Wells Fargo 2008 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

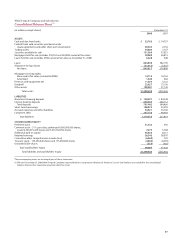

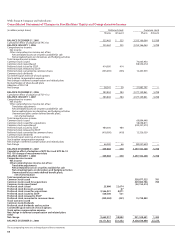

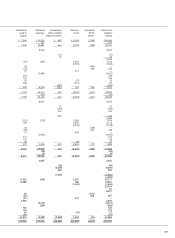

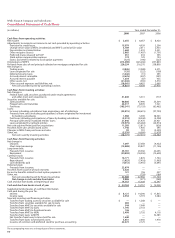

Wells Fargo & Company and Subsidiaries

Consolidated Statement of Income

(in millions, except per share amounts) Year ended December 31,

2008 2007 2006

INTEREST INCOME

Trading assets $ 177 $ 173 $ 225

Securities available for sale 5,287 3,451 3,278

Mortgages held for sale 1,573 2,150 2,746

Loans held for sale 48 70 47

Loans 27,632 29,040 25,611

Other interest income 181 293 332

Total interest income 34,898 35,177 32,239

INTEREST EXPENSE

Deposits 4,521 8,152 7,174

Short-term borrowings 1,478 1,245 992

Long-term debt 3,756 4,806 4,122

Total interest expense 9,755 14,203 12,288

NET INTEREST INCOME 25,143 20,974 19,951

Provision for credit losses 15,979 4,939 2,204

Net interest income after provision for credit losses 9,164 16,035 17,747

NONINTEREST INCOME

Service charges on deposit accounts 3,190 3,050 2,690

Trust and investment fees 2,924 3,149 2,737

Card fees 2,336 2,136 1,747

Other fees 2,097 2,292 2,057

Mortgage banking 2,525 3,133 2,311

Operating leases 427 703 783

Insurance 1,830 1,530 1,340

Net gains (losses) on debt securities available for sale 1,037 209 (19)

Net gains (losses) from equity investments (737) 734 738

Other 1,125 1,480 1,356

Total noninterest income 16,754 18,416 15,740

NONINTEREST EXPENSE

Salaries 8,260 7,762 7,007

Commission and incentive compensation 2,676 3,284 2,885

Employee benefits 2,004 2,322 2,035

Equipment 1,357 1,294 1,252

Net occupancy 1,619 1,545 1,405

Operating leases 389 561 630

Other 6,356 6,056 5,623

Total noninterest expense 22,661 22,824 20,837

INCOME BEFORE INCOME TAX EXPENSE 3,257 11,627 12,650

Income tax expense 602 3,570 4,230

NET INCOME $ 2,655 $ 8,057 $ 8,420

NET INCOME APPLICABLE TO COMMON STOCK $ 2,369 $ 8,057 $ 8,420

EARNINGS PER COMMON SHARE $0.70 $ 2.41 $ 2.50

DILUTED EARNINGS PER COMMON SHARE $ 0.70 $ 2.38 $ 2.47

DIVIDENDS DECLARED PER COMMON SHARE $ 1.30 $ 1.18 $ 1.08

Average common shares outstanding 3,378.1 3,348.5 3,368.3

Diluted average common shares outstanding 3,391.3 3,382.8 3,410.1

The accompanying notes are an integral part of these statements.

Financial Statements