Wells Fargo 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The degree of management judgment involved in deter-

mining the fair value of a financial instrument is dependent

upon the availability of quoted market prices or observable

market parameters. For financial instruments that trade

actively and have quoted market prices or observable market

parameters, there is minimal subjectivity involved in measur-

ing fair value. When observable market prices and parame-

ters are not fully available, management judgment is neces-

sary to estimate fair value. In addition, changes in the market

conditions may reduce the availability of quoted prices or

observable data. For example, reduced liquidity in the capital

markets or changes in secondary market activities could

result in observable market inputs becoming unavailable.

When significant adjustments are required to available

observable inputs, it may be appropriate to utilize an esti-

mate based primarily on unobservable inputs. When an

active market for a security does not exist, the use of manage-

ment estimates that incorporate current market participant

expectations of future cash flows, and include appropriate

risk premiums, is acceptable.

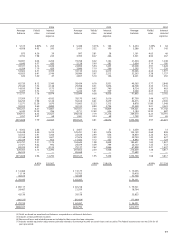

Approximately 19% of total assets ($247.5 billion) at

December 31, 2008, and 22% of total assets ($123.8 billion) at

December 31, 2007, consisted of financial instruments record-

ed at fair value on a recurring basis. Assets for which fair val-

ues were measured using significant Level 3 inputs repre-

sented approximately 19% of these financial instruments (4%

of total assets) at December 31, 2008, and approximately 18%

(4% of total assets) at December 31, 2007. The fair value of the

remaining assets were measured using valuation methodolo-

gies involving market-based or market-derived information,

collectively Level 1 and 2 measurements.

Our financial assets valued using Level 3 measurements

consisted of certain asset-backed securities, including those

collateralized by auto leases and cash reserves, private collat-

eralized mortgage obligations (CMOs), collateralized debt

obligations (CDOs), collateralized loan obligations (CLOs),

auction-rate securities, certain derivative contracts such as

credit default swaps related to CMO, CDO and CLO expo-

sures and certain MHFS and MSRs. While MSR valuations

generally require use of significant unobservable inputs and

therefore are classified as Level 3, significant judgment may

be required to determine whether certain other assets mea-

sured at fair value are included in Level 2 or Level 3. For

example, we closely monitor market conditions involving

assets that have become less actively traded, such as MHFS,

private CMOs, and certain other debt securities, including

CDOs and CLOs. See Note 8 (Securitizations and Variable

Interest Entities) to Financial Statements for a detailed dis-

cussion of the key assumptions used to determine the fair

value of our MSRs and the related sensitivity analysis. If fair

value measurement is based upon recent observable market

activity of such assets or comparable assets (other than

forced or distressed transactions) that occur in sufficient vol-

ume and do not require significant adjustment using unob-

servable inputs, those assets are classified as Level 2; if not,

they are classified as Level 3. Making this assessment

requires significant judgment. In 2008, $4.3 billion of fair

value option MHFS and $1.9 billion of debt securities avail-

able for sale were transferred from Level 2 to Level 3 because

significant inputs to the valuation became unobservable,

largely due to reduced levels of market liquidity.

We use prices from independent pricing services and to a

lesser extent, indicative (non-binding) quotes from indepen-

dent brokers, to measure fair value of our investment securi-

ties. See Note 17 (Fair Values of Assets and Liabilities) to

Financial Statements for the amount and fair value hierarchy

classification of those securities measured at fair value using

an independent pricing service and those measured at fair

value using broker quotes. We utilize multiple independent

pricing services and brokers to obtain fair values, however,

we generally obtain one price/quote for each individual secu-

rity. For securities priced by independent pricing services, we

determine the most appropriate and relevant pricing service

for each security class and have that vendor provide the price

for each security in the class. We record the unadjusted value

provided by the independent pricing service/broker in our

financial statements, subject to our internal price verification

procedures. We validate prices received from pricing services

or brokers using a variety of methods, including, but not lim-

ited to, comparison to secondary pricing services, corrobora-

tion of pricing by reference to other independent market data

such as secondary broker quotes and relevant benchmark

indices, and review of pricing by Company personnel familiar

with market liquidity and other market-related conditions.

Based upon our internal price verification procedures and

review of fair value methodology documentation provided by

independent pricing services, we have concluded that the fair

values for our investment securities at year end were consis-

tent with the guidance in FAS 157.

Approximately 2% of total liabilities ($18.8 billion) at

December 31, 2008, and 0.5% ($2.6 billion) at December 31,

2007, consisted of financial instruments recorded at fair value

on a recurring basis. Liabilities valued using Level 3 measure-

ments were $638 million and $280 million at December 31,

2008 and 2007, respectively.

See Note 17 (Fair Values of Assets and Liabilities) to

Financial Statements for a complete discussion on our use of

fair valuation of financial instruments, our related measurement

techniques and its impact to our financial statements.

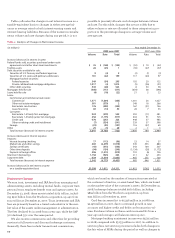

Pension Accounting

We account for our defined benefit pension plans using an

actuarial model required by FAS 87, Employers’ Accounting

for Pensions, as amended by FAS 158, Employers’ Accounting

for Defined Benefit Pension and Other Postretirement Plans –

an amendment of FASB Statements No. 87, 88, 106, and 132(R).

FAS 158 was issued on September 29, 2006, and became

effective for us on December 31, 2006. FAS 158 requires us to

recognize the funded status of our pension and postretire-

ment benefit plans in our balance sheet. Additionally, FAS

158 required us to use a year-end measurement date begin-

ning in 2008. The adoption of FAS 158 did not change the

amount of net periodic benefit expense recognized in our

income statement.