Wells Fargo 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

with us covering the full range of lending and operating

services such as Treasury Management, the Commercial

Electronic O ce®, and Desktop Deposit®.

Our Asset Management group now has $500 billion in

assets under management. In the last fi ve years our mutual

funds have grown from the 27th-largest fund complex in 2003

($78 billion) to the 14th-largest in 2008 ($172 billion). Combined

with Wachovia’s Evergreen Investments, our mutual fund assets

under management had a balance of $250 billion, among the 15

largest in our industry.

We welcome to our Board

With the merger, four members of the Wachovia Board have

joined the Wells Fargo Board, and we’re benefi ting from

their experience and knowledge of Wachovia’s markets and

customers. We welcome:

• John Baker, president and CEO of Patriot Transportation

Holding, Inc., Jacksonville, Florida, Wachovia Board member

since 2001.

• Don James, chairman and CEO of Vulcan Materials

Company, Birmingham, Alabama, Wachovia Board member

since 2004.

• Mackey McDonald, retired chairman and CEO of

VF Corporation, an apparel manufacturer in Greensboro,

North Carolina, Wachovia Board member since 1997.

• Bob Steel, former president and CEO of Wachovia

Corporation, Wachovia Board member since 2008.

We also thank:

• Dick Kovacevich, who, at the Board’s invitation, agreed

to continue as chairman for an interim period to help us

successfully integrate Wachovia into Wells Fargo. His

experience and counsel are needed now more than ever

because he shaped our company’s vision and values and

led what is known as the most successful merger of two

large fi nancial services companies in U.S. history — the

Norwest-Wells Fargo merger 10 years ago.

• Phil Quigley, who our Board elected to the new position

of lead director to work with Dick and me to approve

Board meeting agendas, chair meetings of independent

directors, call executive sessions of the Board, help ensure

coordinated coverage of Board responsibilities, and facilitate

communication between the Board and senior management.

• Mike Wright, retired chairman and CEO of

SUPERVALU INC., who will retire from the Board in April

2009 after 18 years of service to our company. Mike joined

our Board in 1991 and has served on the Credit, Human

Resources, and Governance and Nominating Committees.

We thank him for his outstanding contributions to the

governance of our company.

The year ahead: we believe in America

If you’re a pessimist, there’s a lot for you to like about 2009.

It will be a rough year for our economy and our industry.

Consumer loans will continue under stress with falling home

prices, a nine-month inventory of unsold homes nationally,

higher unemployment, less disposable income and discretionary

spending, more bankruptcies. Credit quality will not improve

until the housing market stabilizes. Charge-o s (uncollectible

debt) probably will continue to rise. Loan losses in consumer

credit businesses including home equity will continue higher

than normal until home values stop falling.

Regardless of what the economy and the markets do in

2009, we focus on our vision and on doing what’s right for our

customers. Now, more than ever before in our lifetimes, people

need a safe, trustworthy, capable fi nancial advisor who can

partner with them to help plan and achieve their fi nancial goals

for a home, education, building a business and retirement.

Despite the pain of 2008, we continue to believe in the spirit,

ingenuity, work ethic, creativity and adaptability of American

workers. We’re capitalists and proud of it. We believe in free

enterprise. We’re Americans fi rst, bankers second. We’re

long-term optimists. We believe in the economic potential of

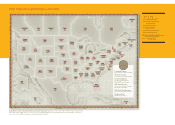

every one of our communities, from Atlanta to Anchorage,

from Galveston to Great Falls. We believe in the United States

of America as a beacon for freedom, liberty and economic

opportunity worldwide. We believe our country can learn from

its mistakes and survive downturns in business cycles better

than any country in the world. It’s still the global leader in

technology, manufacturing and services, still the global leader

by far in gross domestic product, still the leader in global

buying power, still the best place in the world in which to invest

and do business.

Our country and our ancestors have faced far more di cult

challenges than those we face today. Just ask your grandparents

or read about their lives. My parents were children of the Great

Depression. They raised 11 children on a family farm in central

Minnesota, worked hard and sacrifi ced, and taught us what is

really important in life. I see no reason why with discipline and

determination our great country cannot persevere and prosper

through these times as well. Now more than ever before, our

company wants to stand by our customers and do what’s right

for them just as Wells Fargo has done for almost 16 decades and

seven generations.

We thank all our 281,000 team members from Wells Fargo

and Wachovia for working together with our customers to earn

more of their business and for collaborating to help ensure

a smooth merger integration. We thank our customers for

entrusting us with more of their business and for returning

to us for their next fi nancial services product. We thank our

communities for allowing us to serve them. And we thank you,

our owners, for your confi dence in Wells Fargo as we begin

our 158th year.

Together we’ll go far!

John G. Stumpf, President and Chief Executive O cer