Wells Fargo 2008 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

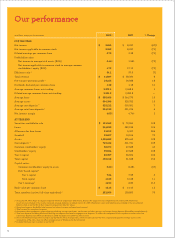

This performance is all the more remarkable because our

talented team achieved it during the sharpest, most volatile,

painful economic downturn our country has experienced in

more than a quarter century. We made some mistakes but kept

our credit discipline.

We took several actions to further strengthen our balance

sheet as we completed the merger of Wells Fargo and Wachovia

— to lay the foundation for the future growth of our combined

company. One was to take a charge against earnings in the

fourth quarter to add $5.6 billion to our credit reserves —

money we set aside to cover future estimated loan losses. This

includes a $3.9 billion provision to conform reserving policies

to the most conservative practices of both companies. This

is in addition to building our reserves earlier in 2008 by $2.5

billion for possible future credit losses. We ended the year with

an allowance for credit losses of $21.7 billion, or $3.20 for every

dollar of our loans that were not accruing interest.*

We further strengthened our balance sheet by taking a

$37.2 billion write-down on $93.9 billion of higher-risk loans

from Wachovia. We also reduced the risk of future charges to

earnings from Wachovia’s securities portfolio by $9.6 billion.

These write-downs of loans and securities and other actions

related to the Wachovia acquisition reduced our reported Tier

1 capital by about 230 basis points. Tier 1 capital is a core

regulatory measure of a bank’s fi nancial strength — the ratio

of a bank’s core equity capital to its total risk-weighted assets.

At year end our Tier 1 ratio was 7.84 percent. That’s well above

regulatory minimums for a well-capitalized bank.

Emerging even stronger

We believe the true test of a fi nancial services company — its

vision, business model, culture and people — is not when times

are good. It’s when times are not so good. When the tide goes

out. We emerged from 2008 even stronger, ready for even more

market share growth. That’s because we stayed faithful to our

vision of satisfying all our credit-worthy customers’ fi nancial

needs and helping them succeed fi nancially — a vision we’ve

been making steady progress toward for more than 20 years,

through virtually every economic cycle. This vision does not

require any complex mathematical models. All we do is try to

create the best customer experience and then keep count: How

many fi nancial products do our customers have with us, and

how can we earn all their business?

Combining Wells Fargo and Wachovia

Firmly grounded in our vision, we earned even more business

from our more than 40 million customers in 2008. Because

of our fi nancial performance, capital strength, liquidity,

credit discipline and earnings, we also were able to seize an

unprecedented opportunity to satisfy all the fi nancial needs

of at least 30 million more customers. Our merger with

Wachovia Corporation, completed December 31, 2008, has

created the United States’ premier coast-to-coast community

banking presence, the most extensive distribution system of

any fi nancial services company across North America — 11,000

stores, 12,300 ATMs, wellsfargo.com and Wells Fargo Phone

Bank. Our combined company is #1 in mortgage lending,

agricultural lending, small business lending, middle market

commercial banking, asset-based lending, commercial real

estate lending, commercial real estate brokerage and bank-

owned insurance brokerage. We’re #2 in deposits, mortgage

servicing, and debit card.

We believed this merger was a compelling value the day

we announced the agreement. We like it even more now. The

integration is on schedule and proceeding as planned. In late

2008 loan o cers from both Wells Fargo and Wachovia again

carefully reexamined Wachovia’s entire loan portfolio. We’re

comfortable overall with the credit assumptions we made

when we agreed to acquire Wachovia October 3, 2008, without

government assistance. We’re confi dent we can reduce the

combined company’s expenses by 10 percent, or $5 billion,

by the end of 2010 and achieve an internal rate of return of

20 percent.

Building our house

We did not, however, merge with Wachovia just to get bigger.

Size alone means nothing to us. You may have noticed:

Nowhere above do I mention how big our combined company

is in assets. Where we rank in asset size alone is meaningless

to us. That’s because we did this merger to get better. In fact,

to our customers, bigness can be a barrier. I’ve yet to hear of

a customer walking into one of our banks and saying, “I want

to bank here because you’re so … big!” Safe, secure and stable,

yes. Friendly, hometown and approachable, yes. Smart, savvy,

ethical, yes. But not just because we’re big. As we like to say:

You don’t get better by getting bigger, you get bigger by

getting better.

So, we’re approaching this merger not as if we’re building

an empire but as if we’re building a home — into which we can

welcome our customers so we can have conversations they

fi nd of value about their hopes and dreams and fi nancial goals.

It took only 90 days from defi nitive agreement to o cial merger

at the end of 2008. It will take much more time to fully blend

the cultures of our two companies, combine businesses and

products and systems, and name-change where needed.

Just as we did with the very successful Norwest-Wells Fargo

merger a decade ago, we’re taking our time to do it right. We’re

putting our customers fi rst, not the calendar. We’re beginning

every discussion with what’s best for our customers and our

team members — focusing fi rst not on the bottom line but the

top line. This may sound odd to some people, but we don’t

believe our fi rst job is to make a lot of money. Our fi rst job is

to understand our customers’ fi nancial objectives, their true

fi nancial needs, then o er them products and services to

help satisfy those needs so they can be fi nancially successful.

If we do that right, then all sorts of good things happen for

all our stakeholders, and we’ll be able to produce industry-

leading returns for our shareholders. Based on this vision, the

Wells Fargo-Wachovia team is building something together

that we couldn’t have built separately. We’re building what we

believe can become the premier fi nancial services company not

just in America but in the world. We’re building not just for the

next quarter but for generations to come.

* At 12/31/08, our allowance for credit losses excluded $12.0 billion of Wachovia’s allowance

for credit-impaired loans, and nonaccrual loans excluded $20.0 billion that Wachovia had

reported as nonaccrual.