Wells Fargo 2008 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Interest income on MHFS measured at fair value is

calculated based on the note rate of the loan and is recorded

in interest income in the income statement.

For MHFS measured at fair value under FAS 159, the

estimated amount of losses included in earnings attributable to

instrument-specific credit risk for the year ended December 31,

2008 and 2007, was $648 million and $515 million, respectively.

For performing loans, instrument-specific credit risk gains

or losses were derived principally by determining the change

in fair value of the loans due to changes in the observable or

implied credit spread. Credit spread is the market yield on

the loans less the relevant risk-free benchmark interest rate.

Since the second half of 2007, spreads have been significantly

impacted by the lack of liquidity in the secondary market for

mortgage loans. For nonperforming loans, we attribute all

changes in fair value to instrument-specific credit risk.

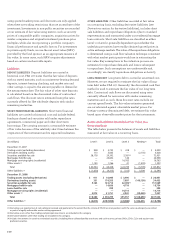

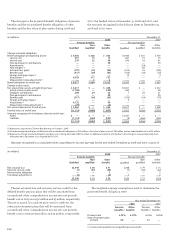

(in millions) December 31,

2008 2007

Carrying Estimated Carrying Estimated

amount fair value amount fair value

FINANCIAL ASSETS

Mortgages held for sale

(1)

$ 1,334 $ 1,333 $ 1,817 $ 1,817

Loans held for sale 5,830 5,876 948 955

Loans, net 843,817 829,603 376,888 377,219

Nonmarketable equity investments (cost method) 11,104 11,220 5,855 6,076

FINANCIAL LIABILITIES

Deposits $781,402 $781,964 $344,460 $344,484

Long-term debt

(2)

267,055 266,023 99,373 98,449

(1) Balance excludes mortgages held for sale for which the fair value option under FAS 159 was elected, and therefore includes nonprime residential and commercial

mortgages held for sale.

(2) The carrying amount and fair value exclude obligations under capital leases of $103 million and $20 million at December 31, 2008 and 2007, respectively.

FAS 107, Disclosures about Fair Value of

Financial Instruments

The table below is a summary of fair value estimates as

of December 31, 2008 and 2007, for financial instruments,

as defined by FAS 107, excluding short-term financial assets

and liabilities, for which carrying amounts approximate fair

value, and excluding financial instruments recorded at fair

value on a recurring basis. The carrying amounts in the

following table are recorded in the balance sheet under the

indicated captions.

In accordance with FAS 107, we have not included assets

and liabilities that are not financial instruments in our

disclosure, such as the value of the long-term relationships

with our deposit, credit card and trust customers, amortized

MSRs, premises and equipment, goodwill and other intangibles,

deferred taxes and other liabilities. Additionally, the amounts

in the table have not been updated since year end, therefore

the valuations may have changed significantly since that

point in time. For these reasons, the total of the fair value

calculations presented does not represent, and should not be

construed to represent, the underlying value of the Company.

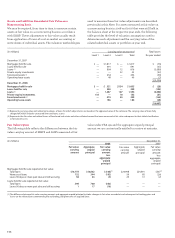

The assets accounted for under FAS 159 are initially

measured at fair value. Gains and losses from initial

measurement and subsequent changes in fair value are

recognized in earnings. The changes in fair values related

to initial measurement and subsequent changes in fair value

included in earnings for these assets measured at fair value

are shown, by income statement line item, below.

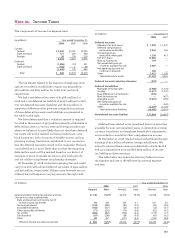

(in millions) Year ended December 31,

2008 2007

Mortgages Other Mortgages Other

held for interests held for interests

sale held sale held

Changes in fair value included in net income:

Mortgage banking noninterest income:

Net gains on mortgage loan origination/sales activities (1) $2,111 $ — $986 $ —

Other noninterest income — (109) — (153)

(1) Includes changes in fair value of servicing associated with MHFS.