Wells Fargo 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On February 20, 2008, the FASB issued FSP FAS No. 140-3,

Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities (FSP FAS 140-3). FSP FAS 140-3

requires that, if an entity transfers a loan to, and then subse-

quently executes a repurchase financing with the transferor

collateralized by that loan, then the transferor would not be

permitted to treat the initial transfer as a sale unless certain

criteria are met, including that the transferred asset must be

readily obtainable in the marketplace. The provisions of this

FSP are effective beginning January 1, 2009, and shall be

applied prospectively to initial transfers and repurchase

financings for which the initial transfer is executed on or

after this date. Early application is not permitted. FSP FAS

140-3 is not expected to have a material effect on our consoli-

dated financial results.

On March 19, 2008, the FASB issued FAS 161, Disclosures

about Derivative Instruments and Hedging Activities – an

amendment of FASB Statement No. 133 (FAS 161). FAS 161

changes the disclosure requirements for derivative instru-

ments and hedging activities. It requires enhanced disclo-

sures about how and why an entity uses derivatives, how

derivatives and related hedged items are accounted for, and

how derivatives and hedged items affect an entity’s financial

position, performance and cash flows. The provisions of FAS

161 are effective for financial statements issued for fiscal

years and interim periods beginning after November 15,

2008, with early adoption encouraged. Because FAS 161

amends only the disclosure requirements for derivative

instruments and hedged items, the adoption of FAS 161 will

not affect our consolidated financial results.

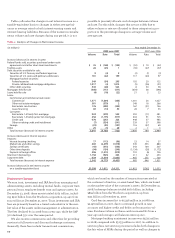

Our significant accounting policies (see Note 1 (Summary of

Significant Accounting Policies) to Financial Statements) are

fundamental to understanding our results of operations and

financial condition, because they require that we use esti-

mates and assumptions that may affect the value of our

assets or liabilities and financial results. Six of these policies

are critical because they require management to make diffi-

cult, subjective and complex judgments about matters that

are inherently uncertain and because it is likely that materially

different amounts would be reported under different condi-

tions or using different assumptions. These policies govern:

• the allowance for credit losses;

• acquired loans accounted for under SOP 03-3;

• the valuation of residential mortgage servicing rights

(MSRs);

• the fair valuation of financial instruments;

• pension accounting; and

• income taxes.

Management has reviewed and approved these critical

accounting policies and has discussed these policies with the

Audit and Examination Committee of the Company’s Board

of Directors.

Allowance for Credit Losses

The allowance for credit losses, which consists of the

allowance for loan losses and the reserve for unfunded credit

commitments, is management’s estimate of credit losses

inherent in the loan portfolio at the balance sheet date. We

have an established process, using several analytical tools

and benchmarks, to calculate a range of possible outcomes

and determine the adequacy of the allowance. The allowance

carried over from Wachovia was generally subject to the

same methodology described above. No single statistic or

measurement determines the adequacy of the allowance.

Loan recoveries and the provision for credit losses increase

the allowance, while loan charge-offs decrease the allowance.

PROCESS TO DETERMINE THE ADEQUACY OF THE ALLOWANCE

FOR CREDIT LOSSES While we attribute portions of the

allowance to specific loan categories as part of our analytical

process, the entire allowance is used to absorb credit losses

inherent in the total loan portfolio.

At December 31, 2008, the portion of the allowance for

credit losses estimated at a pooled level for consumer loans

and some segments of commercial small business loans was

$16.4 billion. For purposes of determining the allowance for

credit losses, we pool certain loans in our portfolio by product

type, primarily for the auto, credit card and real estate mortgage

portfolios. To achieve greater accuracy, we further segment

selected portfolios. As appropriate, the business groups may

attempt to achieve greater accuracy through segmentation by

sub-product, origination channel, vintage, loss type, geography

and other predictive characteristics. For example, credit cards

are segmented by origination channel and the Home Equity

portfolios are further segmented between liquidating and

nonliquidating. In the case of residential mortgages, we

segment the liquidating Pick-a-Pay portfolio, and further

segment this portfolio based on origination channel.

To measure losses inherent in consumer loans and some

commercial small business loans, we use loss models and

other quantitative, mathematical techniques to forecast losses.

Each business group forecasts losses for loans as of the bal-

ance sheet date over the estimated loss emergence period.

Each business group determines the model type and/or

segmentation method that fits the loss characteristics of its

portfolios and provides the greatest level of forecasting accu-

racy. We use both internally developed and vendor supplied

roll rate/net cash flow models. Roll rate/net cash flow models,

vintage base-models and behavior score models are often

used for near-term loss projections as well as time series/

statistical trend models for longer term projections. Models

are independently validated and are reviewed by corporate

credit personnel to ensure that the theory, assumptions, data,

Critical Accounting Policies