Wells Fargo 2008 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(1.07% of average loans), compared with $536 million (0.40%)

in 2007. A major portion of these charge-offs came from loans

originated through our Business Direct channel. Business

Direct consists primarily of unsecured lines of credit to small

firms and sole proprietors that tend to perform in a manner

similar to credit cards. Similarly, we have not made a market in

subprime securities. Leveraged-buyout-related outstandings

are diversified by business and borrower and totaled less

than 4% of total loans.

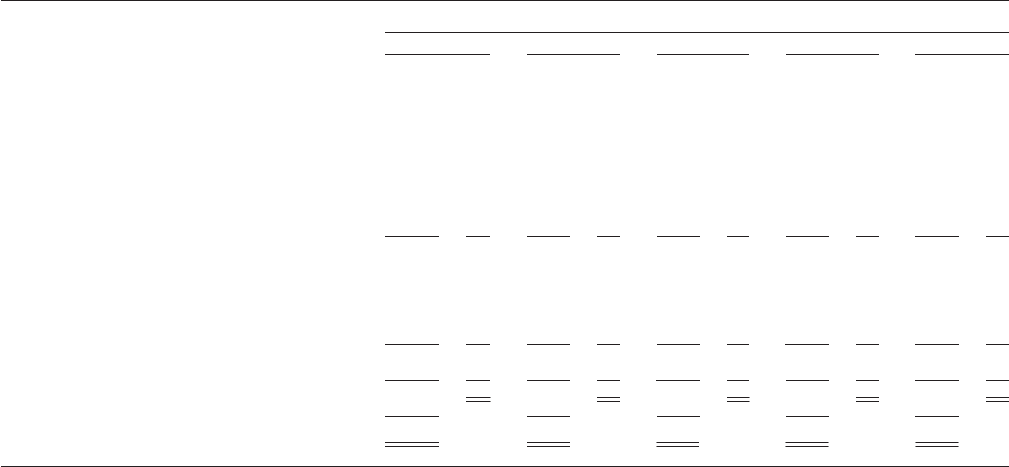

The following table presents the allocation of the

allowance for credit losses by type of loans. The $16.2 billion

increase in the allowance for credit losses from year-end 2007

to year-end 2008 included an $8.1 billion credit reserve build,

including $3.9 billion to conform credit reserve practices of

Wells Fargo and Wachovia, and the addition of $7.8 billion

from Wachovia. The $1.55 billion increase in the allowance

for credit losses from year-end 2006 to year-end 2007 was

due to actions taken in 2007 primarily related to the Home

Equity portfolio and approximately $100 million acquired

from bank acquisitions. Changes in the allowance reflect

changes in statistically derived loss estimates, historical loss

experience, current trends in borrower risk and/or general

economic activity on portfolio performance, and manage-

ment’s estimate for imprecision and uncertainty. Effective

December 31, 2006, the entire allowance was assigned to indi-

vidual portfolio types to better reflect our view of risk in

these portfolios. The allowance for credit losses includes a

combination of baseline loss estimates and a range of impre-

cision or uncertainty specific to each portfolio segment previ-

ously categorized as unallocated in prior years.

We believe the allowance for credit losses of $21.7 billion

was adequate to cover credit losses inherent in the loan portfolio,

including unfunded credit commitments, at December 31, 2008.

The process for determining the adequacy of the allowance

for credit losses is critical to our financial results. It requires

difficult, subjective and complex judgments as a result of the

need to make estimates about the effect of matters that are

uncertain. See “Financial Review – Critical Accounting Policies

– Allowance for Credit Losses.” Therefore, we cannot provide

assurance that, in any particular period, we will not have

sizeable credit losses in relation to the amount reserved.

We may need to significantly adjust the allowance for credit

losses, considering current factors at the time, including eco-

nomic or market conditions and ongoing internal and exter-

nal examination processes. Our process for determining the

adequacy of the allowance for credit losses is discussed in

“Financial Review – Critical Accounting Policies – Allowance

for Credit Losses” and Note 6 (Loans and Allowance for

Credit Losses) to Financial Statements.

Asset/Liability and Market Risk Management

Asset/liability management involves the evaluation, monitor-

ing and management of interest rate risk, market risk, liquidity

and funding. The Corporate Asset/Liability Management

Committee (Corporate ALCO)—which oversees these risks

and reports periodically to the Finance Committee of the

Board of Directors—consists of senior financial and business

executives. Each of our principal business groups has its own

asset/liability management committee and process linked to

the Corporate ALCO process.

INTEREST RATE RISK Interest rate risk, which potentially can

have a significant earnings impact, is an integral part of being a

financial intermediary. We are subject to interest rate risk because:

• assets and liabilities may mature or reprice at different

times (for example, if assets reprice faster than liabilities

and interest rates are generally falling, earnings will

initially decline);

Table 21: Allocation of the Allowance for Credit Losses (ACL)

(in millions) December 31,

2008 2007 2006 2005 2004

ACL Loans ACL Loans ACL Loans ACL Loans ACL Loans

as % as % as % as % as %

of total of total of total of total of total

loans loans loans loans loans

Commercial and commercial real estate:

Commercial $ 4,129 23% $1,137 24% $1,051 22% $ 926 20% $ 940 19%

Other real estate mortgage 1,011 12 288 9 225 9 253 9 298 11

Real estate construction 1,023 4 156 5 109 5 115 4 46 3

Lease financing 135 2 51 2 40 2 51 2 30 2

Total commercial and commercial real estate 6,298 41 1,632 40 1,425 38 1,345 35 1,314 35

Consumer:

Real estate 1-4 family first mortgage 4,938 28 415 19 186 17 229 25 150 31

Real estate 1-4 family junior lien mortgage 4,496 13 1,329 20 168 21 118 19 104 18

Credit card 2,463 3 834 5 606 5 508 4 466 4

Other revolving credit and installment 3,251 11 1,164 14 1,434 17 1,060 15 889 11

Total consumer 15,148 55 3,742 58 2,394 60 1,915 63 1,609 64

Foreign 265 4 144 2 145 2 149 2 139 1

Total allocated 21,711 100% 5,518 100% 3,964 100% 3,409 100% 3,062 100%

Unallocated component of allowance — — — 648 888

Total $21,711 $5,518 $3,964 $4,057 $3,950