Wells Fargo 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

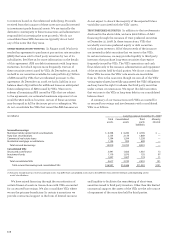

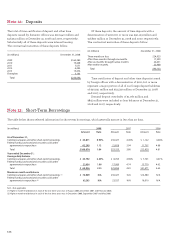

(in millions)

December 31,

Maturity Stated 2008

2007

date(s)

interest

rate(s)

Wells Fargo Financial, Inc., and its subsidiaries (WFFI)

Senior

Fixed-Rate Notes 2009-2034 3.60-6.85% $ 6,456 $ 8,103

Floating-Rate Notes 2009-2010 Varies 1,075 1,405

Total senior debt – WFFI 7,531 9,508

Subordinated

Other notes and debentures 2009-2017 3.50-5.125% 6 —

Total subordinated – WFFI 6 —

Total long-term debt – WFFI 7,537 9,508

Other consolidated subsidiaries

Senior

Fixed-Rate Notes (1) 2009-2049 0.00-7.50% 2,489 951

Fixed-Rate Notes – Auto secured financing 2009-2015 1.36-9.05% 1,804 —

Fixed-Rate Advances – FHLB 2009-2031 2.85-8.45% 2,545 —

Floating-Rate Notes (3) 2009-2011 Varies 2,641 —

Floating-Rate Advances – FHLB (3) 2009-2013 Varies 46,282 1,250

Other notes and debentures – Floating-Rate 2009-2049 Varies 3,347 1,752

Total senior debt – Other consolidated subsidiaries 59,108 3,953

Subordinated

Fixed-Rate Notes 6.25% —202

Floating-Rate Notes (3) 2013 Varies 421 —

Floating-Rate Notes – Preferred units (3) Varies Varies 349 —

Other notes and debentures – Floating-Rate 2011-2016 Varies 84 83

Total subordinated debt – Other consolidated subsidiaries 854 285

Junior Subordinated

Fixed-Rate Notes (8) 2011-2031 5.50-10.875% 116 112

Floating-Rate Notes (3)(8) 2026-2036 Varies 763 257

FixFloat Notes 2036 7.06% through

mid-2011, varies 80 81

Total junior subordinated debt – Other consolidated subsidiaries 959 450

Mortgage notes and other debt of subsidiaries Varies Varies 799 —

Total long-term debt – Other consolidated subsidiaries 61,720 4,688

Total long-term debt $267,158 $99,393

(1) We entered into interest rate swap agreements for most of these notes, whereby we receive fixed-rate interest payments approximately equal to interest on the notes

and make interest payments based on an average one-month, three-month or six-month London Interbank Offered Rate (LIBOR).

(2) On December 10, 2008, Wells Fargo issued $3 billion of 3% fixed senior unsecured notes and $3 billion of floating senior unsecured notes both maturing on December 9,

2011. These notes are guaranteed under the FDIC’s Temporary Liquidity Guarantee Program and are backed by the full faith and credit of the United States.

(3) We entered into interest rate swap agreements for a portion of these notes, whereby we receive variable-rate interest payments and make interest payments based on a

fixed rate.

(4) The extendable notes are floating-rate securities with an initial maturity of 13 or 24 months, which can be extended on a rolling monthly or quarterly basis, respectively,

to a final maturity of five years at the investor’s option.

(5) Consists of long-term notes where the performance of the note is linked to an embedded equity, commodity, or currency index, or basket of indices accounted for

separately from the note as a free-standing derivative. For information on embedded derivatives, see Note 16 – Free-standing derivatives.

(6) On April 15, 2003, we issued $3 billion of convertible senior debentures as a private placement. In November 2004, we amended the indenture under which the debentures

were issued to eliminate a provision in the indenture that prohibited us from paying cash upon conversion of the debentures if an event of default as defined in the

indenture exists at the time of conversion. We then made an irrevocable election under the indenture on December 15, 2004, that upon conversion of the debentures,

we must satisfy the accreted value of the obligation (the amount of accrued benefit of the holder exclusive of the conversion spread) in cash and may satisfy the

conversion spread (the excess conversion value over the accreted value) in either cash or stock.

(7) On May 1, 2008, the $3 billion of convertible senior debentures were remarketed at a rate of 3.55175% per annum. Upon the remarketing event the debentures were no

longer convertible securities.

(8) Effective December 31, 2003, as a result of the adoption of FIN 46 (revised December 2003), Consolidation of Variable Interest Entities (FIN 46(R)), we deconsolidated certain

wholly-owned trusts formed for the sole purpose of issuing trust preferred securities (the Trusts). The junior subordinated debentures held by the Trusts are included in

the Company’s long-term debt.

(9) On December 5, 2006, Wells Fargo Capital X issued 5.95% Capital Securities and used the proceeds to purchase from the Parent 5.95% Capital Efficient Notes (the Notes)

due 2086 (scheduled maturity 2036). When it issued the Notes, the Parent entered into a Replacement Capital Covenant (the Covenant) in which it agreed for the benefit

of the holders of the Parent’s 5.625% Junior Subordinated Debentures due 2034 that it will not repay, redeem or repurchase, and that none of its subsidiaries will purchase,

any part of the Notes or the Capital Securities on or before December 1, 2066, unless the repayment, redemption or repurchase is made from the net cash proceeds of the

issuance of certain qualified securities and pursuant to the other terms and conditions set forth in the Covenant. For more information, refer to the Covenant, which was

filed as Exhibit 99.1 to the Company’s Current Report on Form 8-K filed December 5, 2006.

(continued from previous page)