Wells Fargo 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

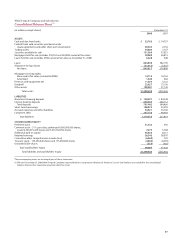

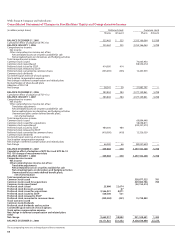

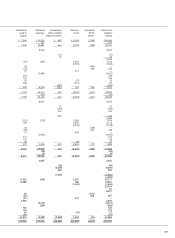

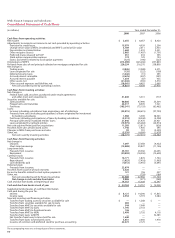

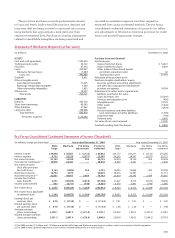

Notes to Financial Statements

Wells Fargo & Company is a diversified financial services

company. We provide banking, insurance, investments, mort-

gage banking, investment banking, retail banking, brokerage,

and consumer finance through banking stores, the internet

and other distribution channels to consumers, businesses and

institutions in all 50 states of the U.S. and in other countries.

In this Annual Report, when we refer to “the Company,” “we,”

“our” or “us” we mean Wells Fargo & Company and

Subsidiaries (consolidated). Wells Fargo & Company (the

Parent) is a financial holding company and a bank holding

company. We also hold a majority interest in a retail broker-

age subsidiary and a real estate investment trust, which has

publicly traded preferred stock outstanding.

Our accounting and reporting policies conform with U.S.

generally accepted accounting principles (GAAP) and prac-

tices in the financial services industry. To prepare the finan-

cial statements in conformity with GAAP, management must

make estimates based on assumptions about future economic

and market conditions (for example, unemployment, market

liquidity, real estate prices, etc.) that affect the reported

amounts of assets and liabilities at the date of the financial

statements and income and expenses during the reporting

period and the related disclosures. Although our estimates

contemplate current conditions and how we expect them to

change in the future, it is reasonably possible that in 2009

actual conditions could be worse than anticipated in those

estimates, which could materially affect our results of opera-

tions and financial condition. Management has made signifi-

cant estimates in several areas, including the evaluation of

other-than-temporary impairment on investment securities

(Note 5), allowance for credit losses and loans accounted for

under American Institute of Certified Public Accountants

(AICPA) Statement of Position 03-3, Accounting for Certain

Loans or Debt Securities Acquired in a Transfer (SOP 03-3)

(Note 6), valuing residential mortgage servicing rights (MSRs)

(Notes 8 and 9) and financial instruments (Note 17), pension

accounting (Note 20) and income taxes (Note 21). Actual

results could differ from those estimates. Among other effects,

such changes could result in future impairments of investment

securities, establishment of allowance for loan losses, as well

as increased pension expense.

On October 3, 2008, we signed a definitive merger agree-

ment with Wachovia Corporation (Wachovia) and the merger

was consummated on December 31, 2008. Wachovia’s assets

and liabilities are included in the consolidated balance sheet

at their respective acquisition date fair values. Because the

acquisition was completed at the end of 2008, Wachovia’s

results of operations are not included in the income state-

ment. The accounting policies of Wachovia have been con-

formed to those of Wells Fargo as described herein.

In the Financial Statements and related Notes, all common

share and per share disclosures reflect a two-for-one stock split

in the form of a 100% stock dividend distributed August 11, 2006.

On January 1, 2008, we adopted the following new

accounting pronouncements:

• FSP FIN 39-1 – Financial Accounting Standards Board

(FASB) Staff Position on Interpretation No. 39,

Amendment of FASB Interpretation No. 39;

• EITF 06-4 – Emerging Issues Task Force (EITF) Issue

No. 06-4, Accounting for Deferred Compensation and

Postretirement Benefit Aspects of Endorsement Split-Dollar

Life Insurance Arrangements;

• EITF 06-10 – EITF Issue No. 06-10, Accounting for

Collateral Assignment Split-Dollar Life Insurance

Arrangements; and

• SAB 109 – Staff Accounting Bulletin No. 109, Written Loan

Commitments Recorded at Fair Value Through Earnings.

On July 1, 2008, we adopted the following new accounting

pronouncement:

• FSP FAS 157-3 – FASB Staff Position No. FAS 157-3,

Determining the Fair Value of a Financial Asset When the

Market for That Asset Is Not Active.

We adopted the following new accounting pronounce-

ments, which were effective for year-end 2008 reporting:

• FSP FAS 140-4 and FIN 46(R)-8 – FASB Staff Position

No. 140-4 and FIN 46(R)-8, Disclosures by Public Entities

(Enterprises) about Transfers of Financial Assets and

Interests in Variable Interest Entities;

• FSP FAS 133-1 and FIN 45-4 – FASB Staff Position No. 133-1

and FIN 45-4, Disclosures about Credit Derivatives and

Certain Guarantees: An Amendment of FASB Statement

No. 133 and FASB Interpretation No. 45; and Clarification

of the Effective Date of FASB Statement No. 161; and

• FSP EITF 99-20-1, FASB Staff Position No. EITF 99-20-1,

Amendments to the Impairment Guidance of EITF Issue

No. 99-20.

On April 30, 2007, the FASB issued FSP FIN 39-1, which

amends Interpretation No. 39 to permit a reporting entity to

offset the right to reclaim cash collateral (a receivable), or the

obligation to return cash collateral (a payable), against deriv-

ative instruments executed with the same counterparty under

the same master netting arrangement. The provisions of this

FSP are effective for the year beginning on January 1, 2008,

with early adoption permitted. We adopted FSP FIN 39-1 on

January 1, 2008, and it did not have a material effect on our

consolidated financial statements.

On September 20, 2006, the FASB ratified the consensus

reached by the EITF at its September 7, 2006, meeting with

respect to EITF 06-4. On March 28, 2007, the FASB ratified the

consensus reached by the EITF at its March 15, 2007, meeting

with respect to EITF 06-10. These pronouncements require

that for endorsement split-dollar life insurance arrangements

and collateral split-dollar life insurance arrangements where

the employee is provided benefits in postretirement periods,

the employer should recognize the cost of providing that

insurance over the employee’s service period by accruing a

liability for the benefit obligation. Additionally, for collateral

assignment split-dollar life insurance arrangements, an

employer is required to recognize and measure an asset based

Note 1: Summary of Significant Accounting Policies