Wells Fargo 2008 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2008 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

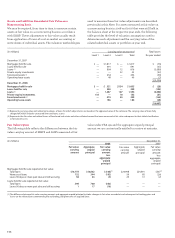

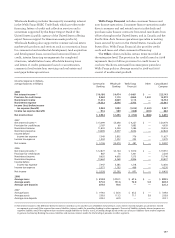

As of December 31, 2008, there was $140 million of

unrecognized compensation cost related to stock options.

That cost is expected to be recognized over a weighted-

average period of 1.9 years.

The total intrinsic value of options exercised during 2008

and 2007 was $348 million and $588 million, respectively.

Cash received from the exercise of options for 2008 and

2007 was $747 million and $1,026 million, respectively. The

actual tax benefit recognized in stockholders’ equity for the tax

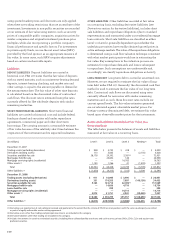

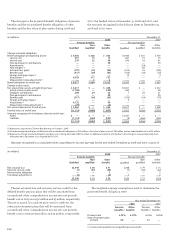

Number Weighted- Weighted- Aggregate

average average intrinsic

exercise remaining value

price contractual (in millions)

term (in yrs.)

Incentive Compensation Plans

Options outstanding as of December 31, 2007 238,629,924 $ 28.87

Granted 48,890,048 31.40

Canceled or forfeited (4,123,158) 32.61

Exercised (25,986,596) 23.66

Acquisitions 26,197,039 198.07

Options outstanding as of December 31, 2008 283,607,257 45.36 5.7 $414

As of December 31, 2008:

Options exercisable and expected to be exercisable (1) 281,180,115 45.47 5.7 414

Options exercisable 200,077,486 50.76 4.5 413

PartnerShares Plan

Options outstanding as of December 31, 2007 24,365,561 $ 23.50

Canceled or forfeited (543,896) 21.12

Exercised (6,159,198) 21.34

Options outstanding as of December 31, 2008 17,662,467 24.33 2.6 $ 91

As of December 31, 2008:

Options exercisable and expected to be exercisable (1) 17,662,467 24.33 2.6 91

Options exercisable 17,662,467 24.33 2.6 91

Director Plans

Options outstanding as of December 31, 2007 827,285 $ 27.72

Granted 146,860 29.88

Canceled (34,080) 34.51

Exercised (32,956) 19.32

Options outstanding as of December 31, 2008 907,109 28.12 5.6 $ 2

As of December 31, 2008:

Options exercisable and expected to be exercisable (1) 907,109 28.12 5.6 2

Options exercisable 907,109 28.12 5.6 2

(1) Adjusted for estimated forfeitures.

deductions from the exercise of options totaled $123 million

and $210 million, respectively, for 2008 and 2007.

We do not have a specific policy on repurchasing shares

to satisfy share option exercises. Rather, we have a general

policy on repurchasing shares to meet common stock

issuance requirements for our benefit plans (including share

option exercises), conversion of its convertible securities,

acquisitions, and other corporate purposes. Various factors

determine the amount and timing of our share repurchases,

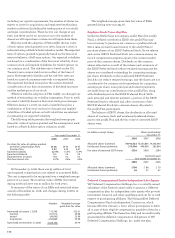

options generally expire 10 years after the date of grant.

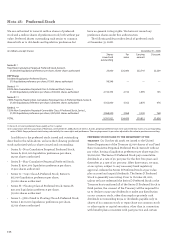

Because the exercise price of each PartnerShares Plan grant

has been equal to or higher than the quoted market price of

our common stock at the date of grant, we did not recognize

any compensation expense in 2005 and prior years. In 2006,

under FAS 123(R), we began to recognize expense related to

these grants, based on the remaining vesting period. All of

our PartnerShares Plan grants were fully vested as of

December 31, 2008.

Director Plan

We grant common stock and options to purchase common

stock to non-employee directors elected or re-elected at the

annual meeting of stockholders and prorated awards to

directors who join the Board at any other time. The stock

award vests immediately. Options granted in 2008 or earlier

can be exercised after six months through the tenth anniversary

of the grant date. Stock awards and option grants were made

to non-employee directors under the Directors Stock

Compensation and Deferral Plan. As a result of action taken

by the Board of Directors on September 30, 2008, future stock

awards and option grants will be made under our Long-Term

Incentive Compensation Plan.

The table below summarizes stock option activity and

related information for 2008. Options assumed in mergers

are included in the activity and related information for

Incentive Compensation Plans if originally issued under

an employee plan, and in the activity and related information

for Director Plans if originally issued under a director plan.