Wells Fargo 2008 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

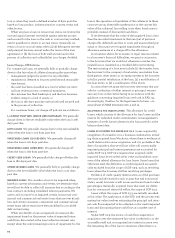

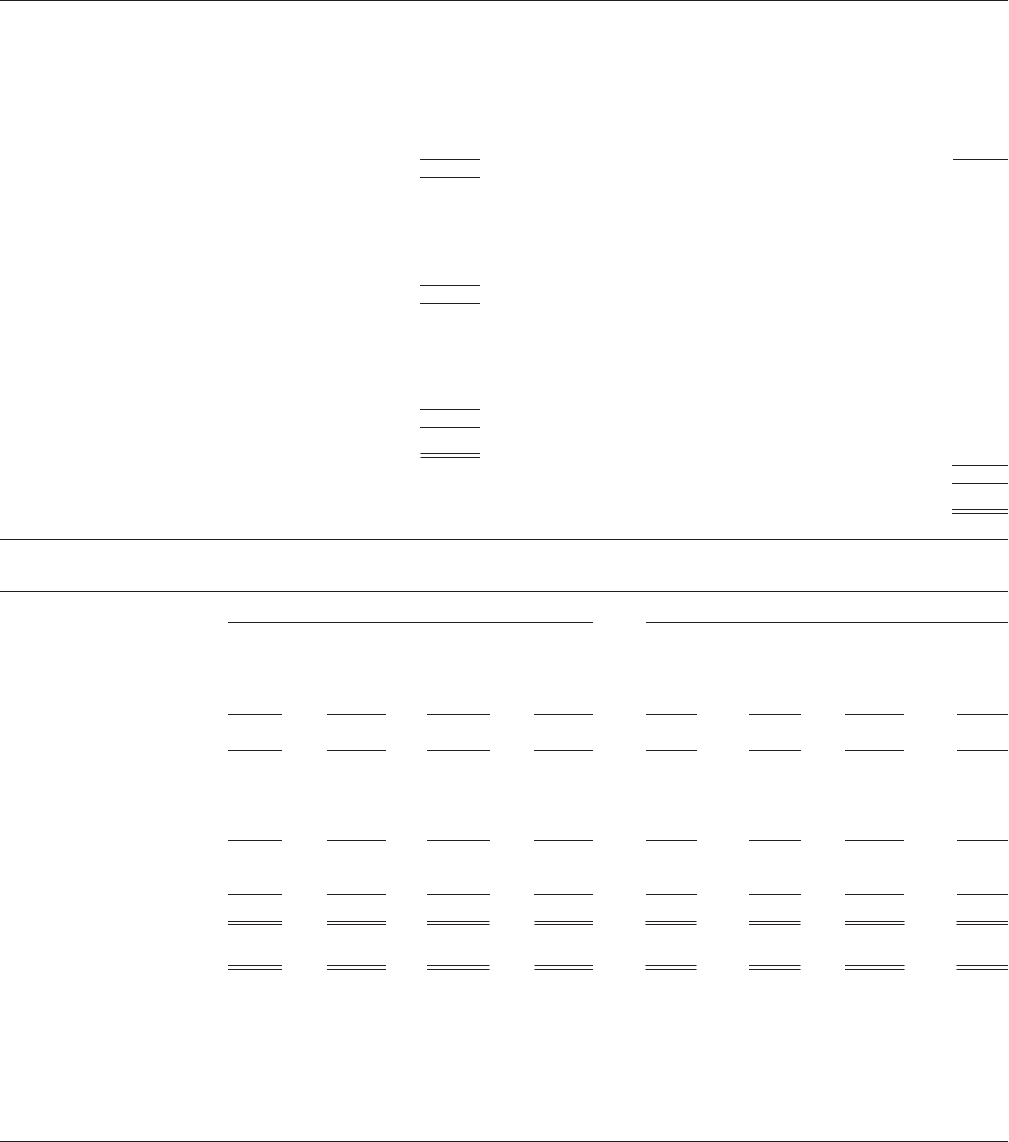

Statement of Net Assets Acquired (at fair value)

(in millions) December 31, 2008

ASSETS

Cash and cash equivalents $109,534

Trading account assets 44,102

Securities 67,356

Loans 450,967

Allowance for loan losses (7,487)

Loans, net 443,480

Goodwill 8,802

Other intangible assets

Core deposit intangible 11,625

Brokerage relationship intangible 1,260

Other relationship intangibles 1,855

Other assets 18,507

Total assets 706,521

LIABILITIES

Deposits 426,126

Short-term borrowings 69,383

Other liabilities 27,962

Long-term debt 159,958

Total liabilities 683,429

Net assets acquired $ 23,092

Purchase Price and Goodwill

Purchase price:

Value of common shares $ 14,621

Value of preferred shares 8,409

Other (value of share based awards

and direct acquisition costs) 62

Total purchase price 23,092

Allocation of the purchase price:

Wachovia tangible stockholders’ equity,

less prior purchase accounting adjustments

and other basis adjustments eliminated in

purchase accounting 19,394

Adjustments to reflect assets acquired and

liabilities assumed at fair value:

Loans and leases, net (16,397)

Premises and equipment, net (456)

Intangible assets 14,740

Other assets (3,444)

Deposits (4,434)

Accrued expenses and other liabilities

(exit, termination and other liabilities) (1,599)

Long-term debt (190)

Deferred taxes 6,676

Fair value of net assets acquired 14,290

Goodwill resulting from the merger $ 8,802

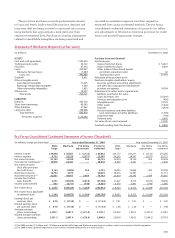

(in millions, except per share data) Year ended December 31, 2008 Year ended December 31, 2007

Wells Wachovia Pro forma Pro forma Wells Wachovia Pro forma Pro forma

Fargo adjustments combined Fargo adjustments combined

Interest income $34,898 $ 36,867 $ (2,123) $ 69,642 $35,177 $42,231 $ (2,123) $75,285

Interest expense 9,755 18,329 (2,577) 25,507 14,203 24,101 (2,577) 35,727

Net interest income 25,143 18,538 454 44,135 20,974 18,130 454 39,558

Provision for credit losses (1) 15,979 22,431 — 38,410 4,939 2,261 — 7,200

Net interest income

(loss) after provision

for credit losses 9,164 (3,893) 454 5,725 16,035 15,869 454 32,358

Noninterest income 16,754 3,875 — 20,629 18,416 13,297 — 31,713

Noninterest expense (2) 22,661 49,017 2,464 74,142 22,824 20,393 2,464 45,681

Income (loss) before

taxes (benefit) 3,257 (49,035) (2,010) (47,788) 11,627 8,773 (2,010) 18,390

Income taxes (benefit) 602 (4,711) (746) (4,855) 3,570 2,461 (746) 5,285

Net income (loss) $ 2,655 $(44,324) $ (1,264) $(42,933) $ 8,057 $ 6,312 $ (1,264) $13,105

Net income (loss) applicable

to common stock $ 2,369 $(44,873) $ (1,264) $(43,768) $ 8,057 $ 6,312 $ (1,264) $13,105

Earnings (loss) per

common share $ 0.70 $ (21.50) $ — $ (11.54) $ 2.41 $ 3.31 $ — $ 3.52

Diluted earnings (loss)

per common share $ 0.70 $ (21.50) $ — $ (11.54) $ 2.38 $ 3.26 $ — $ 3.48

Average common

shares outstanding 3,378.1 2,087.4 (1,671.8) 3,793.7 3,348.5 1,907.2 (1,527.5) 3,728.2

Diluted average common

shares outstanding 3,391.3 2,097.4 (1,679.8) 3,808.9 3,382.8 1,934.2 (1,549.2) 3,767.8

(1) For 2008 includes $2.7 billion and $1.2 billion recorded by Wells Fargo and Wachovia, respectively, to conform credit reserve practices of both companies.

(2) For 2008 includes goodwill impairment of $24.8 billion recorded by Wachovia on a historical basis.

The pro forma purchase accounting adjustments related

to loans and leases, bank-owned life insurance, deposits and

long-term debt are being accreted or amortized into income

using methods that approximate a level yield over their

respective estimated lives. Purchase accounting adjustments

related to identifiable intangibles are being amortized and

recorded as noninterest expense over their respective

estimated lives using accelerated methods. The pro forma

consolidated condensed statements of income do not reflect

any adjustments to Wachovia’s historical provision for credit

losses and goodwill impairment charges.

Pro Forma Consolidated Condensed Statements of Income (Unaudited)