Wells Fargo 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We also have in place proactive steps to work with

customers to refinance or restructure their Pick-a-Pay

loans into other loan products. For customers at-risk, we

will offer combinations of term extensions of up to 40 years,

interest rate reductions, charge no interest on a portion

of the principal for some period of time and, in geographies

with substantial property value declines, we will even use

permanent principal reductions.

We expect to continually reassess our loss mitigation

strategies and may adopt additional strategies in the future.

To the extent that these strategies involve making an economic

concession to a customer experiencing financial difficulty,

they will be accounted for and reported as TDRs.

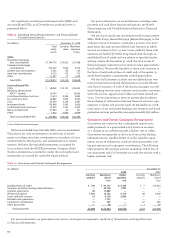

Table 16: Pick-a-Pay Portfolio

(in millions) December 31, 2008

SOP 03-3 loans All other loans

Outstanding Current Carrying Ratio of Outstanding Current

balance (1) LTV ratio (2) amount carrying balance LTV ratio (2)

amount

to current

value

California $42,650 133% $25,472 85% $28,107 86%

Florida 5,992 119 3,439 76 6,099 89

New Jersey 1,809 94 1,246 60 3,545 74

Texas 562 72 385 49 2,231 61

Arizona 1,552 133 895 85 1,449 95

Other states 9,381 92 6,178 61 16,269 75

Total Pick-a-Pay loans $61,946 $37,615 $57,700

(1) Outstanding balances exclude purchase accounting nonaccretable difference of $(24.3) billion; include accretable yield.

(2) Current LTV ratio is based on collateral values and is updated quarterly by an independent vendor. LTV ratio includes outstanding balance on equity lines of credit

(included in Table 15) that share common collateral and are junior to the above Pick-a-Pay loans.