Wells Fargo 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

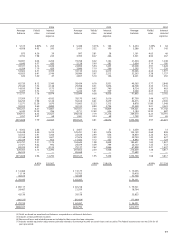

2006 2005 2004

Average Yields/ Interest Average Yields/ Interest Average Yields/ Interest

balance rates income/ balance rates income/ balance rates income/

expense expense expense

$ 5,515 4.80% $ 265 $ 5,448 3.01% $ 164 $ 4,254 1.49% $ 64

4,958 4.95 245 5,411 3.52 190 5,286 2.75 145

875 4.36 39 997 3.81 38 1,161 4.05 46

3,192 7.98 245 3,395 8.27 266 3,501 8.00 267

36,691 6.04 2,206 19,768 6.02 1,162 21,404 6.03 1,248

6,640 6.57 430 5,128 5.60 283 3,604 5.16 180

43,331 6.12 2,636 24,896 5.94 1,445 25,008 5.91 1,428

6,204 7.10 439 3,846 7.10 266 3,395 7.72 236

53,602 6.31 3,359 33,134 6.24 2,015 33,065 6.24 1,977

42,855 6.41 2,746 38,986 5.67 2,213 32,263 5.38 1,737

630 7.40 47 2,857 5.10 146 8,201 3.56 292

65,720 8.13 5,340 58,434 6.76 3,951 49,365 5.77 2,848

29,344 7.32 2,148 29,098 6.31 1,836 28,708 5.35 1,535

14,810 7.94 1,175 11,086 6.67 740 8,724 5.30 463

5,437 5.72 311 5,226 5.91 309 5,068 6.23 316

115,311 7.78 8,974 103,844 6.58 6,836 91,865 5.62 5,162

57,509 7.27 4,182 78,170 6.42 5,016 87,700 5.44 4,772

64,255 7.98 5,126 55,616 6.61 3,679 44,415 5.18 2,300

12,571 13.29 1,670 10,663 12.33 1,315 8,878 11.80 1,048

50,922 9.60 4,889 43,102 8.80 3,794 33,528 9.01 3,022

185,257 8.57 15,867 187,551 7.36 13,804 174,521 6.38 11,142

6,343 12.39 786 4,711 13.49 636 3,184 15.30 487

306,911 8.35 25,627 296,106 7.19 21,276 269,570 6.23 16,791

1,357 4.97 68 1,581 4.34 68 1,709 3.81 65

$415,828 7.79 32,357 $383,523 6.81 26,072 $354,348 5.97 21,071

$ 4,302 2.86 123 $ 3,607 1.43 51 $ 3,059 0.44 13

134,248 2.40 3,225 129,291 1.45 1,874 122,129 0.69 838

32,355 3.91 1,266 22,638 2.90 656 18,850 2.26 425

32,168 4.99 1,607 27,676 3.29 910 29,750 1.43 427

20,724 4.60 953 11,432 3.12 357 8,843 1.40 124

223,797 3.21 7,174 194,644 1.98 3,848 182,631 1.00 1,827

21,471 4.62 992 24,074 3.09 744 26,130 1.35 353

84,035 4.91 4,124 79,137 3.62 2,866 67,898 2.41 1,637

329,303 3.73 12,290 297,855 2.50 7,458 276,659 1.38 3,817

86,525 — — 85,668 — — 77,689 — —

$415,828 2.96 12,290 $383,523 1.95 7,458 $354,348 1.08 3,817

4.83% $20,067 4.86% $18,614 4.89% $17,254

$ 12,466 $ 13,173 $ 13,055

11,114 10,705 10,418

46,615 38,389 32,758

$ 70,195 $ 62,267 $ 56,231

$ 89,117 $ 87,218 $ 79,321

24,467 21,559 18,764

———

43,136 39,158 35,835

(86,525) (85,668) (77,689)

$ 70,195 $ 62,267 $ 56,231

$486,023 $445,790 $410,579

(4) Yields are based on amortized cost balances computed on a settlement date basis.

(5) Includes certain preferred securities.

(6) Nonaccrual loans and related income are included in their respective loan categories.

(7) Includes taxable-equivalent adjustments primarily related to tax-exempt income on certain loans and securities. The federal statutory tax rate was 35% for all

years presented.