Wells Fargo 2008 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

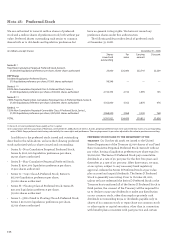

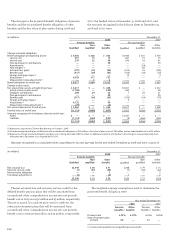

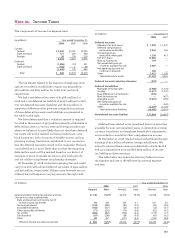

Note 20: Employee Benefits and Other Expenses

Employee Benefits

We sponsor noncontributory qualified defined benefit

retirement plans including the Wells Fargo & Company

Cash Balance Plan (Cash Balance Plan), which covers

eligible employees of the legacy Wells Fargo and the

Wachovia Corporation Pension Plan (Pension Plan), a cash

balance plan that covers eligible employees of the legacy

Wachovia Corporation.

Under the Cash Balance Plan, eligible employees’ Cash

Balance Plan accounts are allocated a compensation credit

based on a percentage of their qualifying compensation. The

compensation credit percentage is based on age and years of

credited service. In addition, investment credits are allocated

to participants quarterly based on their accumulated balances.

Prior to January 1, 2008, employees became vested in their

Cash Balance Plan accounts after completing five years of

vesting service or reaching age 65, if earlier. Effective

January 1, 2008, employees become vested in their Cash

Balance Plan accounts after completing three years of

vesting service or reaching age 65, if earlier.

Under the Pension Plan, eligible employees who were

hired prior to January 1, 2008, are allocated an annual

compensation credit based on a percentage of their qualifying

compensation. The compensation credit is based on their

level of compensation. In addition, investment credits are

allocated to participants annually based on their accumulated

balances. Effective January 1, 2008, employees become

vested in their Pension Plan accounts after completing

three years of vesting service.

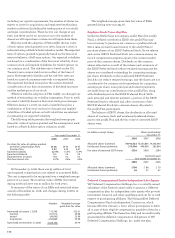

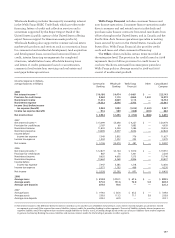

We made a $250 million contribution to our Cash Balance

Plan in 2008 although a contribution was not required. We

expect that we will not be required to make a contribution to

the Cash Balance Plan or the Pension Plan in 2009, however,

this is dependent on the finalization of participant data. Our

decision of whether to make a contribution in 2009 will be

based on various factors including the maximum deductible

contribution under the Internal Revenue Code and the actual

investment performance of plan assets during 2009. Given

these uncertainties, we cannot estimate at this time the

amount, if any, that we will contribute in 2009 to the Cash

Balance Plan or Pension Plan. The total amount contributed

for our other pension plans in 2008 was $33 million. For the

unfunded nonqualified pension plans and postretirement

benefit plans, we will contribute the minimum required amount

in 2009, which equals the benefits paid under the plans. In

2008, we paid $65 million in benefits for the postretirement

plans, which included $39 million in retiree contributions.

We sponsor defined contribution retirement plans

including the Wells Fargo & Company 401(k) Plan (401(k)

Plan) and the Wachovia Savings Plan (Savings Plan). We

also have a frozen defined contribution plan resulting from

a company acquired by Wachovia. No contributions are

permitted to that plan. Under the 401(k) Plan, after one month

of service, eligible employees may contribute up to 25% of

their pre-tax qualifying compensation, although there may

be a lower limit for certain highly compensated employees

in order to maintain the qualified status of the 401(k) Plan.

Eligible employees who complete one year of service are

eligible for matching company contributions, which are

generally a 100% match up to 6% of an employee’s qualifying

compensation. The matching contributions generally vest

over four years.

Under the Savings Plan, after one month of service, eligible

employees may contribute up to 30% of their qualifying

compensation on a pre-tax or after-tax basis, although there

may be a lower limit for certain highly compensated employees

in order to maintain the qualified status of this Savings Plan.

Eligible employees who complete one year of service are

eligible for matching company contributions, which are

generally a 100% match up to 6% of an employee’s qualifying

compensation. The matching contributions vest immediately.

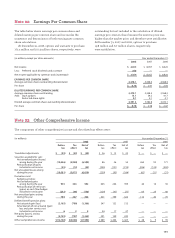

Expenses for defined contribution retirement plans were

$411 million, $426 million and $373 million in 2008, 2007

and 2006, respectively.

We provide health care and life insurance benefits for

certain retired employees and reserve the right to terminate

or amend any of the benefits at any time.

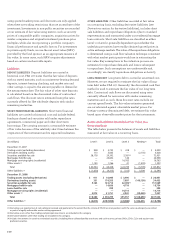

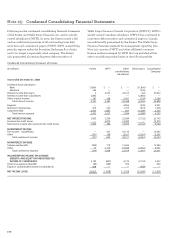

The information set forth in the following tables is

based on current actuarial reports using the measurement

date of December 31 for our pension and postretirement

benefit plans.

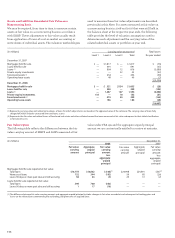

Under FAS 158, Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans – an amendment

of FASB Statements No. 87, 88, 106, and 132(R), we were

required to change the measurement date for our pension

and postretirement plan assets and benefit obligations from

November 30 to December 31 beginning in 2008. To reflect

this change, we recorded an $8 million (after tax) adjustment

to the 2008 beginning balance of retained earnings.