Wells Fargo 2008 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

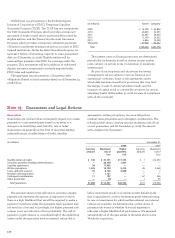

LE-NATURE’S, INC. Wachovia Bank, N.A. is the administrative

agent on a $285 million credit facility extended to Le-Nature’s,

Inc. in September 2006, of which approximately $270 million

was syndicated to other lenders by Wachovia Capital

Markets, LLC. Le-Nature’s was the subject of a Chapter 7

bankruptcy petition which was converted to a Chapter 11

bankruptcy petition in November 2006 in the U.S.

Bankruptcy Court for the Western District of Pennsylvania.

The filing was precipitated by an apparent fraud relating

to Le-Nature’s financial condition. On March 14, 2007, the

two Wachovia entities filed an action against several hedge

funds in the Superior Court for the State of North Carolina,

Mecklenburg County, alleging that the hedge fund defendants

had acquired a significant quantity of the outstanding

debt with full knowledge of Le-Nature’s fraud and with the

intention of pursuing alleged fraud and other tort claims

against the two Wachovia entities purportedly related to their

role in Le-Nature’s credit facility. A preliminary injunction

was entered by the Court that, among other things, prohibited

defendants from asserting any such claims in any other

forum. On September 18, 2007, these defendants filed an

action in the U.S. District Court for the Southern District of

New York against Wachovia Capital Markets, a third party

and two members of Le-Nature’s management asserting

claims arising under federal RICO laws. On March 13, 2008,

the North Carolina judge granted Defendants’ motion to stay

the North Carolina action and modified the injunction to

allow the Defendants to attempt to assert claims in the New

York action. The Wachovia entities have appealed. Wachovia

Capital Markets filed a motion to dismiss the New York

action which was granted on August 26, 2008. Plaintiffs have

appealed that ruling. Plaintiffs subsequently filed a case

asserting similar allegations in the New York State Supreme

Court for the County of Manhattan. On April 28, 2008, holders

of Le-Nature’s Senior Subordinated Notes, an offering which

was underwritten by Wachovia Capital Markets in June 2003,

sued alleging various fraud claims; this case is pending in the

U.S. District Court for the Western District of Pennsylvania.

On October 30, 2008, the liquidation trust in Le-Nature’s

bankruptcy filed suit against a number of individuals and

entities, including Wachovia Capital Markets, LLC, and

Wachovia Bank, N.A., in the U.S. District Court for the

Western District of Pennsylvania, asserting a variety

of claims on behalf of the estate.

MERGER RELATED LITIGATION On October 4, 2008, Citigroup,

Inc. (Citigroup) purported to commence an action in the

Supreme Court of the State of New York for the County of

Manhattan, captioned Citigroup, Inc. v. Wachovia Corp., et al.,

naming as defendants Wachovia Corporation (Wachovia),

Wells Fargo & Company (Wells Fargo), and the directors

of both companies. The complaint alleged that Wachovia

Corporation breached an exclusivity agreement with

Citigroup, which by its terms was to expire on October 6,

2008, by entering into negotiations and an eventual

acquisition agreement with Wells Fargo, and that Wells Fargo

and the individual defendants had tortiously interfered

with the same contract. In the complaint, Citigroup seeks

$20 billion in compensatory damages and $40 billion in

punitive damages. After significant procedural activity

over the week of October 4-9, 2008, including a voluntary

dismissal and re-filing of the action in amended form, the

case was removed on October 9, 2008, to the U.S. District

Court for the Southern District of New York. On October 10,

2008, Citigroup filed a motion to remand the case to the

New York state court, and filed a new proposed amended

complaint. The proposed amended complaint includes claims

for breach of contract, tortious interference with contract,

unjust enrichment, promissory estoppel, and quantum meruit.

In the proposed amended complaint, which the court has not

yet approved, Citigroup seeks $20 billion in compensatory

damages, $20 billion in restitutionary and unjust enrichment

damages, and $40 billion in punitive damages. On October

24, 2008, Wachovia Corporation and Wells Fargo filed a joint

response to the motion to remand.

On October 4, 2008, Wachovia Corporation filed a

complaint in the U.S. District Court for the Southern District

of New York, captioned Wachovia Corp. v. Citigroup, Inc.

The complaint seeks declaratory relief, stating that the

Wells Fargo merger agreement is valid, proper, and not

prohibited by the exclusivity agreement. On October 5, 2008,

Wachovia filed a motion for a preliminary injunction seeking

to prevent Citigroup from interfering with or impeding its

merger with Wells Fargo. On October 9, 2008, Citigroup

issued a press release stating that Citigroup would no longer

seek to enjoin the merger, but would continue to seek

compensatory and punitive damages against Wachovia

Corporation and Wells Fargo. On October 14, 2008,

Wells Fargo filed a related complaint in the U.S. District

Court for the Southern District of New York, captioned

Wells Fargo v. Citigroup, Inc. The complaint seeks declaratory

and injunctive relief, stating that the Wells Fargo merger

agreement is valid, proper, and not prohibited by the

exclusivity agreement. Citigroup has moved to dismiss

the complaint. The cases have been assigned to the same

judge for further proceedings.

MUNICIPAL DERIVATIVES BID PRACTICES INVESTIGATION

The Department of Justice (DOJ) and the SEC, beginning

in November 2006, have been requesting information from

a number of financial institutions, including Wachovia Bank,

N.A.’s municipal derivatives group, generally with regard

to competitive bid practices in the municipal derivative

markets. In connection with these inquiries, Wachovia Bank

has received subpoenas from both the DOJ and SEC as

well as requests from the OCC and several states seeking

documents and information. The DOJ and the SEC have

advised Wachovia Bank that they believe certain of its

employees engaged in improper conduct in conjunction

with certain competitively bid transactions and, in November

2007, the DOJ notified two Wachovia Bank employees, both

of whom have since been terminated, that they are regarded