Wells Fargo 2008 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

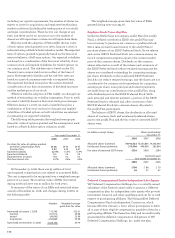

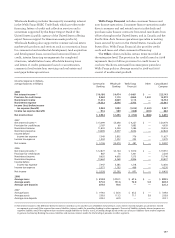

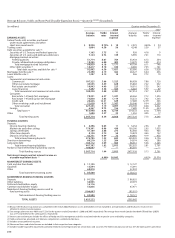

Note 24: Operating Segments

We have three lines of business for management reporting:

Community Banking, Wholesale Banking and Wells Fargo

Financial. The results for these lines of business are based on

our management accounting process, which assigns balance

sheet and income statement items to each responsible operating

segment. This process is dynamic and, unlike financial

accounting, there is no comprehensive, authoritative guidance

for management accounting equivalent to generally accepted

accounting principles. The management accounting process

measures the performance of the operating segments based on

our management structure and is not necessarily comparable

with similar information for other financial services companies.

We define our operating segments by product type and

customer segments. If the management structure and/or

the allocation process changes, allocations, transfers and

assignments may change. Because the Wachovia acquisition

was completed on December 31, 2008, Wachovia’s results are

not included in the segment results or average balances for

2008. To reflect the realignment of our corporate trust business

from Community Banking into Wholesale Banking in 2008,

results for prior periods have been revised.

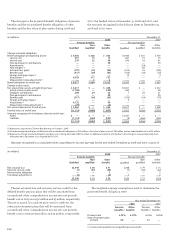

The Community Banking Group offers a complete line of

diversified financial products and services to consumers and

small businesses with annual sales generally up to $20 million

in which the owner generally is the financial decision maker.

Community Banking also offers investment management

and other services to retail customers and high net worth

individuals, securities brokerage through affiliates and

venture capital financing. These products and services

include the Wells Fargo Advantage FundsSM, a family of

mutual funds, as well as personal trust and agency assets.

Loan products include lines of credit, equity lines and loans,

equipment and transportation (recreational vehicle and

marine) loans, education loans, origination and purchase of

residential mortgage loans and servicing of mortgage loans

and credit cards. Other credit products and financial

services available to small businesses and their owners

include receivables and inventory financing, equipment

leases, real estate financing, Small Business Administration

financing, venture capital financing, cash management,

payroll services, retirement plans, Health Savings Accounts

and merchant payment processing. Consumer and business

deposit products include checking accounts, savings

deposits, market rate accounts, Individual Retirement

Accounts (IRAs), time deposits and debit cards.

Community Banking serves customers through a wide

range of channels, which include traditional banking stores,

in-store banking centers, business centers and ATMs. Also,

Phone BankSM centers and the National Business Banking

Center provide 24-hour telephone service. Online banking

services include single sign-on to online banking, bill pay

and brokerage, as well as online banking for small business.

The Wholesale Banking Group serves businesses across

the United States with annual sales generally in excess of

$10 million. Wholesale Banking provides a complete line

of commercial, corporate and real estate banking products

and services. These include traditional commercial loans

and lines of credit, letters of credit, asset-based lending,

equipment leasing, mezzanine financing, high-yield debt,

international trade facilities, foreign exchange services,

treasury management, investment management, institutional

fixed-income sales, interest rate, commodity and equity risk

management, online/electronic products such as the

Commercial Electronic Office® (CEO®) portal, insurance,

corporate trust fiduciary and agency services and investment

banking services. Wholesale Banking manages and administers

institutional investments, employee benefit trusts and

mutual funds, including the Wells Fargo Advantage Funds.

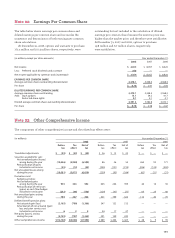

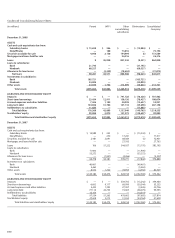

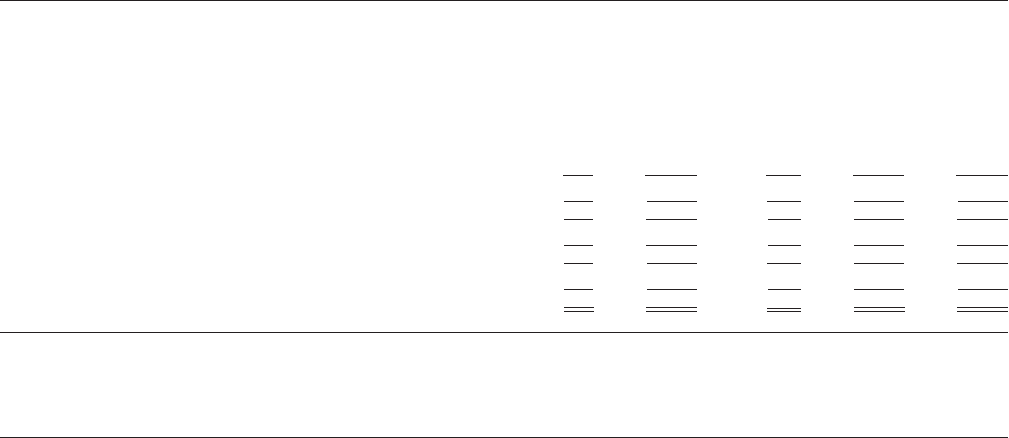

Cumulative other comprehensive income balances were:

(in millions) Translation Net Net Defined Cumulative

adjustments unrealized unrealized benefit other

gains gains on pension compre-

(losses) on derivatives plans hensive

securities and income

available hedging

for sale activities

Balance, December 31, 2005 $ 29 $ 593 $ 43 $ — $ 665

Net change — (31) 70 (402)(1) (363)

Balance, December 31, 2006 29 562 113 (402) 302

Net change 23 (164) 322 242 423

Balance, December 31, 2007 52 398 435 (160) 725

Net change (58) (6,610) 436 (1,362) (7,594)

Balance, December 31, 2008 $ (6) $(6,212) $871 $(1,522) $(6,869)

(1) Adoption of FAS 158.