Wells Fargo 2008 Annual Report Download - page 63

Download and view the complete annual report

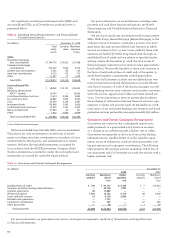

Please find page 63 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The deterioration in specific segments of the Home Equity

portfolios required a targeted approach to managing these

assets. A liquidating portfolio, consisting of home equity

loans generated through the wholesale channel not behind a

Wells Fargo first mortgage, and home equity loans acquired

through correspondents, was identified. While the $10.3 billion

of loans in this liquidating portfolio represented about 1% of

total loans outstanding at December 31, 2008, these loans

represented some of the highest risk in the $129.5 billion

Home Equity portfolios, with a loss rate of 6.18% compared

with 1.70% for the core portfolio. The loans in the liquidating

portfolio are largely concentrated in geographic markets that

have experienced the most abrupt and steepest declines

in housing prices. The core portfolio was $118.4 billion at

December 31, 2008, of which 98% was originated through

the retail channel and approximately 15% of the outstanding

balance was in a first lien position. Table 15 includes the

credit attributes of these two portfolios.

PICK-A-PAY PORTFOLIO Our Pick-a-Pay loan portfolio, which

we acquired in the Wachovia merger, had an outstanding bal-

ance of $119.6 billion and a carrying value of $95.3 billion at

December 31, 2008. The carrying value is net of $22.2 billion

of purchase accounting net write-downs to reflect SOP 03-3

loans at fair value and a $249 million increase to reflect all

other loans at a market rate of interest. Pick-a-Pay loans are

home mortgages on which the customer has the option each

month to select from among four payment options: (1) a

minimum payment as described below, (2) an interest-only

payment, (3) a fully amortizing 15-year payment, or (4) a fully

amortizing 30-year payment. Approximately 80% of the Pick-

a-Pay portfolio has payment options calculated using a monthly

adjustable interest rate; the rest of the portfolio is fixed rate.

Approximately 85% of the December 31, 2008, Pick-a-Pay

loan portfolio was originated under Wachovia’s “Quick Qualifier”

program where the level of documentation obtained from a

prospective customer relative to income and assets was

determined based in part on data provided by the customer

in their loan application. The remaining 15% was originated

with full documentation (verified assets and verified income).

The minimum monthly payment for substantially all of

our Pick-a-Pay loans is reset annually. The new minimum

monthly payment amount generally cannot exceed the prior

year’s minimum payment amount by more than 7.5%. The

minimum payment may not be sufficient to pay the monthly

interest due, and in those situations a loan on which the cus-

tomer has made a minimum payment is subject to “negative

amortization,” where unpaid interest is added to the principal

balance of the loan. The amount of interest that has been

added to a loan balance is referred to as “deferred interest.”

Our Pick-a-Pay customers have been fairly constant in their

utilization of the minimum payment option. Of our Pick-a-

Pay customers, approximately 66% at December 31, 2008,

based on number of loans, had elected this option. At

December 31, 2008, approximately 51% of Pick-a-Pay cus-

tomers had elected the minimum payment option in each

of the past six months.

Deferral of interest on a Pick-a-Pay loan may continue as

long as the loan balance remains below a pre-defined princi-

pal cap, which is based on the percentage that the current

loan balance represents to the original loan balance. Loans

with an original loan-to-value (LTV) ratio equal to or below

85% have a cap of 125% of the original loan balance, and these

loans represent substantially all of the Pick-a-Pay portfolio.

Loans with an original LTV ratio above 85% have a cap of

110% of the original loan balance. Pick-a-Pay loans on which

there is a deferred interest balance re-amortize (the monthly

payment amount is reset or “recast”) on the earlier of the

date when the loan balance reaches its principal cap, or the

10-year anniversary of the loan. After a recast, the customers’

new payment terms are reset to the amount necessary to

repay the balance over the remainder of the original loan

term. Based on assumptions of a flat rate environment, if all

eligible customers elect the minimum payment option 100%

of the time and no balances prepay, we would expect the

following balance of loans to recast based on reaching the cap:

$5 million in 2009, $15 million in 2010, $16 million in 2011 and

$45 million in 2012. In addition, we would expect the following

balance of ARM loans having a payment change based on the

contractual terms of the loan to recast; $27 million in 2009,

$59 million in 2010, $92 million in 2011 and $163 million in

2012.

Included in the Pick-a-Pay portfolio are loans accounted

for under SOP 03-3 with a total outstanding balance of

$61.9 billion and a carrying value of $37.6 billion. Loans that

we acquired from Wachovia with evidence of credit quality

deterioration since origination and for which it was probable

at the date of the Wachovia acquisition that we will be unable

to collect all contractually required payments are accounted

for under SOP 03-3, which requires that acquired credit-

impaired loans be recorded at fair value and prohibits carry-

ing over of the related allowance in the initial accounting.

In stressed housing markets with declining home prices

and increasing delinquencies, the LTV ratio is a key metric

in predicting future loan performance, including charge-offs.

Because SOP 03-3 loans are carried at fair value, the LTV ratio

is not necessarily a predictor of future loan performance. For

informational purposes we have also included the ratio of the

carrying amount to the current value of the loans.

To maximize return and allow flexibility for customers

to avoid foreclosure, we have in place several loss mitigation

strategies for our Pick-a-Pay loan portfolio. We contact

customers who are experiencing difficulty and may in certain

cases modify the terms of a loan based on a customer’s

documented income and other circumstances.