101

Other 1,832 3,806 4,699

Total unconsolidated VIEs $ 269,880 $40,336 $65,349

(1) Asset-backed commercial paper

For more information on guarantees and certain contingent arrangements, see Note 15 (Guarantees and Legal Actions)

to Financial Statements.