Wells Fargo 2008 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NONACCRUAL LOANS AND OTHER ASSETS Table 19 shows the

five-year trend for nonaccrual loans and other assets. We

generally place loans on nonaccrual status when:

• the full and timely collection of interest or principal

becomes uncertain;

• they are 90 days (120 days with respect to real estate 1-4

family first and junior lien mortgages and auto loans) past

due for interest or principal (unless both well-secured and

in the process of collection); or

• part of the principal balance has been charged off.

The combined company’s nonaccrual loans include

$97 million from Wachovia related largely to lease financing.

Prior to the application of SOP 03-3, Wachovia’s nonaccrual

loans totaled $20.1 billion, including $14.0 billion of consumer

loans ($11.6 billion of Pick-a-Pay) and $6.1 billion of commer-

cial and commercial real estate loans.

Note 1 (Summary of Significant Accounting Policies) to

Financial Statements describes our accounting policy for

nonaccrual loans.

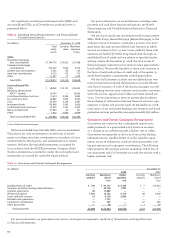

Table 19: Nonaccrual Loans and Other Assets

(in millions) December 31,

2008 (1) 2007 2006 2005 2004

Nonaccrual loans:

Commercial and commercial real estate:

Commercial $1,253 $ 432 $ 331 $ 286 $ 345

Other real estate mortgage 594 128 105 165 229

Real estate construction 989 293 78 31 57

Lease financing 92 45 29 45 68

Total commercial and commercial real estate 2,928 898 543 527 699

Consumer:

Real estate 1-4 family first mortgage (2) 2,648 1,272 688 471 386

Real estate 1-4 family junior lien mortgage 894 280 212 144 92

Other revolving credit and installment 273 184 180 171 160

Total consumer 3,815 1,736 1,080 786 638

Foreign 57 45 43 25 21

Total nonaccrual loans (3) 6,800 2,679 1,666 1,338 1,358

As a percentage of total loans 0.79% 0.70% 0.52% 0.43% 0.47%

Foreclosed assets:

GNMA loans (4) 667 535 322 — —

Other 1,526 649 423 191 212

Real estate and other nonaccrual investments (5) 16 5 5 2 2

Total nonaccrual loans and other assets $9,009 $3,868 $2,416 $1,531 $1,572

As a percentage of total loans 1.04% 1.01% 0.76% 0.49% 0.55%

(1) The allowance for credit losses does not include any amounts related to loans acquired from Wachovia that are accounted for under SOP 03-3 (Wachovia’s allowance

related to these loans was $12.0 billion), and nonaccrual loans exclude $20.0 billion of SOP 03-3 loans that were previously reflected as nonaccrual by Wachovia.

(2) Includes nonaccrual mortgages held for sale.

(3) Includes impaired loans of $3,640 million, $469 million, $230 million, $190 million and $309 million at December 31, 2008, 2007, 2006, 2005 and 2004, respectively. See

Note 1 (Summary of Significant Accounting Policies) and Note 6 (Loans and Allowance for Credit Losses) to Financial Statements for further discussion of impaired loans.

(4) Due to a change in regulatory reporting requirements effective January 1, 2006, foreclosed real estate securing GNMA loans has been classified as nonperforming. Both

principal and interest for GNMA loans secured by the foreclosed real estate are collectible because the GNMA loans are insured by the FHA or guaranteed by the

Department of Veterans Affairs.

(5) Includes real estate investments (contingent interest loans accounted for as investments) that would be classified as nonaccrual if these assets were recorded as loans.

Nonaccrual loans increased $4.1 billion to $6.8 billion at

December 31, 2008, from $2.7 billion a year ago, reflecting the

deterioration in economic conditions, primarily in portfolios

affected by the residential real estate environment and the

associated impact on the consumer. A small portion of the

increase in nonaccrual loans from a year ago continues to be

related to our active loss mitigation strategies at Home

Equity, Home Mortgage and Wells Fargo Financial as we are

aggressively working with customers to keep them in their

homes or find alternative solutions to their financial chal-

lenges. Home builders, mortgage service providers, contrac-

tors, suppliers and others in the residential real estate-related

segments continued to be stressed during this credit cycle.

Additionally, as consumers cut back on discretionary spend-

ing, we are seeing some of the commercial loan portfolios

dependent on their spending weaken. The $2.1 billion

increase in nonaccrual consumer loans from a year ago was

primarily due to an increase of $742 million in Wells Fargo

Financial real estate and an increase of $424 million in Home

Mortgage. Nonaccrual real estate 1-4 family loans included

approximately $3.4 billion of loans at December 31, 2008, that

have been modified. Our policy requires six consecutive

months of payments on modified loans before they are

returned to accrual status. Other foreclosed assets increased

$877 million (including $885 million acquired from

Wachovia) to $1.5 billion at December 31, 2008. Until condi-

tions improve in the residential real estate and liquidity mar-

kets, we will continue to hold more nonperforming assets on

our balance sheet as it is currently the most economic option

available. Increases in commercial nonperforming assets

were also primarily a direct result of the conditions in the res-

idential real estate markets and general consumer economy.