Wells Fargo 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

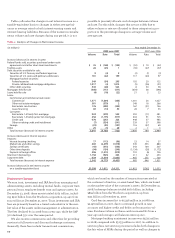

Balance Sheet Analysis

Securities Available for Sale

Our securities available for sale consist of both debt and

marketable equity securities. We hold debt securities available

for sale primarily for liquidity, interest rate risk management

and long-term yield enhancement. Accordingly, this portfolio

primarily includes liquid, high-quality federal agency debt

as well as privately issued mortgage-backed securities. At

December 31, 2008, we held $145.4 billion of debt securities

available for sale, including $63.7 billion acquired from Wachovia,

with net unrealized losses of $9.8 billion, compared with

$70.2 billion at December 31, 2007, with net unrealized gains

of $775 million. We also held $6.1 billion of marketable equity

securities available for sale at December 31, 2008, including

$3.7 billion acquired from Wachovia, and $2.8 billion at

December 31, 2007, with net unrealized losses of $160 million

and $95 million for the same periods, respectively. The net

unrealized loss in cumulative other comprehensive income at

December 31, 2008, related entirely to the legacy Wells Fargo

portfolio. The net unrealized loss related to the legacy

Wachovia portfolio was written off in purchase accounting.

The significant increase in net unrealized losses on debt

securities available for sale to $9.8 billion at December 31,

2008, from net unrealized gains of $775 million at December

31, 2007, was primarily due to extraordinarily wide asset

spreads for residential mortgage, commercial mortgage and

commercial loan asset-backed securities resulting from an

extremely illiquid market, causing these assets to be valued

at significant discounts from their cost. We conduct other-

than-temporary impairment analysis on a quarterly basis or

more often if a potential loss-triggering event occurs. We rec-

ognize an other-than-temporary impairment when it is proba-

ble that we will be unable to collect all amounts due accord-

ing to the contractual terms of the security and the fair value

of the investment security is less than its amortized cost. The

initial indication of other-than-temporary impairment for

both debt and equity securities is a decline in the market

value below the amount recorded for an investment, and the

severity and duration of the decline. In determining whether

an impairment is other than temporary, we consider the

length of time and the extent to which the market value has

been below cost, recent events specific to the issuer, includ-

ing investment downgrades by rating agencies and economic

conditions of its industry, and our ability and intent to hold

the investment for a period of time, including maturity, suffi-

cient to allow for any anticipated recovery in the fair value of

the security. For marketable equity securities, we also consider

the issuer’s financial condition, capital strength and near-term

prospects. For debt securities and for perpetual preferred

securities, which are treated as debt securities for the pur-

pose of other-than-temporary analysis, we also consider the

cause of the price decline (general level of interest rates and

industry- and issuer-specific factors), the issuer’s financial

condition, near-term prospects and current ability to make

future payments in a timely manner, the issuer’s ability to

service debt, any change in agencies’ ratings at evaluation

date from acquisition date and any likely imminent action,

and for asset-backed securities, the credit performance of the

underlying collateral, including delinquency rates, cumulative

losses to date, and the remaining credit enhancement com-

pared to expected credit losses of the security.

We have approximately $7 billion of investments in secu-

rities, primarily municipal bonds, that are guaranteed against

loss by bond insurers. These securities are almost exclusively

investment grade and were generally underwritten in accor-

dance with our own investment standards prior to the deter-

mination to purchase, without relying on the bond insurer’s

guarantee in making the investment decision. These securi-

ties will continue to be monitored as part of our on-going

impairment analysis of our securities available for sale, but

are expected to perform, even if the rating agencies reduce

the credit rating of the bond insurers.

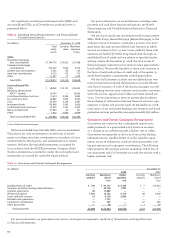

The weighted-average expected maturity of debt securi-

ties available for sale was 5.3 years at December 31, 2008.

Since 69% of this portfolio is mortgage-backed securities, the

expected remaining maturity may differ from contractual

maturity because borrowers generally have the right to pre-

pay obligations before the underlying mortgages mature. The

estimated effect of a 200 basis point increase or decrease in

interest rates on the fair value and the expected remaining

maturity of the mortgage-backed securities available for sale

is shown in Table 7.

See Note 5 (Securities Available for Sale) to Financial

Statements for securities available for sale by security type.

Table 7: Mortgage-Backed Securities

(in billions) Fair Net Remaining

value unrealized maturity

gain (loss)

At December 31, 2008 $ 99.7 $ (6.8) 2.9 yrs.

At December 31, 2008,

assuming a 200 basis point:

Increase in interest rates 90.9 (15.6) 4.3 yrs.

Decrease in interest rates 104.0 (2.5) 1.8 yrs.