Wells Fargo 2008 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The higher payment risk category is based on the portion

of the maximum loss exposure for which there is a greater

risk that we will be required to make a payment or perform

under the credit derivative. The current status of the risk of

payment or performance being required is considered high

if the underlying assets under the credit derivative have an

external rating that is below investment grade or an internal

credit default grade that would be equivalent to a below

investment grade external rating. It is important to note that

the higher payment risk represents the amount of exposure

for which payment is of a high likelihood. Such payment may

not result in a loss. As such, the higher payment risk column

is not an indication of loss probability.

Counterparty Credit Risk

By using derivatives, we are exposed to credit risk if

counterparties to the derivative contracts do not perform as

expected. If a counterparty fails to perform, our counterparty

credit risk is equal to the amount reported as a derivative

asset in our balance sheet. The amounts reported as a

derivative asset are derivative contracts in a gain position,

and to the extent subject to master netting arrangements,

net of derivatives in a loss position with the same counterparty

and cash collateral received. We minimize counterparty

credit risk through credit approvals, limits, monitoring

procedures, executing master netting arrangements and

obtaining collateral, where appropriate. To the extent the

master netting arrangements and other criteria meet the

requirements of FASB Interpretation No. 39, Offsetting of

Amounts Related to Certain Contracts, as amended by FSP

FIN 39-1, derivatives balances and related cash collateral

amounts are shown net in the balance sheet. Counterparty

credit risk related to derivatives is considered and, if material,

provided for separately.

In connection with the bankruptcy filing by Lehman

Brothers in September 2008, we recognized a $106 million

charge in noninterest income related to unsecured counterparty

exposure on our derivative contracts with Lehman Brothers.

The bankruptcy filing triggered an early termination of the

derivative contracts that after consideration of the master

netting arrangement and posted cash collateral, resulted in

a net amount due to us of $106 million. We assessed the

collectability of this receivable and determined it was not

realizable. We took appropriate actions to replace, as necessary,

the terminated derivative contracts in order to maintain our

various risk management strategies that previously involved

the Lehman Brothers derivative contracts.

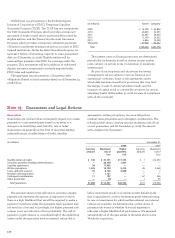

(in millions) December 31, 2008

Fair value Maximum Higher Range of

liability exposure payment maturities

risk

Credit default swaps on corporate bonds $ 9,643 $ 83,446 $39,987 2009-2018

Credit default swaps on structured products 4,940 7,451 5,824 2009-2056

Credit protection on credit default swap index 2,611 35,943 6,364 2009-2017

Credit protection on commercial mortgage-backed securities index 2,231 7,291 2,938 2009-2052

Credit protection on asset-backed securities index 1,331 1,526 1,116 2037-2046

Loan deliverable credit default swaps 106 611 592 2009-2014

Other 18 845 150 2009-2020

Total credit derivatives $20,880 $137,113 $56,971

The following table provides details of credit derivatives at December 31, 2008.