Wells Fargo 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

value with changes in fair value included in earnings, and

immediately recognize gains and losses that were accumulated

in other comprehensive income in earnings.

In all other situations in which we discontinue hedge

accounting, the derivative will be carried at its fair value in

the balance sheet, with changes in its fair value recognized in

current period earnings.

We occasionally purchase or originate financial instru-

ments that contain an embedded derivative. At inception of

the financial instrument, we assess (1) if the economic char-

acteristics of the embedded derivative are not clearly and

closely related to the economic characteristics of the finan-

cial instrument (host contract), (2) if the financial instrument

that embodies both the embedded derivative and the host

contract is not measured at fair value with changes in fair

value reported in earnings, and (3) if a separate instrument

with the same terms as the embedded instrument would meet

the definition of a derivative. If the embedded derivative

meets all of these conditions, we separate it from the host

contract by recording the bifurcated derivative at fair value

and the remaining host contract at the difference between the

basis of the hybrid instrument and the fair value of the bifur-

cated derivative. The bifurcated derivative is carried as a

free-standing derivative at fair value with changes recorded

in current period earnings.

Revenue Recognition

We recognize revenue when the earnings process is com-

plete, generally on the trade date, and collectability is

assured. Specifically, brokerage commission fees are recog-

nized in income on a trade date basis. We accrue asset man-

agement fees, measured by assets at a particular date, as

earned. We recognize advisory and underwriting fees when

the related transaction is complete. We record commission

expenses when the related revenue is recognized.

For derivative contracts, we recognize gains and losses at

inception only if the fair value of the contract is evidenced by

a quoted market price in an active market, an observable

price of other market transactions or other observable data

supporting a valuation technique. For those gains and losses

that are not evidenced by market data, we use the transaction

price as the fair value of the contract, and do not recognize

any gain or loss at inception. Any gains or losses not meeting

the criteria for initial recognition are deferred and recognized

when realized.

On December 31, 2008, we acquired all outstanding shares of

Wachovia Corporation (Wachovia) common stock in a stock-

for-stock transaction. Wachovia, based in Charlotte, North

Carolina, was one of the nation’s largest diversified financial

services companies, providing a broad range of retail bank-

ing and brokerage, asset and wealth management, and corpo-

rate and investment banking products and services to cus-

tomers through 3,300 financial centers in 21 states from

Connecticut to Florida and west to Texas and California, and

nationwide retail brokerage, mortgage lending and auto

finance businesses. In the merger, Wells Fargo exchanged

0.1991 shares of its common stock for each outstanding share

of Wachovia common stock, issuing a total of 422.7 million

shares of Wells Fargo common stock with a December 31,

2008, value of $12.5 billion to Wachovia shareholders. Shares

of each outstanding series of Wachovia preferred stock were

converted into shares (or fractional shares) of a correspond-

ing series of Wells Fargo preferred stock having substantially

the same rights and preferences. Because the acquisition was

completed at the end of 2008, Wachovia’s results of opera-

tions for 2008 are not included in our income statement.

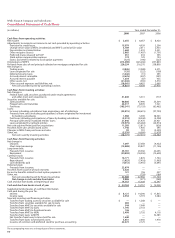

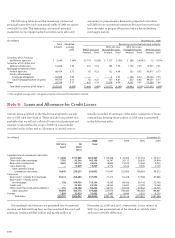

The Wachovia acquisition was accounted for under the

purchase method of accounting in accordance with FAS 141.

The statement of net assets acquired as of December 31,

2008, purchase price and the computation of goodwill related to

the merger of Wells Fargo and Wachovia are presented in the

following table.

Note 2: Business Combinations

The assets and liabilities of Wachovia were recorded at

their respective acquisition date fair values, and identifiable

intangible assets were recorded at fair value. Because the

transaction closed on the last day of the annual reporting period,

certain fair value purchase accounting adjustments were based

on data as of an interim period with estimates through year end.

Accordingly, we will be re-validating and, where necessary,

refining our purchase accounting adjustments. We expect that

the refinements will focus largely on loans with evidence of

credit deterioration. The impact of any changes will be recorded

as an adjustment to goodwill. Additional exit reserves related

to costs associated with involuntary employee termination,

contract termination penalties and closing duplicate facilities

will be recorded within the next year as part of the further

integration of Wachovia’s employees, locations and operations

with Wells Fargo. At December 31, 2008, $199 million of exit

reserves in connection with management’s finalized integration

plans have been allocated to the purchase price and included

in the following table.

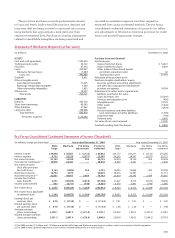

The pro forma consolidated condensed statements of

income for Wells Fargo and Wachovia for the years ended

December 31, 2008 and 2007, are presented on the following

page. The unaudited pro forma information presented does

not necessarily reflect the results of operations that would

have resulted had the merger been completed at the begin-

ning of the applicable periods presented, nor does it indicate

the results of operations in future periods.