Wells Fargo 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

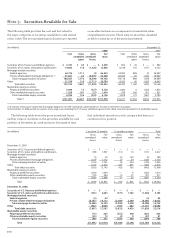

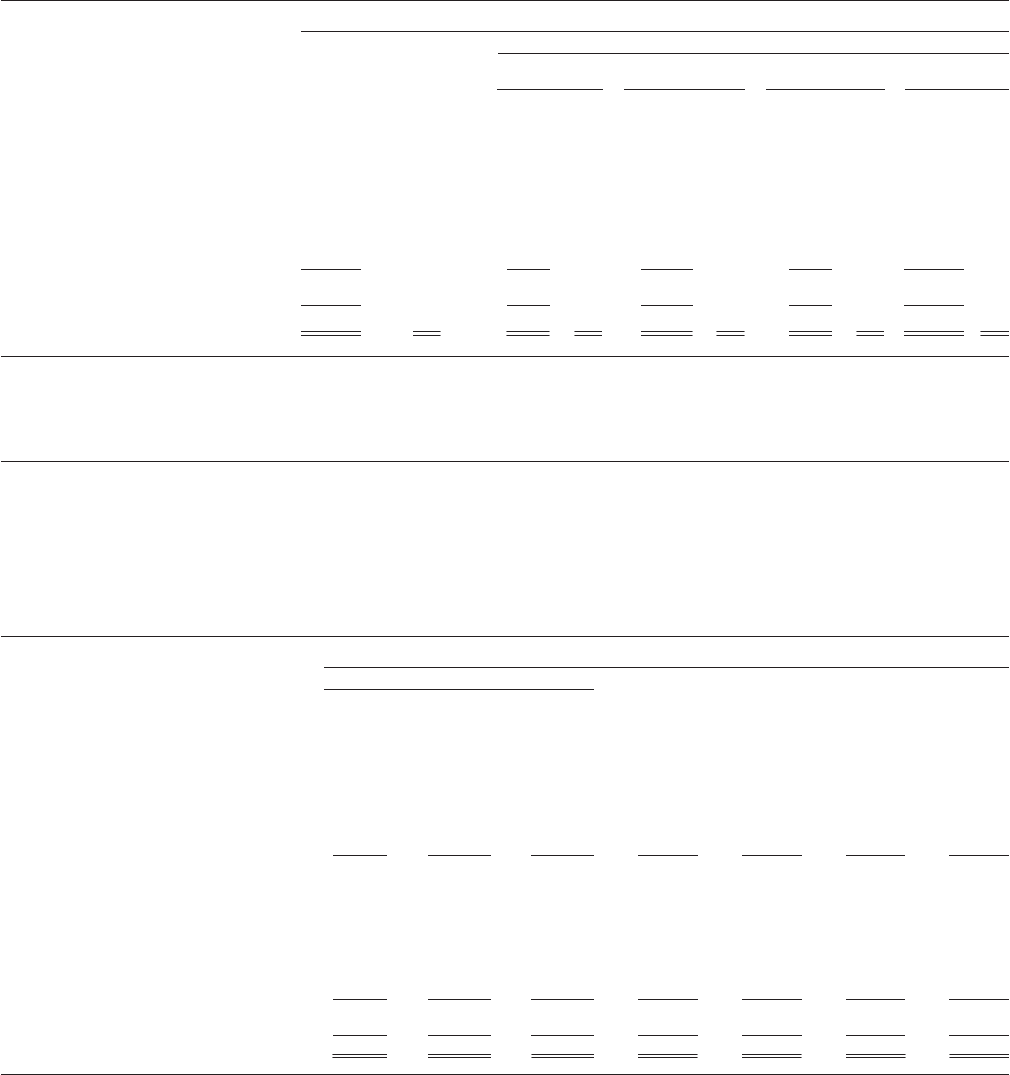

(in millions) December 31, 2008

Total Weighted- Remaining contractual principal maturity

amount average After one year After five years

yield Within one year through five years through ten years After ten years

Amount Yield Amount Yield Amount Yield Amount Yield

Securities of U.S. Treasury

and federal agencies $ 3,249 1.54% $1,719 0.02% $ 1,127 3.15% $ 388 3.40% $ 15 4.79%

Securities of U.S. states and

political subdivisions 12,658 7.54 210 5.54 784 7.36 1,163 7.39 10,501 7.61

Mortgage-backed securities:

Federal agencies 66,434 5.73 42 4.23 122 4.98 353 6.02 65,917 5.73

Private collateralized

mortgage obligations 33,308 7.04 —— 5 2.22 169 8.54 33,134 7.03

Total mortgage-backed securities 99,742 6.17 42 4.23 127 4.87 522 6.83 99,051 6.17

Other 29,784 5.27 475 5.34 11,874 6.59 4,367 5.97 13,068 3.85

Total debt securities at fair value (1) $145,433 6.00% $2,446 1.60% $13,912 6.34% $6,440 6.14% $122,635 6.04%

(1) The weighted-average yield is computed using the contractual life amortization method.

The following table shows the remaining contractual

principal maturities and contractual yields of debt securities

available for sale. The remaining contractual principal

maturities for mortgage-backed securities were allocated

assuming no prepayments. Remaining expected maturities

will differ from contractual maturities because borrowers may

have the right to prepay obligations before the underlying

mortgages mature.

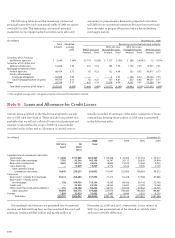

Certain loans acquired in the Wachovia acquisition are sub-

ject to SOP 03-3 (see Note 1). These include loans where it is

probable that we will not collect all contractual principal and

interest. Loans within the scope of SOP 03-3 are initially

recorded at fair value, and no allowance is carried over or

Note 6: Loans and Allowance for Credit Losses

(in millions) December 31,

2008 2007 2006 2005 2004

SOP 03-3 All Total

loans other

loans

Commercial and commercial real estate:

Commercial $ 4,580 $197,889 $202,469 $ 90,468 $ 70,404 $ 61,552 $ 54,517

Other real estate mortgage 7,762 95,346 103,108 36,747 30,112 28,545 29,804

Real estate construction 4,503 30,173 34,676 18,854 15,935 13,406 9,025

Lease financing — 15,829 15,829 6,772 5,614 5,400 5,169

Total commercial and

commercial real estate 16,845 339,237 356,082 152,841 122,065 108,903 98,515

Consumer:

Real estate 1-4 family first mortgage 39,214 208,680 247,894 71,415 53,228 77,768 87,686

Real estate 1-4 family junior

lien mortgage 728 109,436 110,164 75,565 68,926 59,143 52,190

Credit card — 23,555 23,555 18,762 14,697 12,009 10,260

Other revolving credit and installment 151 93,102 93,253 56,171 53,534 47,462 34,725

Total consumer 40,093 434,773 474,866 221,913 190,385 196,382 184,861

Foreign 1,859 32,023 33,882 7,441 6,666 5,552 4,210

Total loans $58,797 $806,033 $864,830 $382,195 $319,116 $310,837 $287,586

Outstanding loan balances are presented net of unearned

income, net deferred loan fees, and unamortized discount and

premium totaling $16,891 million and $4,083 million at

December 31, 2008 and 2007, respectively. Loans subject to

SOP 03-3 are presented net of the related accretable yield

and nonaccretable difference.

initially recorded. A summary of the major categories of loans

outstanding showing those subject to SOP 03-3 is presented

in the following table.