Wells Fargo 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ALLOWANCE FOR CREDIT LOSSES The allowance for credit

losses, which consists of the allowance for loan losses and the

reserve for unfunded credit commitments, is management’s

estimate of credit losses inherent in the loan portfolio at the

balance sheet date. We assume that our allowance for credit

losses as a percentage of charge-offs and nonaccrual loans

will change at different points in time based on credit perfor-

mance, loan mix and collateral values. Any loan with past due

principal or interest that is not both well-secured and in the

process of collection generally is charged off (to the extent

that it exceeds the fair value of any related collateral) based

on loan category after a defined period of time. Also, a loan is

charged off when classified as a loss by either internal loan

examiners or regulatory examiners. The detail of the changes

in the allowance for credit losses, including charge-offs and

recoveries by loan category, is in Note 6 (Loans and

Allowance for Credit Losses) to Financial Statements.

At December 31, 2008, the allowance for loan losses

totaled $21.0 billion (Wells Fargo and Wachovia) (2.43% of

total loans), compared with $5.3 billion (Wells Fargo only)

(1.39%), at December 31, 2007. The allowance for credit losses

was $21.7 billion (2.51% of total loans) at December 31, 2008,

and $5.52 billion (1.44%) at December 31, 2007. The allowance

for loan losses and the allowance for credit losses do not include

any amounts related to loans acquired from Wachovia that

are accounted for under SOP 03-3 (Wachovia’s allowance

related to these loans was $12.0 billion), and loans acquired

from Wachovia are included in total loans net of related

purchase accounting net write-downs. These ratios fluctuate

from period to period and the increase in the ratios of the

allowance for loan losses and the allowance for credit losses to

total loans in 2008 was primarily due to the $8.1 billion credit

reserve build in 2008 that included $3.9 billion to conform

We expect that the amount of nonaccrual loans will

change due to portfolio growth, economic growth, portfolio

seasoning, routine problem loan recognition and resolution

through collections, sales or charge-offs. See “Financial

Review – Allowance for Credit Losses” for additional discus-

sion. The performance of any one loan can be affected by

external factors, such as economic or market conditions, or

factors affecting a particular borrower.

If interest due on the book balances of all nonaccrual

loans (including loans that were but are no longer on nonac-

crual at year end) had been accrued under the original terms,

approximately $310 million of interest would have been

recorded in 2008, compared with payments of $33 million

recorded as interest income.

At year-end 2008, substantially all of our foreclosed assets

of $2.2 billion have been in the portfolio one year or less,

including $885 million acquired from Wachovia.

LOANS DAYS OR MORE PAST DUE AND STILL ACCRUING

Loans included in this category are 90 days or more past due

as to interest or principal and still accruing, because they are

(1) well-secured and in the process of collection or (2) real

estate 1-4 family first mortgage loans or consumer loans

exempt under regulatory rules from being classified as

nonaccrual. Loans acquired from Wachovia that are subject

to SOP 03-3 are excluded from the disclosure of loans 90 days

or more past due and still accruing interest even though sub-

stantially all of them are 90 days or more contractually past

due and they are considered to be accruing because the inter-

est income on these loans relates to the establishment of an

accretable yield in purchase accounting under the SOP and

not to contractual interest payments.

Loans 90 days or more past due and still accruing totaled

$12,645 million (Wells Fargo and Wachovia combined),

$6,393 million, $5,073 million, $3,606 million and $2,578 mil-

lion at December 31, 2008, 2007, 2006, 2005 and 2004, respec-

tively. The total included $8,184 million, $4,834 million,

$3,913 million, $2,923 million and $1,820 million for the same

periods, respectively, in advances pursuant to our servicing

agreements to GNMA mortgage pools and similar loans

whose repayments are insured by the FHA or guaranteed by

the Department of Veterans Affairs. Table 20 reflects loans

90 days or more past due and still accruing excluding the

insured/guaranteed GNMA advances.

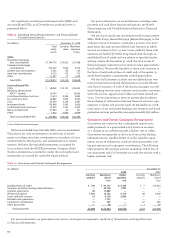

Table 20: Loans 90 Days or More Past Due and Still Accruing

(Excluding Insured/Guaranteed GNMA and Similar Loans)

(in millions) December 31,

2008 2007 2006 2005 2004

Commercial and

commercial real estate:

Commercial $ 218 $ 32 $ 15 $ 18 $ 26

Other real estate

mortgage 88 10 3 13 6

Real estate construction 232 24 3 9 6

Total commercial

and commercial

real estate 538 66 21 40 38

Consumer:

Real estate

1-4 family

first mortgage (1) 1,565 286 154 103 148

Real estate

1-4 family junior

lien mortgage 590 201 63 50 40

Credit card 687 402 262 159 150

Other revolving credit

and installment 1,047 552 616 290 306

Total consumer 3,889 1,441 1,095 602 644

Foreign 34 52 44 41 76

Total $4,461 $1,559 $1,160 $683 $758

(1) Includes mortgage loans held for sale 90 days or more past due and still accruing.