Wells Fargo 2008 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

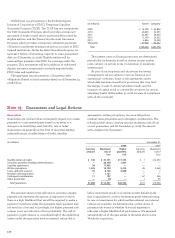

(in millions) December 31,

2008 2007 2006

Net gains (losses) from fair

value hedges (1) from:

Change in value of

derivatives excluded

from the assessment

of hedge effectiveness $— $8 $ (5)

Ineffective portion of

change in value

of derivatives 177 19 11

Net gains (losses) from ineffective

portion of change in the

value of cash flow hedges (2) (4) 26 45

(1) Includes hedges of long-term debt and certificates of deposit, commercial real

estate and franchise loans, and debt and equity securities.

(2) Includes hedges of floating-rate long-term debt and floating-rate commercial

loans and, for 2006, hedges of forecasted sales of prime residential MHFS.

Upon adoption of FAS 159, derivatives used to hedge our prime residential

MHFS were no longer accounted for as cash flow hedges under FAS 133.

Prior to June 1, 2006, we used the short-cut method of

assessing hedge effectiveness for certain fair value hedging

relationships of U.S. dollar denominated fixed-rate long-term

debt and certificates of deposits. The short-cut method allows

an entity to assume perfect hedge effectiveness if certain

qualitative criteria are met, and accordingly, does not require

quantitative measures such as regression analysis. We used

the short-cut method only when appropriate, based on the

qualitative assessment of the criteria in paragraph 68 of

FAS 133, performed at inception of the hedging relationship

and on an ongoing basis. Effective January 1, 2006, for any

new hedging relationships of these types, we used the

long-haul method to assess hedge effectiveness. By June 1,

2006, we stopped using the short-cut method by de-designating

all remaining short-cut relationships and re-designating them

to use the long-haul method to evaluate hedge effectiveness.

From time to time, we enter into equity collars to lock

in share prices between specified levels for certain equity

securities. As permitted, we include the intrinsic value only

(excluding time value) when assessing hedge effectiveness.

We assess hedge effectiveness based on a dollar-offset ratio,

at inception of the hedging relationship and on an ongoing

basis, by comparing cumulative changes in the intrinsic

value of the equity collar with changes in the fair value of

the hedged equity securities. The net derivative gain or loss

related to the equity collars is recorded in other noninterest

income in the income statement.

Cash Flow Hedges

We hedge floating-rate debt against future interest rate

increases by using interest rate swaps to convert floating-rate

debt to fixed rates and by using interest rate caps, floors and

futures to limit variability of rates. We also use interest rate

swaps and floors to hedge the variability in interest payments

received on certain floating-rate commercial loans, due

to changes in the benchmark interest rate. Upon adoption

of FAS 159 on January 1, 2007, derivatives used to hedge

the forecasted sales of prime residential MHFS originated

subsequent to January 1, 2007, were accounted for as

economic hedges. We previously accounted for these

derivatives as cash flow hedges under FAS 133. Gains and

losses on derivatives that are reclassified from cumulative

other comprehensive income to current period earnings, are

included in the line item in which the hedged item’s effect in

earnings is recorded. All parts of gain or loss on these derivatives

are included in the assessment of hedge effectiveness. For all

cash flow hedges, we assess hedge effectiveness using regression

analysis, both at inception of the hedging relationship and on

an ongoing basis. The regression analysis involves regressing

the periodic changes in cash flows of the hedging instrument

against the periodic changes in cash flows of the forecasted

transaction being hedged due to changes in the hedged

risk(s). The assessment includes an evaluation of the

quantitative measures of the regression results used to

validate the conclusion of high effectiveness.

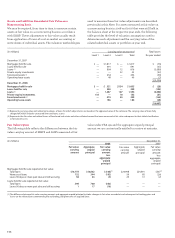

We expect that $60 million of deferred net loss on

derivatives in other comprehensive income at December 31,

2008, will be reclassified as earnings during the next twelve

months, compared with $63 million and $53 million of net

deferred gains at December 31, 2007 and 2006, respectively.

We are hedging our exposure to the variability of future

cash flows for all forecasted transactions for a maximum of

seventeen years for both hedges of floating-rate debt and

floating-rate commercial loans.

The following table provides derivative gains and losses

related to fair value and cash flow hedges resulting from

the change in value of the derivatives excluded from the

assessment of hedge effectiveness and the change in value

of the ineffective portion of the derivatives.