Wells Fargo 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.considering the impact of prepayments, is referred to as the

nonaccretable difference. Subsequent decreases to the

expected cash flows will generally result in a charge to the

provision for credit losses resulting in an increase to the

allowance for loan losses. Subsequent increases in cash flows

result in reversal of any nonaccretable difference (or allowance

for loan losses to the extent any has been recorded) with a

positive impact on interest income. Disposals of loans, which

may include sales of loans, receipt of payments in full by the

borrower, foreclosure or TDRs, result in removal of the loan

from the SOP 03-3 portfolio at its carrying amount.

In connection with the Wachovia acquisition, we acquired

certain loans that were deemed to be credit impaired under

SOP 03-3. SOP 03-3 allows purchasers to aggregate credit-

impaired loans acquired in the same fiscal quarter into one or

more pools, provided that the loans have common risk char-

acteristics. A pool is then accounted for as a single asset with

a single composite interest rate and an aggregate expectation

of cash flows. With respect to the Wachovia acquisition, we

aggregated all of the consumer loans and wholesale loans

with balances of $3 million or less into pools with common

risk characteristics. We accounted for wholesale loans with

balances in excess of $3 million individually.

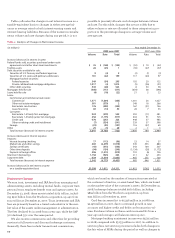

To estimate the possible impact on the accounting for the

SOP 03-3 loans as of December 31, 2008, we assumed the fol-

lowing scenarios of a reasonable possible improvement or

deterioration in loan credit quality.

Assumptions for deterioration in loan credit quality for

SOP 03-3 loans were:

· for Pick-a-Pay loans, a 10% increase in expected life of loan

loss rates from December 31, 2008, purchase accounting

estimates, based on increased loss severity due to pro-

longed residential real estate value deterioration, contin-

ued increase in unemployment levels and higher bank-

ruptcy levels; and

· for commercial real estate loans, a 10% increase in expect-

ed life of loan loss rates from December 31, 2008, purchase

accounting estimates due to continued deterioration in

the homebuilder and income property sectors.

Assumptions for improvement in loan credit quality for

SOP 03-3 were:

· for Pick-a-Pay loans, a 10% decrease in expected life of

loan loss rates from December 31, 2008, purchase account-

ing estimates, based on decreased loss severity due to res-

idential real estate value stabilization; and

· for commercial real estate loans, a 10% decrease in expect-

ed life of loan loss rates from December 31, 2008, purchase

accounting estimates due to an improvement in the home-

builder and income property sectors.

Had the expected life of loan loss rates we used to deter-

mine the nonaccretable difference at December 31, 2008, for

these two portfolios reflected the 10% increase or decrease in

life of loan loss rates as described above, the nonaccretable

difference would have changed by approximately $2.4 billion

for Pick-a-Pay loans and $680 million for commercial

real estate.

In accordance with SOP 03-3, loans that were classified as

nonperforming loans by Wachovia are no longer classified as

nonperforming because, at acquisition, we believe we will

fully collect the new carrying value of these loans. It is impor-

tant to note that judgment is required in reclassifying loans

subject to SOP 03-3 to performing status, and is dependent

on having a reasonable expectation about the timing and

amount of cash flows expected to be collected, even if the

loan is contractually past due.

Valuation of Residential Mortgage Servicing Rights

We recognize as assets the rights to service mortgage loans

for others, or mortgage servicing rights (MSRs), whether we

purchase the servicing rights, or the servicing rights result

from the sale or securitization of loans we originate (asset

transfers). We also acquire MSRs under co-issuer agreements

that provide for us to service loans that are originated and

securitized by third-party correspondents. We initially mea-

sure and carry our MSRs related to residential mortgage

loans (residential MSRs) using the fair value measurement

method, under which purchased MSRs and MSRs from asset

transfers are capitalized and carried at fair value.

At the end of each quarter, we determine the fair value of

MSRs using a valuation model that calculates the present

value of estimated future net servicing income. The model

incorporates assumptions that market participants use in

estimating future net servicing income, including estimates

of prepayment speeds (including housing price volatility),

discount rate, default rates, cost to service (including delin-

quency and foreclosure costs), escrow account earnings, con-

tractual servicing fee income, ancillary income and late fees.

The valuation of MSRs is discussed further in this section

and in Note 1 (Summary of Significant Accounting Policies),

Note 8 (Securitizations and Variable Interest Entities), Note 9

(Mortgage Banking Activities) and Note 17 (Fair Values of

Assets and Liabilities) to Financial Statements.

To reduce the sensitivity of earnings to interest rate and

market value fluctuations, we may use securities available for

sale and free-standing derivatives (economic hedges) to

hedge the risk of changes in the fair value of MSRs, with the

resulting gains or losses reflected in income. Changes in the

fair value of the MSRs from changing mortgage interest rates

are generally offset by gains or losses in the fair value of the

derivatives depending on the amount of MSRs we hedge and

the particular instruments used to hedge the MSRs. We may

choose not to fully hedge MSRs, partly because origination

volume tends to act as a “natural hedge.” For example, as

interest rates decline, servicing values generally decrease

and fees from origination volume tend to increase.

Conversely, as interest rates increase, the fair value of the

MSRs generally increases, while fees from origination volume

tend to decline. See “Mortgage Banking Interest Rate and

Market Risk” for discussion of the timing of the effect of

changes in mortgage interest rates.