Wells Fargo 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

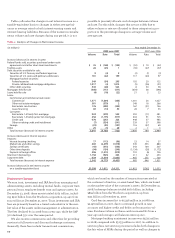

the value of derivatives (economic hedges) used to hedge the

MSRs. Net servicing income for 2008 included a $242 million

net MSRs valuation loss that was recorded to earnings

($3.34 billion fair value loss offsetting by a $3.10 billion eco-

nomic hedging gain) and for 2007 included a $583 million net

MSRs valuation gain ($571 million fair value loss offsetting a

$1.15 billion economic hedging gain). Our portfolio of loans

serviced for others was $1.86 trillion, including $379 billion

acquired from Wachovia, at December 31, 2008, up 30% from

$1.43 trillion at December 31, 2007. At December 31, 2008, the

ratio of MSRs to related loans serviced for others was 0.87%.

Net gains on mortgage loan origination/sales activities

were $1,183 million in 2008, down from $1,289 million in 2007.

Residential real estate originations totaled $230 billion in

2008, compared with $272 billion in 2007. For additional

detail, see “Asset/Liability and Market Risk Management –

Mortgage Banking Interest Rate and Market Risk,” and Note 1

(Summary of Significant Accounting Policies), Note 9

(Mortgage Banking Activities) and Note 17 (Fair Values of

Assets and Liabilities) to Financial Statements.

Mortgage loans are repurchased based on standard repre-

sentations and warranties and early payment default clauses

in mortgage sale contracts. The $234 million increase in the

repurchase reserve in 2008 included $208 million related to

standard representations and warranties as the housing mar-

ket deteriorated and loss severities on repurchases increased.

An additional $26 million related to an increase in projected

early payment defaults, due to the overall deterioration in the

market. To the extent the market does not recover, Home

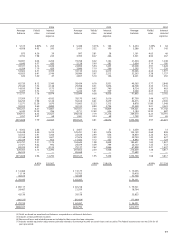

Table 5: Noninterest Income

(in millions) Year ended December 31, % Change

2008 2007 2006 2008/ 2007/

2007 2006

Service charges on

deposit accounts $ 3,190 $ 3,050 $ 2,690

5% 13%

Trust and investment fees:

Trust, investment and IRA fees 2,161 2,305 2,033

(6) 13

Commissions and all other fees

763 844 704 (10) 20

Total trust and

investment fees

2,924 3,149 2,737 (7) 15

Card fees

2,336 2,136 1,747 922

Other fees:

Cash network fees

188 193 184 (3) 5

Charges and fees on loans

1,037 1,011 976 34

All other fees

872 1,088 897 (20) 21

Total other fees

2,097 2,292 2,057 (9) 11

Mortgage banking:

Servicing income, net

979 1,511 893 (35) 69

Net gains on mortgage loan

origination/sales activities

1,183 1,289 1,116 (8) 16

All other

363 333 302 910

Total mortgage banking

2,525 3,133 2,311 (19) 36

Operating leases

427 703 783 (39) (10)

Insurance

1,830 1,530 1,340 20 14

Net gains from trading activities

275 544 544 (49) —

Net gains (losses) on debt

securities available for sale

1,037 209 (19) 396 NM

Net gains (losses) from

equity investments

(737) 734 738 NM (1)

All other

850 936 812 (9) 15

Total

$16,754 $18,416 $15,740 (9) 17

NM – Not meaningful

Mortgage could continue to have increased loss severity

on repurchases, causing future increases in the repurchase

reserve. In addition, there was $29 million in warehouse valua-

tion adjustments in 2008 due to increasing losses associated

with repurchase risk. The write-down of the mortgage ware-

house/pipeline in 2008 was $584 million, including losses of

$320 million due to spread widening primarily on the prime

mortgage warehouse caused by changes in liquidity. The

remaining $264 million of losses were primarily losses on unsal-

able loans. Due to the deterioration in the overall credit market

and related secondary market liquidity challenges, these losses

have been significant. Similar losses on unsalable loans could be

possible in the future if the housing market does not recover.

The 1-4 family first mortgage unclosed pipeline was $71 bil-

lion (including $5 billion from Wachovia) at December 31, 2008,

and $43 billion at December 31, 2007.

Operating lease income decreased 39% from a year ago, due

to continued softening in the auto market, reflecting tightened

credit standards. In third quarter 2008, we stopped originating

new indirect auto leases, but will continue to service existing

lease contracts.

Insurance revenue was up 20% from 2007, due to customer

growth, higher crop insurance revenue and the fourth quarter

2007 acquisition of ABD Insurance.

Income from trading activities was $275 million in 2008 and

$544 million in 2007. Income from trading activities and “all

other” income collectively included a $106 million charge in

2008 related to unsecured counterparty exposure on derivative

contracts with Lehman Brothers. Net investment gains (debt

and equity) totaled $300 million for 2008 and included other-

than-temporary impairment charges of $646 million for Fannie

Mae, Freddie Mac and Lehman Brothers, an additional $1,364

million of other-than-temporary write-downs and $1,710 million

of net realized investment gains. Net gains on debt securities

available for sale were $1,037 million for 2008 and $209 million

for 2007. Net gains (losses) from equity investments were

$(737) million in 2008, compared with $734 million in 2007. For

additional detail, see “Balance Sheet Analysis – Securities

Available for Sale” in this Report.

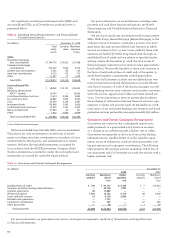

Noninterest Expense

We continued to build our business with investments in addi-

tional team members, largely sales and service professionals,

and new banking stores in 2008. Noninterest expense in 2008

decreased 1% from the prior year. In 2008, we opened 58 regional

banking stores and converted 32 stores acquired from Greater

Bay Bancorp, Farmers State Bank and United Bancorporation of

Wyoming, Inc. to our network. Noninterest expense for 2008

included $124 million of merger integration and severance costs.

Operating lease expense decreased 31% to $389 million in

2008 from $561 million in 2007, as we stopped originating new

indirect auto leases in third quarter 2008.

Insurance expense increased to $725 million in 2008 from

$416 million in 2007 due to the fourth quarter 2007 acquisition

of ABD Insurance, additional insurance reserves at our captive

mortgage reinsurance operation as well as higher commissions

on increased sales volume.