Wells Fargo 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

tors, or when they reach a defined number of days past due

based on loan product, industry practice, country, terms and

other factors.

When we place a loan on nonaccrual status, we reverse the

accrued unpaid interest receivable against interest income

and account for the loan on the cash or cost recovery method,

until it qualifies for return to accrual status. Generally, we

return a loan to accrual status when (a) all delinquent interest

and principal become current under the terms of the loan

agreement or (b) the loan is both well-secured and in the

process of collection and collectibility is no longer doubtful.

Loan Charge-Off Policies

For commercial loans, we generally fully or partially charge

down to the fair value of collateral securing the asset when:

• management judges the asset to be uncollectible;

• repayment is deemed to be protracted beyond reasonable

time frames;

• the asset has been classified as a loss by either our inter-

nal loan review process or external examiners;

• the customer has filed bankruptcy and the loss becomes

evident owing to a lack of assets; or

• the loan is 180 days past due unless both well secured and

in the process of collection.

For consumer loans, our charge-off policies are as follows:

- FAMILY FIRST AND JUNIOR LIEN MORTGAGES We generally

charge down to the net realizable value when the loan is 180

days past due.

AUTO LOANS We generally charge down to the net realizable

value when the loan is 120 days past due.

UNSECURED LOANS (CLOSED END) We generally charge-off

when the loan is 120 days past due.

UNSECURED LOANS (OPEN-END) We generally charge-off

when the loan is 180 days past due.

CREDIT CARD LOANS We generally fully charge-off when the

loan is 180 days past due.

OTHER SECURED LOANS We generally fully or partially charge

down to the net realizable value when the loan is 120 days

past due.

IMPAIRED LOANS We consider a loan to be impaired when,

based on current information and events, we determine that

we will not be able to collect all amounts due according to the

loan contract, including scheduled interest payments. We

assess and account for as impaired certain nonaccrual com-

mercial and commercial real estate loans that are over $5 mil-

lion and certain consumer, commercial and commercial real

estate loans whose terms have been modified in a troubled

debt restructuring.

When we identify a loan as impaired, we measure the

impairment based on the present value of expected future

cash flows, discounted at the loan’s effective interest rate,

except when the sole (remaining) source of repayment for the

loan is the operation or liquidation of the collateral. In these

cases we use an observable market price or the current fair

value of the collateral, less selling costs when foreclosure is

probable, instead of discounted cash flows.

If we determine that the value of the impaired loan is less

than the recorded investment in the loan (net of previous

charge-offs, deferred loan fees or costs and unamortized pre-

mium or discount), we recognize impairment through an

allowance estimate or a charge-off to the allowance.

In situations where, for economic or legal reasons related

to a borrower’s financial difficulties, we grant a concession

to the borrower that we would not otherwise consider, the

related loan is classified as a troubled debt restructuring.

The restructuring of a loan may include (1) the transfer from

the borrower to the company of real estate, receivables from

third parties, other assets, or an equity interest in the borrower

in full or partial satisfaction of the loan, (2) a modification of

the loan terms, or (3) a combination of the above.

In cases where we grant the borrower new terms that pro-

vide for a reduction of either interest or principal, we mea-

sure any loss on the restructuring in accordance with the

guidance concerning impaired loans set forth in FAS 114,

Accounting by Creditors for the Impairment of a Loan – an

amendment of FASB Statements No. 5 and 15.

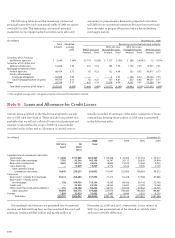

ALLOWANCE FOR CREDIT LOSSES The allowance for credit

losses, which consists of the allowance for loan losses and the

reserve for unfunded credit commitments, is management’s

estimate of credit losses inherent in the loan portfolio at the

balance sheet date.

LOANS ACCOUNTED FOR UNDER SOP - Loans acquired by

completion of a transfer or in a business combination, includ-

ing those acquired from Wachovia, where there is evidence of

credit deterioration since origination and it is probable at the

date of acquisition that we will not collect all contractually

required principal and interest payments are accounted for

under SOP 03-3. SOP 03-3 requires that acquired credit-

impaired loans be recorded at fair value and prohibits carry-

over of the related allowance for loan losses. Some loans that

otherwise meet the definition as credit impaired are specifi-

cally excluded from the scope of SOP 03-3, such as revolving

loans where the borrower still has revolving privileges.

Evidence of credit quality deterioration as of the purchase

date may include statistics such as past due and nonaccrual

status, recent borrower credit scores and recent loan-to-value

percentages. Generally, acquired loans that meet our defini-

tion for nonaccrual status fall within the scope of SOP 03-3.

Loans within the scope of SOP 03-3 are initially recorded

at fair value. The application of the SOP, and the process esti-

mating fair value involves estimating the principal and inter-

est cash flows expected to be collected on the credit impaired

loans and discounting those cash flows at a market rate of

interest.

Under SOP 03-3, the excess of cash flows expected at

acquisition over the estimated fair value is referred to as the

accretable yield and is recognized into interest income over

the remaining life of the loan in situations where there is a